It’s been a difficult few years for International Consolidated Airlines Group (LSE:IAG) shareholders. Airline stocks are volatile at the best of times, but public health restrictions to limit the spread of Covid-19 dealt a severe blow to IAG shares.

The FTSE 100 group, which owns a number of operators including Aer Lingus, British Airways, and Iberia, is yet to recover from the pandemic. I don’t own shares in the company, but if I’d invested £1,000 four years ago, what would I have today? And is the stock now a cheap buy for my portfolio?

Let’s explore.

Four-year return

They say a picture paints a thousand words. Well, the chart below tells a sorry story about the recent performance of the IAG share price.

Shares in the airline group nosedived in late February 2020. They’ve been grounded below £2 almost ever since. In fact, the share price briefly dipped into penny stock territory at various points over the past few years.

Four years ago, I could have bought IAG shares for £3.47 each. With £1,000 to invest, I could have scooped up 288 shares, leaving 64p as spare change.

At today’s price of £1.48 per share, the value of my shareholding would have plummeted to £426.24. That’s a disappointing result, to put it mildly.

One silver lining is that 2019 was a bumper year for dividends. The company paid a special dividend that year in addition to its interim and final payouts. Total dividends totalled a juicy €173.12.

Converted into sterling at historic exchange rates, that translates into £154.07 in passive income, bringing my total return to £580.31.

Unfortunately, IAG hasn’t paid dividends since, although the company has signalled it might restart shareholder distributions next year.

Signs of a rebound

So, what’s the next destination for this airline stock?

The company’s 2022 full-year results contained plenty of encouraging numbers. Aided by a recovery in the travel sector, revenue almost tripled to €23bn and the firm delivered its first full-year profit since the pandemic with operating profit of €1.3bn.

In addition, IAG made positive steps towards repairing its balance sheet. Net debt fell to €10.4bn from €11.7bn the prior year and liquidity expanded from just under €12bn to €14bn today.

These figures are indicators of a business returning to full health. I think they bode well for a possible reinstatement of the dividend, which would be excellent news for passive income seekers.

That said, there are risks facing the group. Capacity is still well below where it was before the pandemic at 78% of 2019 levels.

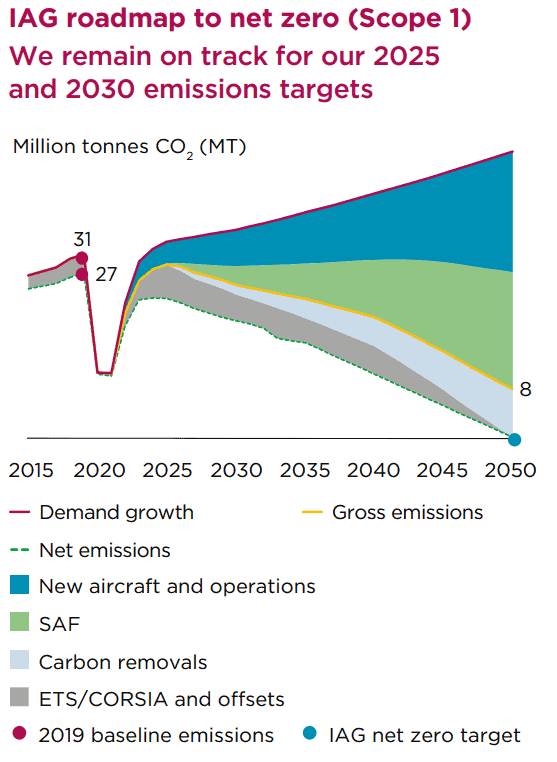

In addition, climate change is a long-term challenge. The possibility of future carbon taxes could spell trouble for sustained growth in the IAG share price considering its fossil fuel-intensive business model.

However, technological innovation could offset this risk. The group has an ambition to reach net zero by 2050. Hydrogen-powered aircraft and the use of sustainable aviation fuel could be transformative factors in helping the company achieve its aim.

Should I buy?

While not without risks, recent results give me confidence in IAG’s future trajectory. I think the next four years are likely to be much better than the last four.

If I had some spare cash, I’d buy IAG shares today.