It was only a month ago when Microsoft unveiled its plan to crush Google by integrating ChatGPT into its search engine, Bing. This led to Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) stock dipping to $89. But with the shares now back above $100, should I increase my position?

Bard hiccup

The drop in Alphabet stock back in February was also down to Google’s hiccup when it introduced its own AI-language model, Bard. The chatbot answered a question incorrectly which led to a massive sell-off as investors feared that the company was losing out in the AI wars.

Nonetheless, Bard has made a comeback. Google has launched an experimental version of it, and it’s available to those who’ve signed up for the waiting list. I’ve been fortunate to gain access to it — and I’d even go as far as to say that it trumps ChatGPT in certain areas due to its ability to access real-time data.

To complement this, Google launched its AI capabilities for its Workspace applications. Some users can now integrate AI into their emails, documents, spreadsheets, and presentations. As such, it’s been no surprise to see Alphabet stock rallying on the back of this flurry of updates.

Ruthless management

Alphabet’s gains aren’t without pain, however. AI-related queries and functions are more expensive to run due to the higher computing power required. Hence, management has been looking for ways to mitigate the increase in costs, especially given the recent slowdown in revenue and decline in earnings.

CFO Ruth Porat has talked of the board’s intention to improve the bottom line through laying off staff. The conglomerate is planning to cut 12,000 workers, and the positive impact on earnings should start showing up in the firm’s Q3 figures.

Alphabet’s a conviction buy for me

This leads to the reason why I think Alphabet stock remains a conviction buy, something I felt back when the shares dropped in February. I feel that aside from it being a blue-chip conglomerate, it’s got plenty of growth avenues too. These include YouTube, Google Cloud, DeepMind, Waymo, and its AI capabilities.

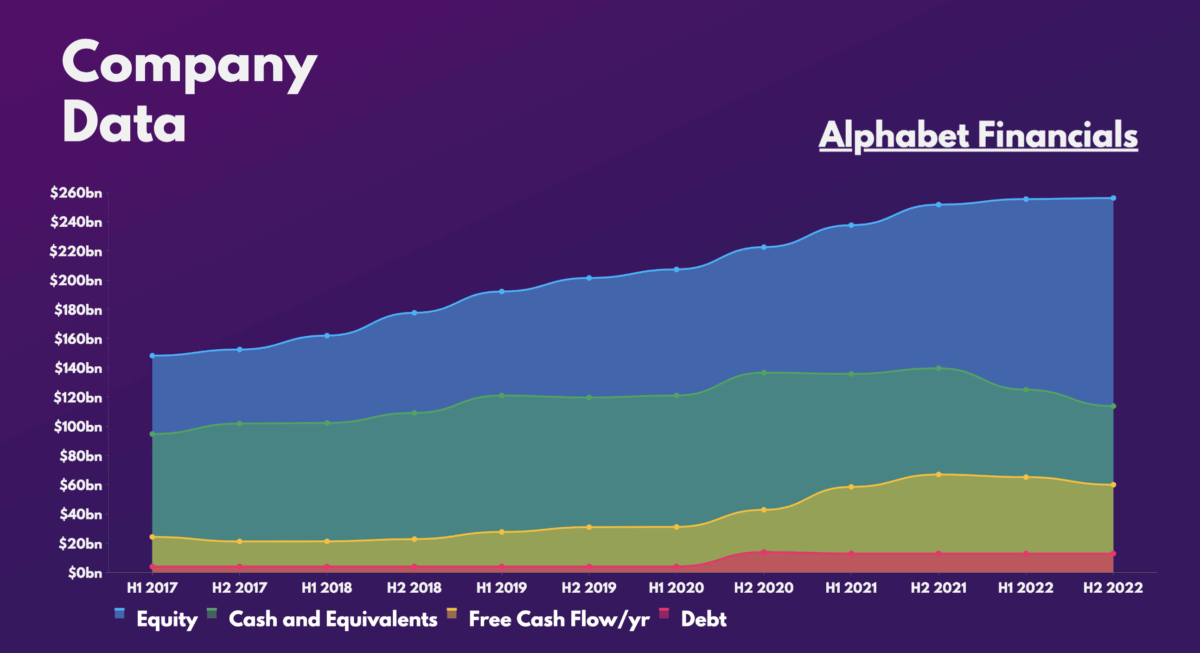

What’s more, the group collectively has one of the best balance sheets on Wall Street. Boasting a debt-to-equity ratio of 5% and mountains of cash, Alphabet has more than enough money to fund its growth ventures while returning satisfactory amounts to shareholders via stock buybacks.

And while Bing has become more prominent recently, Google remains the world’s most popular search engine by far. This is partly because of its deal with Apple to be the default search engine on all iOS devices, as well as Android being the most used mobile operating system.

For those reasons, several brokers such as Stifel, BNP Paribas, and JMP have all either upgraded or reiterated their ‘buy’ ratings for the stock in the past week. It’s not difficult to see why either, given that the shares’ valuation multiples are at multi-year lows and below the industry average.

| Metrics | Alphabet | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 22.5 | 22.7 |

| Forward price-to-earnings (FP/E) ratio | 20.5 | 33.8 |

Thus, with an average price target of $132, buying the shares today could give me a potential gain of 26%. So, despite Alphabet’s recent rally, I still see its current share price as a rare opportunity to capitalise on its huge potential. Therefore, I’ll be looking to add to my largest position.