Moderna (NASDAQ:MRNA) shares are among the most volatile stocks worldwide. The company became a household name during the pandemic with its mRNA vaccine being used around the globe. But this market is quickly shrinking.

So let’s take a closer look at the stock and what’s next for the biotech specialist.

Ups and downs

Moderna stock soared during the pandemic. Two years ago, the shares were worth $130. By late summer 2021, the vaccine-maker stock was trading for nearly $500.

However, the share price was unsustainable despite the huge demand for Spikevax — the Covid-19 vaccine. Shares fell fourfold. Today, it trades at $140 — 20% above its 52-week low.

The stock is up 8% over two years. So if I had invested £1,000 in the stock two years ago today, I’d have £1,080? Not quite.

I have to take currency fluctuations into account as Moderna is listed in the US. The pound is around 14% weaker against dollar today than it was two years ago. So my £1,000 investment would be worth £1272 today.

That’s a pretty good return — around 13.5% a year. However, it worth noting that most of these gains are due to the weakening pound.

What’s next?

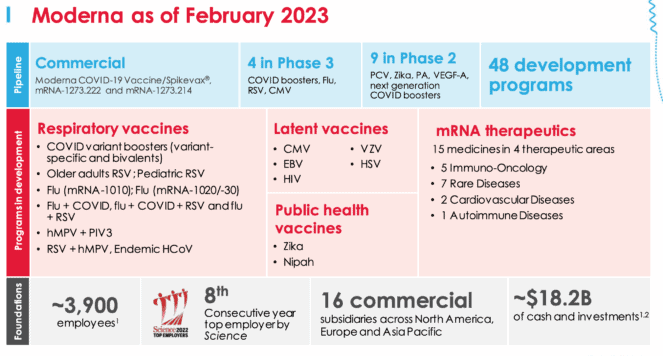

Moderna’s pipeline is phenomenally interesting. It’s trialing treatments for a host of illnesses and diseases, from cancer to HIV, using its novel mRNA technology. However, it’s not thrilling investors.

Revenue from Spikevax is slowing. It reaped $18.4bn in Covid vaccine sales last year, and projects at least $5bn in 2023. This will likely fall to around $2bn or less in 2024. This revenue stream will eventually die out.

The problem is, Moderna is unlikely to replace this revenue generation in the coming years as it only its Covid vaccines are its only commercial products at the moment. And while the prospect of an effective vaccine for flu, cancer and HIV sound amazing, trials normally — with the exception of Covid treatments — take up to a decade, or longer. And, of course, most vaccines or treatments trials aren’t a success.

To some, it looks like a one-hit wonder.

Every investment has its risks, but with this stock I see it as more of a gamble. The success of this multi-billion dollar company is dependent on treatments that are, as yet, unproven. I’m very aware that mRNA technology is highly promising, but it’s a huge risk, and that’s a scary prospect.

One big positive is Moderna’s sizeable cash reserves. Cash, cash equivalents and investments stood at $18.2bn at the end of Q4, up from $17bn at the end of Q3. This means it can continue to fund the development of its new vaccines without borrowing.

However, I’m not buying the shares. Not yet anyway. The stock has an enterprise value of $45bn. For me, that’s a hefty valuation for a business with little guaranteed future cash flow.