Having risen 10% in January, PayPal (NASDAQ:PYPL) stock looked like it was heading for $100. However, the shares have performed poorly in February on the back of the company’s Q4 earnings results. So, here’s why the current share price presents a buying opportunity while it’s below $100.

An investment to pay-off

Diving into the numbers, the fintech company actually posted quite a solid quarter of results. Most metrics beat analysts estimates, and guidance provided for 2023 was also ahead of what Wall Street projected.

More importantly, the group reported an improvement in both its GAAP and non-GAAP EPS. This shows that it’s been able to enrich shareholders’ value despite the tough macroeconomic environment. And with margins guided to expand throughout 2023, it’s confusing to see PayPal stock perform so poorly after its earnings release.

| Metrics | Consensus | Q4 2022 | Q4 2021 | Growth |

|---|---|---|---|---|

| Revenue | $7.39bn | $7.38bn | $6.92bn | 7% |

| Total payment volume (TPV) | $360.3bn | $357.4bn | $339.5bn | 5% |

| Total active accounts (TAA) | ? | 435m | 426m | 2% |

| Payment transactions per active account (TPA) | ? | 51.4 | 45.4 | 13% |

| New active accounts (NAA) | ? | 2.9m | 9.8m | -70% |

| Non-GAAP earnings per share (EPS) | $1.20 | $1.24 | $1.11 | 11% |

Macroeconomic headwinds may continue to persist for a little while longer, and the stepping down of CEO Dan Schulman may have impacted investor sentiment. But this shouldn’t detract from the perks of investing in PayPal stock, and there are many.

Fruitful opportunities

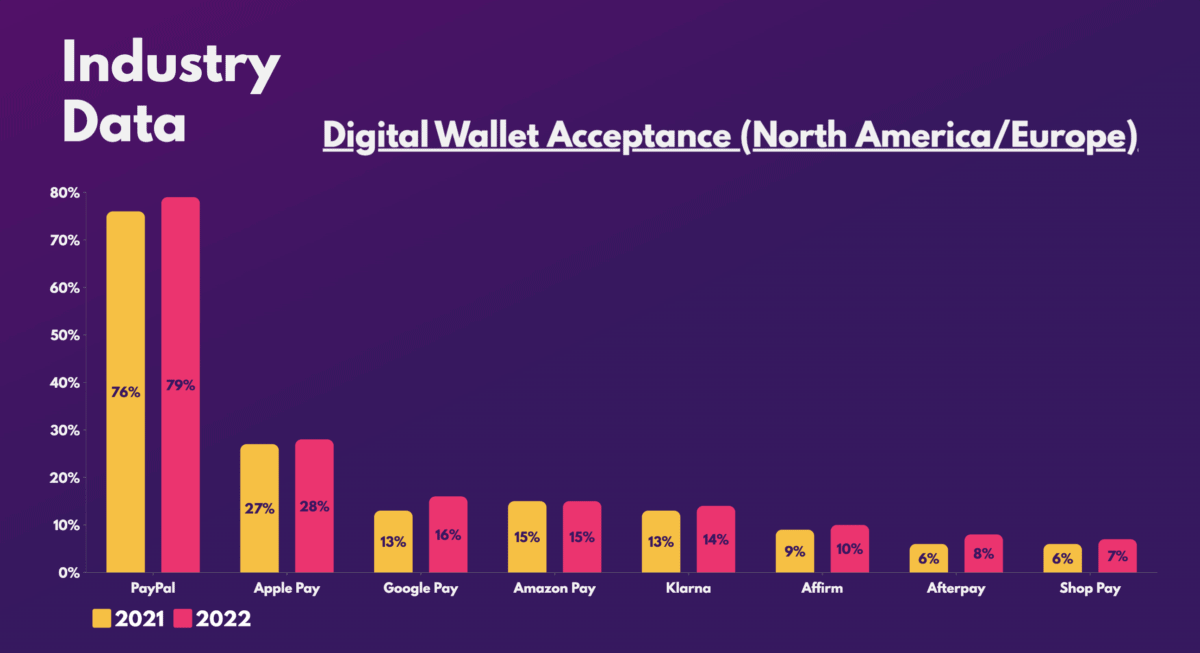

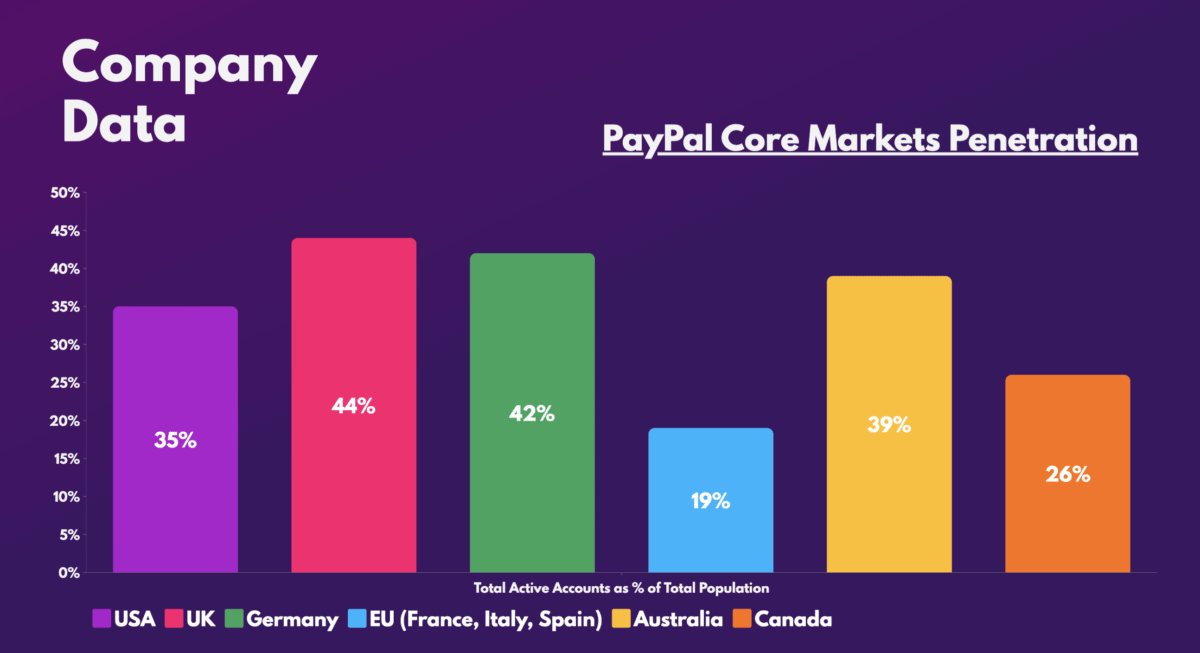

The e-commerce industry continues to grow at a rapid pace, and there’s no better player to take advantage of this than PayPal, with its ginormous market share. Critics will be quick to point towards Apple and Google Pay taking share away. However, there’s limited definitive evidence to support this as PayPal continues to aggressively grow its presence in its core markets.

The argument of competition isn’t very convincing at this point either. That’s because digital wallet acceptance is still in its growth phase. With less than half of the population in core markets penetrated, there’s still plenty of pie up for grabs.

Grabbing a discount

All that being said, the strongest case for buying PayPal stock today is that its valuation multiples indicate the shares are currently trading at a discount. It may not seem like it with the current high P/E ratio, but it’s worth remembering that this is a trailing figure.

The business expects to continue on its cost-cutting spree, which should support its bottom line growth over the coming months. As a result, analysts are forecasting the shares to have a forward P/E that’s much lower. In fact, it’s less than the industry average, and in line with the S&P 500‘s average of 22, which is great value for a growth stock.

| Metrics | PayPal | Industry Average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 35.2 | 27.2 |

| Forward price-to-earnings (FP/E) ratio | 22.4 | 25.9 |

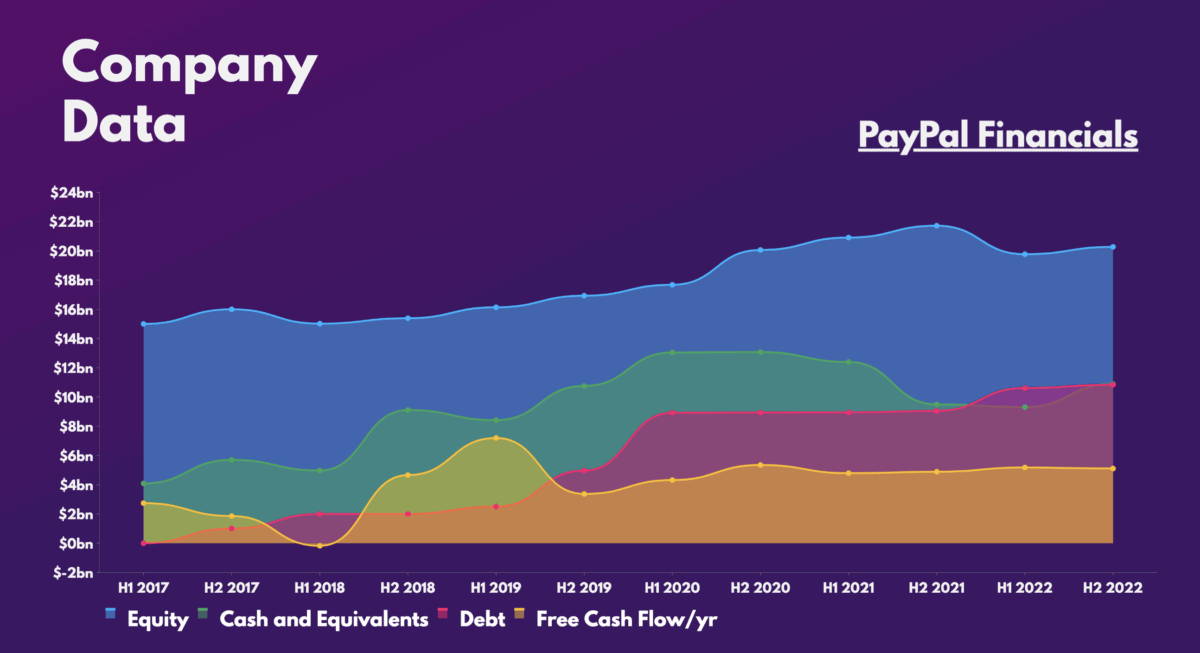

Aside from that, the conglomerate also has a solid balance sheet. Although its debt-to-equity ratio is relatively high at 53%, its cash and equivalents are sufficient to cover its liabilities. And with margins expected to expand next year, its growing bottom line should provide additional coverage.

As such, it’s no surprise to see brokers rating the stock a ‘buy’ with an average price target of $108. This presents a 45% upside from today’s prices. The likes of JP Morgan, Morgan Stanley, and Wells Fargo are all bullish on the payments provider. Thus, I reiterate my position that PayPal stock is a must-buy for my portfolio, especially at these levels.