I’m yet to buy Yalla (NYSE:YALA) shares, but it’s something I’ve been considering doing for a while. However, after the Q4 results, and some more research, I’m confident this stock is a buy, and I’ll be adding it to my portfolio when I have the funds available.

Let me tell you why.

What is Yalla?

In 2022, Yalla became the largest MENA-based online social networking and gaming company in terms of revenue. The Dubai-based tech firm rose to prominence during the pandemic with its voice-centric communication platform and soft gaming offer.

Valuation

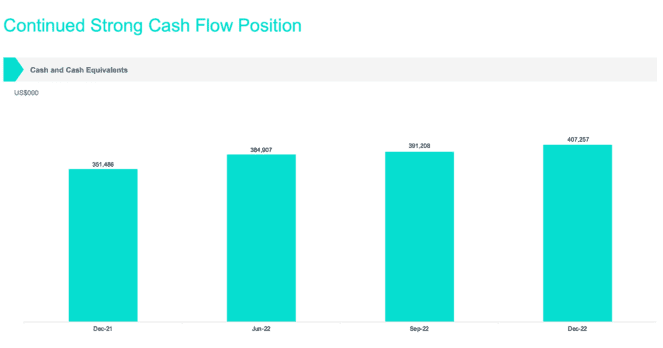

The company’s market-cap is around $583, and with $407m in cash and cash equivalents at the end of Q4, Yalla has an enterprise value of around $176m. To put that into context, in the last two years, Yalla has recorded net income of around $80m.

The firm currently trades with an EV-to-EBITDA ratio of just two, far below its sector (communications) median of 9.6. Yalla’s huge cash and cash equivalents positions also provides management with flexibility on growth plans, share buybacks and dividends — it’s something of a safety blanket which many young companies just don’t have.

To me, Yalla is clearly undervalued.

New growth push

Yalla is something of a company in transition. That’s because its two most successful apps, Yalla Chat and Yalla Ludo, are maturing and there may be better growth prospects in other parts of the market. That’s why Yalla is investing in mid-and-hard-core gaming.

However, the company is doing this without taking on debt, which is highly useful with interest rates pushing higher and higher.

That’s not to say the transition isn’t weighing on performance. Yalla’s Non-GAAP margin fell from 40.8% in Q4 of 2021, to 29% in Q4 of 2022. That’s a considerable fall, although it’s clear this is still a strong margin.

R&D spending and new hires — predominantly in research positions — can be seen in cost growth. Total costs came to $60.1m in Q4 of 2022, versus just $49.3m in Q4 2021.

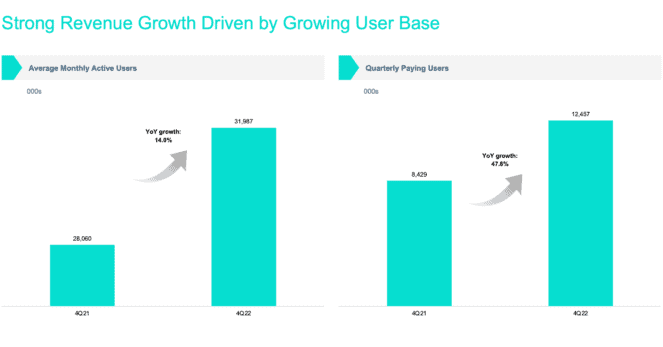

For some analysts, this is a necessary development despite user numbers in mature apps continuing to grow over the past year. During the pandemic, the company registered double and even tripled digit growth. In a post-pandemic world, it seems the company need to keep innovating.

Where next?

Yalla only listed in September 2020 and was priced at $7.50. The company raised around $140m during the IPO. But before long, the stock was trading for $39 as platform usage surged and the pandemic stoked retail investment.

I believe the stock will push upwards from the current $3.90. We won’t see the results of the company’s transition overnight, but I don’t expect to see the company’s profitability eroded much further by rising costs in the near term. Trading at such low multiples, with a huge cash pile, I think Yalla is a buy.