I’m searching for the best ways to make a healthy second income in 2023. And I believe investing in certain retail funds could be an effective way for me to achieve this.

Investors withdrew colossal amounts of cash from UK investment funds last year as market confidence plummeted. However, fund investors are returning as market confidence has improved.

That’s according to Emma Wall, head of investment analysis and research at Hargreaves Lansdown. She notes that “2023 has got off to a more optimistic start” and that the investment firm’s clients “have responded to the rally by buying into global equity funds.”

She adds that a “more cautious money market and total return funds” have also been popular as individuals chew over threats like high inflation and central bank rate action.

3 investment funds on my radar

These three investment funds were among the 20 most popular with Hargreaves Lansdown clients in January, Wall says. I don’t have a bottomless well of capital to build my investment portfolio, but here’s why I’d also buy them if I have cash to spare.

#1: Artemis High Income Fund

As the name suggests, Artemis High Income Fund is designed to provide investors with a market-beating second income. The distribution yield here currently sits at a healthy 6.4%.

This fund primarily holds high-yield corporate and government bonds, though it also includes a smattering of equities. This provides an attractive balance of solid dividend income and capital appreciation.

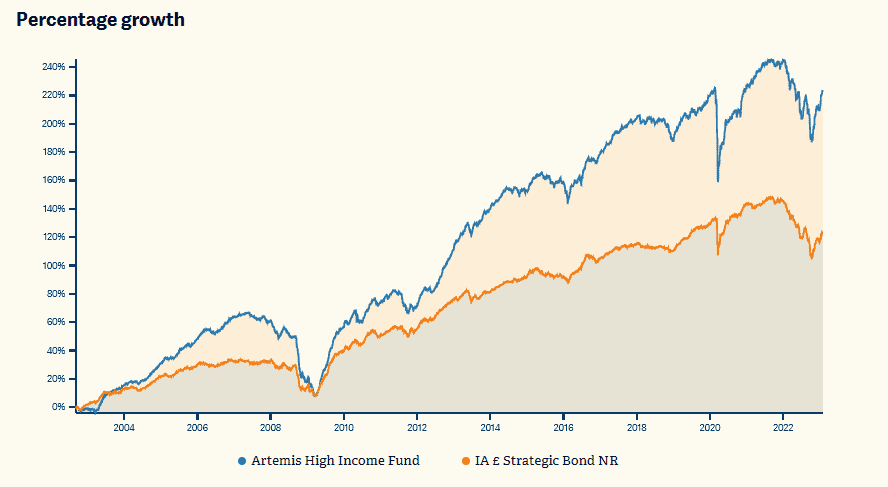

The problem with buying managed funds is that a bad decision by the instrument’s manager can decimate returns. But, encouragingly, the Artemis High Income Fund has a long track record of sector outperformance, as the graph below illustrates.

#2: Jupiter Asian Income Fund

The Jupiter Asian Income Fund gives investors exposure to fast-growing economies in Asia. It has $1.1bn invested, 70% of which is dedicated to companies on that continent. This also includes Australia and New Zealand but excludes Japan.

Investing in emerging markets can be a bumpy ride for investors. The political, economic and regulatory backdrop in some of these countries can be highly volatile. And corporate profits can suffer as a consequence.

However, as a long-term investor, I think having exposure to Asia — where both population and wealth levels are rapidly improving — could supercharge my returns. It’s why already own UK shares with Asian extensive operations such as Prudential and Unilever.

#3: Fundsmith Equity

Hargreaves Lansdown investors have also been piling into Terry Smith’s Fundsmith Equity product at the start of 2023.

The fund remains highly popular given its stunning outperformance of recent decades. Since it began in 2010 it’s delivered total returns of 486.8%. In these uncertain economic times it could prove to a particularly solid buy.

Smith’s fund invests in a range of global equities. However, approximately 68% of its £22.6bn invested is in US stocks. Such a high proportion leaves it vulnerable to tough economic conditions in the States.

Past performance isn’t always a reliable guide to the future. However, given Smith’s terrific track record I’d still happily buy this investment fund for my portfolio.