I’m currently looking for penny stocks that have the potential to deliver big gains. Although such small companies are speculative investments and often experience higher volatility, I’m comfortable that my other investments in more established stocks help to limit the downside risk to my portfolio.

Therefore, with some spare cash, I’d allocate a modest proportion of my stock market holdings to smaller firms with strong growth prospects.

One share that caught my eye recently is Mind Gym (LSE:MIND), a behavioural science consultancy that works with FTSE 100 and S&P 500 companies on business improvement and staff training. With a share price below 78p and a market cap of £77.5m, I think this penny stock could be a good buy for me today. Here’s why.

Buy the dip

The Mind Gym share price has performed poorly over the past year, slumping 46%. However, large falls can sometimes be attractive opportunities for me to scoop up stocks at cheap valuations. I think that’s the case with this penny share.

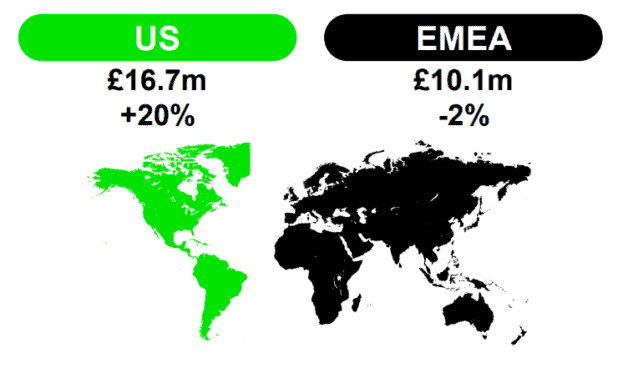

The company’s half-year 2023 results were largely positive. Total revenue grew 11% to £26.8m. The business showed particular strength in the US, where it makes the lion’s share of its income. Mind Gym’s gross profit margin also increased by 1.6% to hit 87.5%. However, EMEA revenue was a little disappointing, declining 2%.

Perhaps the biggest concern is the 62% reduction in the company’s cash in the bank. That figure is now £4.5m, whereas it was £12m at half-year 2022 stage. I’ll keep a close eye on this number to ensure the firm’s cash balance doesn’t become too great a risk from an investor’s viewpoint.

That said, Mind Gym’s debt position remains healthy. The group retains a £10m debt facility for flexibility, but this was undrawn as of 2 December 2022.

Overall, the sell-off of the company’s shares doesn’t look justified to me considering the broadly encouraging results. So I think this could be a dip-buying opportunity for me to open a position.

What’s next?

Looking ahead, there are reasons to be optimistic about future growth. The company recently secured its largest ever client framework agreement with a global energy business. Revenues from this deal are expected to exceed £10m over the next 24 months.

The business also maintained its full-year guidance despite macroeconomic headwinds. Plus, it continues to make progress in digital development with regard to its one-to-one online coaching platform, Performa. As a highly scalable offering, I’m keen to see how this impacts the company’s performance.

A possible US recession is a risk facing the group. Demand for the company’s services could fall in a tricky economic environment. On the other hand, if redundancies rise, I can see how employers would be keen to preserve a positive workplace culture and smooth business functioning. That’s exactly where Mind Gym can help.

Why I’d buy this stock

Retaining talent and creating a positive office dynamic are always going to be goals for major corporations. Provided Mind Gym can ensure its finances remain robust in what could be a challenging year, I think its future looks bright.

If I had some spare cash, I’d buy Mind Gym shares today.