Standard Chartered (LSE:STAN) shares have fallen 22% in a month. It’s one of the biggest casualties of the banking crisis that started with Silicon Valley Bank in the US.

For me, the sell-off in banking stocks has been overdone, particularly with Standard Chartered. The Asia and Middle East-focused bank is fundamentally very strong, and with the share price falling, it looks like a steal.

So, let’s take a closer look.

Not SVB

Let’s start by highlighting that Standard Chartered is very different to Silicon Valley Bank, the tech-financier that had to sell bonds at a loss when depositors needed to withdraw.

Big international banks have broader deposit bases, less dependency on the risky tech sector, and more diverse bond holdings. It’s also important to note that while these banks may also have unrealised bond losses, stemming from interest rate rises, the majority of bonds owned will be held through to maturity.

As such, I really believe this sell-off has been unwarranted.

However, there are risks that have existed for some time. These relate to a slowing global economy and very high interest rates, which could lead to defaults, an increase in bad debt, and eventually more impairment costs.

Valuations and fundamentals

Standard Chartered is very secure. Its liquidity coverage ratio (LCR), a measure of how much cash-like assets the bank has, is solid. Chief Executive Bill Winters recently said that the LCR was 147% before SVB and Credit Suisse got into trouble, and that it was “substantially higher now” without disclosing the current level.

This should be putting investors’ minds at rest.

But it hasn’t so far, and that’s why the share price has fallen. Now its trading below 600p, and I think it’s a very attractive buy here.

The growth-focused bank trades with a very low price-to-earnings (P/E) ratio of 7.1 and even the notoriously low dividend yield currently sits at 2.5% — that’s not bad. The P/E is way below the index average, around 12, and is significantly lower than the stock has previously traded for.

Undervalued? Well some analysts certainly think so. Analysts at Berenberg hiked their target price on the consumer bank from 750p to 1,000p in February, citing “increasingly evident” standalone strength.

“While a potential takeover may provide a backstop for the shares, our attraction to Standard Chartered is predicated on the underappreciated strength of its unique global business,” said Berenberg.

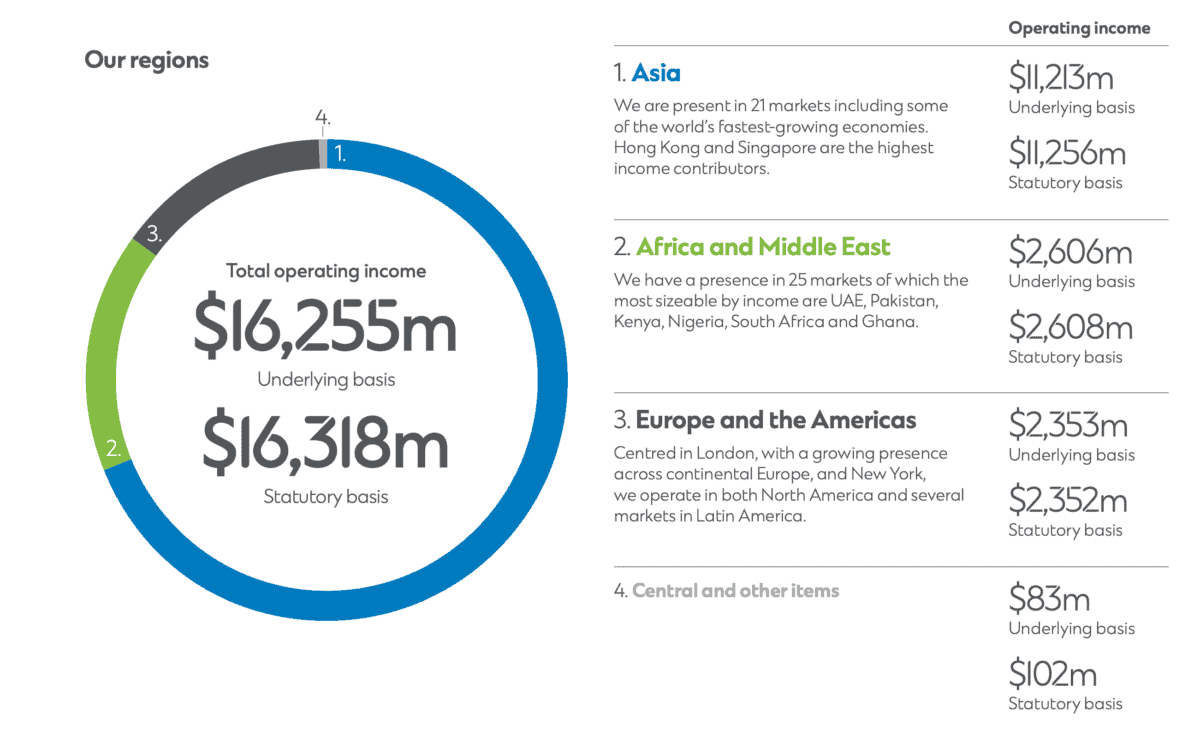

And I think they have a good point. It’s among the most growth-oriented banks on the FTSE 100, with the vast majority of revenue coming from fast-growing markets in the Middle East and Asia.

Earlier in February, Goldman Sachs downgraded its stance on shares of Standard Chartered to ‘neutral’ from ‘buy’. However, it’s worth noting that Standard Chartered was trading for around 100p more at the time of the downgrade.

I’m buying Standard Chartered stock as the price falls.