Penny stocks can provide excellent returns, but they’re high-risk investments. Due to low liquidity, high volatility, and the limited availability of public information about micro-cap companies, they’re not for everyone.

Indeed, my portfolio is primarily concentrated in more established shares, selected from well-known indexes like the FTSE 100 and S&P 500. However, I’m looking to add a small number of penny stocks to my portfolio this year.

One that looks attractive to me is SRT Marine Systems (LSE:SRT). This company develops maritime surveillance and safety systems used by coast guards, fishery authorities, and vessel owners.

A buying opportunity

SRT Marine Systems is AIM-listed. The company is a global leader in the provision of maritime domain awareness products. It produces a variety of automatic identification system (AIS) devices, designed to track and monitor seaborn vessels.

Although the SRT Marine Systems share price is up 10% over the past year, it slumped nearly 19% in 2023. That suggests today’s price could be an appealing entry point for me.

Granted, the business grappled with significant disruption during the pandemic. In the 24 months to 31 March 2022, the company made a cumulative post-tax loss of £11m. But I’m more optimistic about the firm’s future.

A stock that could sail higher

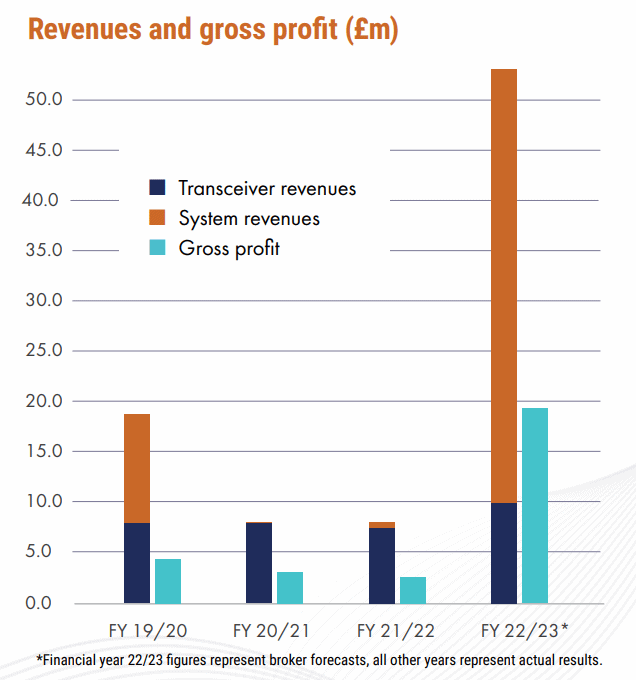

SRT Marine Systems is profitable once again. It posted a post-tax profit of £2.1m in the first half of the current financial year. In H1, the company also delivered a whopping 300% increase in year-on-year revenue to £18.8m. Plus, the gross profit margin was marginally higher at 38%.

What’s more, broker forecasts indicate revenues and growth profit will rise considerably over the course of the year. The outlook is especially rosy for the high-margin systems division, which concentrates on intelligence for coast guards and fisheries.

Admittedly, comparisons to a period in which trading activity was depressed due to Covid-19 might look favourable. However, forward guidance shows promise. The company’s validated pipeline of new system opportunities now stands at over £600m.

Moreover, the firm continues to innovate. It’s currently developing a new NEXUS radio product that will improve user convenience for maritime voice and data communications. This should help to expand the company’s reach into the sizeable commercial and leisure marine electronics market.

Time to get on board?

The company expects growth over the next five years will primarily come from Asia and the Middle East. Over a longer time horizon, the business also aims to tap into new opportunities in Africa and South America. I like the exposure this penny stock offers to emerging markets.

Increasing global challenges such as smuggling and piracy at sea point to a robust demand outlook for the company’s products.

That said, ongoing component shortages for the firm’s transceiver arm remains a headwind that could limit further share price growth. In addition, I’m also concerned by the company’s reliance on private bond funding. The balance sheet isn’t as strong as it could be.

Nonetheless, there’s significant scope for further contract wins. New deals could be transformational for the company’s profits and cash flow. I wouldn’t want to miss the boat on this penny stock, so if I had cash available, I’d invest in the company today.