Rolls-Royce (LSE:RR) shares are among the hottest on the FTSE 100. The stock is up a phenomenal 99% over six months having hit its nadir last year.

So what’s next for the British engineering giant? Personally, I see this is just the first part of the long recovery and, as such, there may be more growth to come.

A turning point

In February, Rolls-Royce beat expectations by some margin, posting a statutory operating profit of £837m in 2022, considerably up on £513m a year earlier.

All three business units — civil aviation, power systems, and defence — had positive cash flow. And revenue grew to £13.5bn from £11.2bn, largely on the back of a recovering civil aviation sector.

While power systems and defence have performed well in recent years, the pandemic-induced collapse of civil aviation almost broke Rolls-Royce. However in 2022, Rolls said that large engine flying hours in civil aerospace grew by 35%.

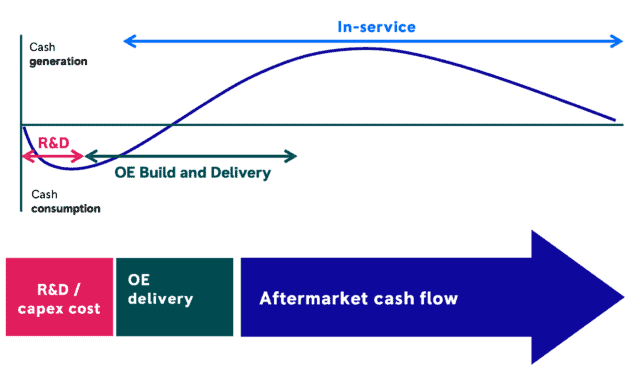

The company makes money through performance hours and service, not just the sale of engine units. Rolls engines are predominately used on long-haul flights, with some exceptions, including in China.

Where next?

The civil aerospace business generates 45% of underlying revenue. And in 2023, the firm is expecting these large engine flying hours to hit 80-90% of 2019 levels. That’s considerably up from 65% at the end of 2022.

China’s reopening will be a major part of this. But we can also see airlines around the world betting on a strong recovery in civil aviation. Lufthansa recently joined major European and global airlines in predicting an earnings boost this year.

So 2023 should be a much better year for Rolls, and I wouldn’t be surprised to see the firm equal or surpass revenue generation in 2019 (£15.4bn). That would be impressive as the firm is considerably smaller, due to selling business units to fund debt repayments, than it was four years ago.

It’s important to remember that Rolls’ share price is down 50% over five years. This engineering giant is not considered anywhere near as valuable as it once was.

For me, there’s plenty of room for continued growth in the share price as the firm continues its recovery. It is a stronger, more resilient and leaner company than it used to be. With an enterprise value P/E around 20, I don’t think it’s too expensive either.

Risk vs reward

Rolls invested in several technologies that could be hugely lucrative in the future, including hydrogen propulsion and small modular nuclear reactors (SMR).

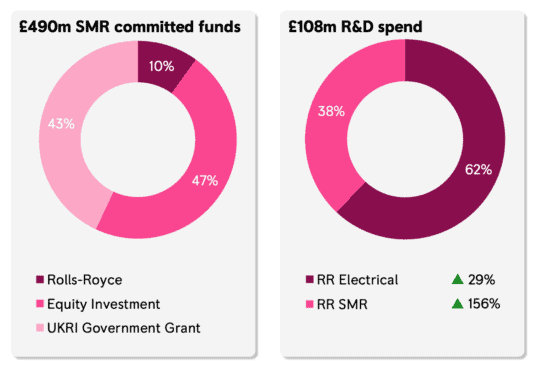

The problem is, these programmes could be a huge drag on earnings if the firm is forced to redirect cash towards their development. The group says its £500m SMR programme will run out of cash by the end of 2024.

Will the government provide more funding, or will Rolls relocate resources? Or maybe it will be dropped.

This is certainly an area for concern, but I’m expecting the business to make a pragmatic decision based on the risk/reward of the programmes.

For me, a new, leaner Rolls has plenty of promise, and I’ll buy more when I have the funds available.