As in its previous three quarters, Google’s parent company posted another disappointing set of results. Consequently, the Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) stock price fell and may see further weakness this year. Nonetheless, I’m willing to weather the short-term headwinds for long-term gains.

Coming up short

Alphabet’s Q4 numbers were nothing to celebrate about. Declines were prominent across the board with both top and bottom lines missing analysts’ estimates. Total revenue eked out a 1% gain due to some support from Google Cloud and Other revenues. Otherwise, the pullback in advertising was prominent, with YouTube Shorts continuing to cannibalise its long-form content.

| Metrics | Consensus | Q4 2022 | Q4 2021 | Growth |

|---|---|---|---|---|

| Google Search revenue | $43.30bn | $42.60bn | $43.30bn | -2% |

| YouTube revenue | $8.30bn | $7.96bn | $8.63bn | -8% |

| Google Network revenue | $8.90bn | $8.48bn | $9.31bn | -9% |

| Google Cloud revenue | $7.30bn | $7.32bn | $5.54bn | 32% |

| Other revenue | $8.10bn | $8.80bn | $8.16bn | 8% |

| Total revenue | $76.65bn | $76.05bn | $75.33bn | 1% |

| Diluted earnings per share (EPS) | $1.21 | $1.05 | $1.53 | -31% |

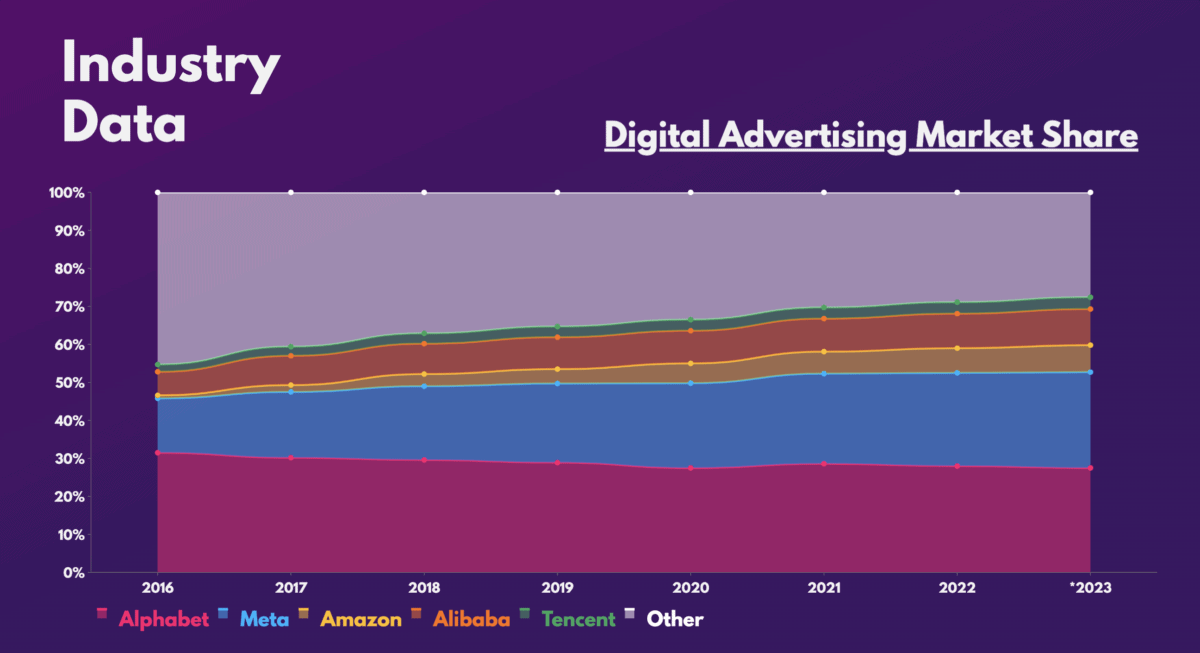

The short-term outlook for Alphabet stock isn’t bright either. Advertising and cloud spending are forecast to grow at a much slower pace this year. Numerous reports are suggesting that global ad spending will only grow by a meagre 4.5% compared to 7.6% last year, and double digits in the years prior. Additionally, Google continues to lose market share after years of dominance.

A GAAP worth noting

Despite missing on both its top and bottom estimates though, I think the negative sentiment surrounding Alphabet stock is overdone. That’s because when zooming out of the headline figures, a clearer picture of the company’s overall performance can be seen. This is especially the case when comparing its GAAP and non-GAAP numbers.

There’s no shying away from the firm’s declining margins this term. However, it’s also important to note that the group reported a big loss in equity securities (-$1.49bn) this year versus a profit ($2.52bn) last year. These have no material impact on Alphabet’s underlying business model, and were losses realised from investments in stocks. Those losses account for approximately -$0.11 in EPS. Pair that with constant currency revenues and the tech giant actually reported EPS broadly in line with estimates.

Discounting the short-term noise, the conglomerate has a bright long-term future ahead. YouTube may continue to see weakness over the next couple of quarters. But the board’s ambitious plans for the platform to introduce e-commerce and turn it into a streaming service may see it come back stronger than ever. What’s more, Shorts has grown from 30bn to 50bn daily views over the past year.

And with fears surrounding ChatGPT potentially taking Google’s place as the world’s biggest search engine, Alphabet has hit back with its own chatbot in LaMDA. The language model is set to be released to the public this year with more details to be revealed this week.

Don’t bet against Alphabet

So, will I buy more Alphabet stock then? Well, its current and future valuation multiples are trading at multi-year lows. This could indicate a cheap buy, especially when taking its high upside potential into consideration.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 21.2 | 30.0 |

| Forward price-to-earnings (FP/E) ratio | 20.4 | 33.3 |

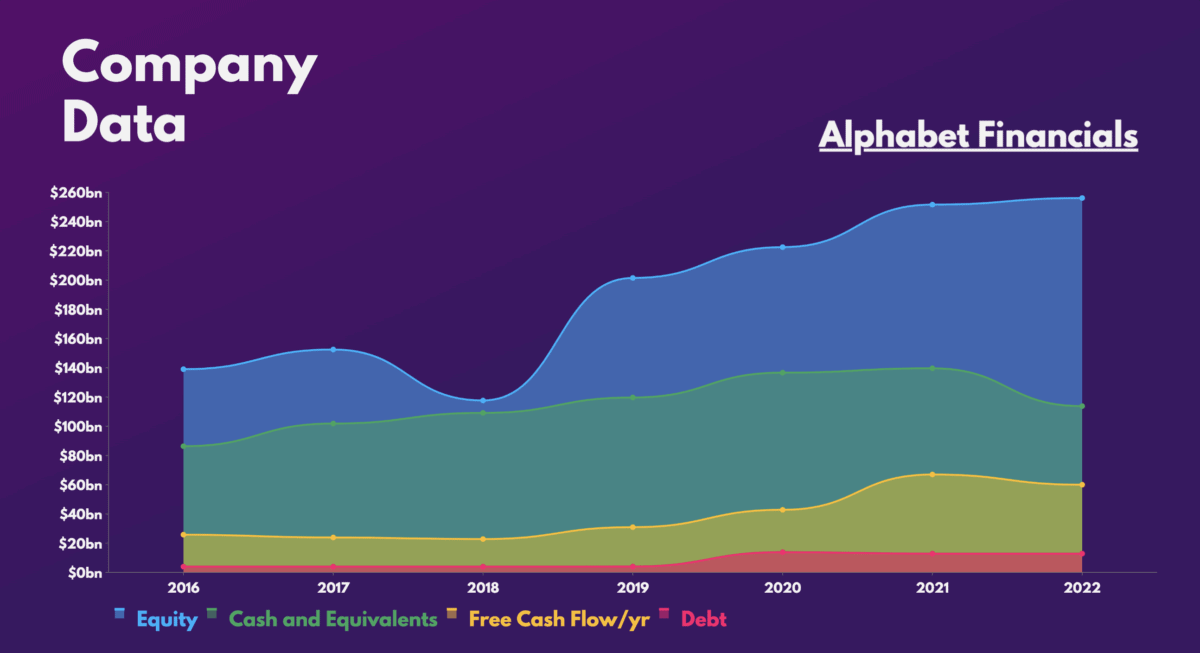

Moreover, it has an impeccable set of financials. A large pile of cash reserves and robust free cash flow could see Alphabet instigating a further stock buyback programme to boost shareholder returns and more importantly, its EPS.

Therefore, it’s no surprise to see the likes of Morgan Stanley, Wells Fargo, Barclays, and many other brokers rating the shares a ‘buy’, with an average price target of $129. As such, I wouldn’t write Alphabet off so soon, and will be dollar cost averaging given the tremendous upside potential.