Investing in dividend stocks is a great way for investors to earn a second income. I’ve been searching the FTSE 100 index for passive income ideas and settled on two shares that could make good additions to my portfolio in February.

The two stocks I’m talking about are energy supplier SSE (LSE: SSE) and packaging specialist DS Smith (LSE: SMDS).

Let’s examine each in turn.

SSE — 5.1% dividend yield

The SSE share price has climbed 10% over the past 12 months, outperforming the FTSE 100 which rose by 4% over the same time frame.

Utilities stocks are often seen as defensive investments during tricky times. I anticipate stock market volatility in 2023. In that context, I consider SSE shares to be a non-cyclical play that could help to protect my portfolio from broader macro shocks.

A recent trading statement issued by the company was full of positive guidance. The business updated its earnings per share forecast to 150p, up from the previous estimate of 120p. It also signalled 5% per annum hikes in the dividend for 2024/25 and 2025/26.

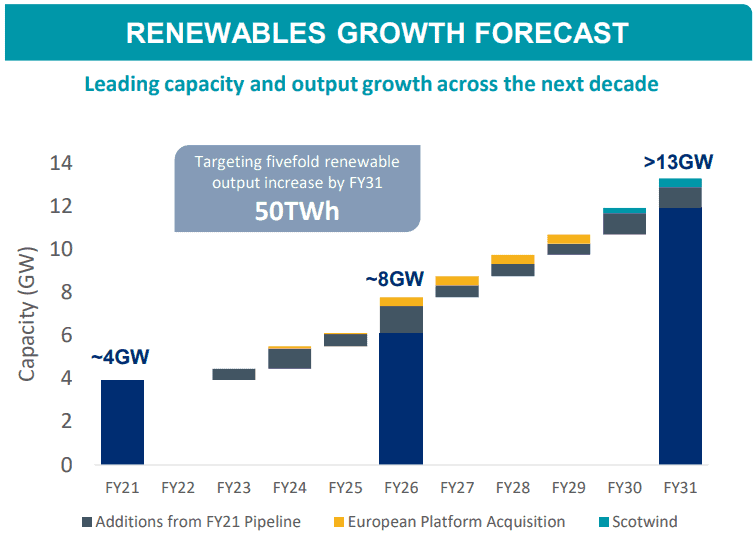

I also like the firm’s ambitious plans for renewable energy. It predicts huge growth in this area. Expected equity returns of at least 10% from its offshore wind projects is a particular highlight.

In light of significant disruption in global energy markets, government intervention remains a key risk for the SSE share price. CEO Alistair Phillips-Davies has warned that the company may need to reduce output at its hydroelectric plants to avoid the 45% levy imposed by the windfall tax on energy producers.

Despite the risks, the stock looks like it could continue to outperform with a £12.5bn investment plan to beef up the UK’s clean energy network by March 2026. If I had some spare cash, I’d buy this Footsie dividend share in February.

DS Smith — 4.5% dividend yield

The DS Smith share price has trailed the index over the past year, declining by 3%.

Although the share price has underperformed the FTSE 100, a forward price-to-earnings ratio of 8.5 suggests this dividend stock could be a value investment opportunity at its current valuation.

The half-year results for 2022/23 were promising. Revenue grew 26%, EBITDA increased 49%, and dividends rose 25%.

I’m particularly encouraged by the increase in the company’s free cash flow to £494m from £188m in the half-year before. This bodes well for the firm’s dividend sustainability in my view. On top of this, DS Smith’s net debt has fallen for five consecutive years.

As one of Europe’s largest corrugated cardboard manufacturers, the business is highly reliant on e-commerce demand to support its profitability. This means it’s susceptible to risks from a global economic slowdown if consumers tighten their purse strings.

In addition, the company had to contend with headwinds posed by industrial action last year as workers voted in favour of strikes over pay. The possibility of further strike action remains a risk this year as the cost-of-living crisis continues.

Nonetheless, healthy finances and a resilient business model make me bullish on this dividend stock’s prospects. With some spare cash, I’d buy DS Smith shares today.