When it comes to investing, one of Warren Buffett’s most famous quotes rings in my head — “Buy low, sell high”. With that in mind, here are three relatively cheap UK shares I’ve been snatching up on a bargain.

1. easyJet

Having initially lagged its peers’ performance in 2022, easyJet (LSE:EZJ) is now the FTSE‘s highest flyer this year, jumping a whopping 45%. This is down to its stellar Q1 update, which sent the stock flying above £5, as it now anticipates turning a profit this year.

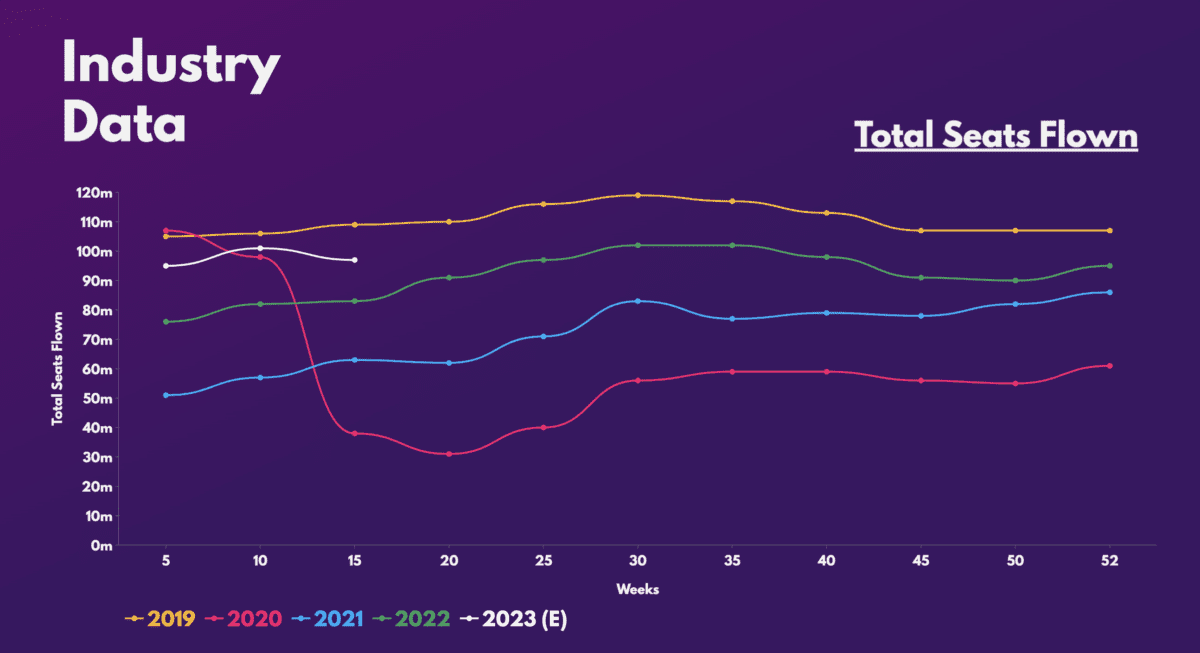

To make things sweeter, total seat numbers haven’t even hit pre-pandemic levels. What’s more, forward bookings remain strong, which means that there’s still plenty of room for growth for easyJet to capitalise on. Additionally, with more fuel efficient aircraft on order, and the rapid growth of the company’s Holidays division, there’s room for margin expansion as well.

These factors have resulted in several brokers upgrading their ratings on the stock. As such, the UK share now has an average price target of £4.58. While this is lower than its current share price of £4.90, potentially indicating an expensive buy, it’s worth noting that easyJet’s current and forward valuation multiples remain relatively cheap.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.7 | 1.8 |

| Price-to-sales (P/S) ratio | 0.7 | 0.9 |

| Forward price-to-sales (P/S) ratio | 0.5 | 0.9 |

| Forward price-to-earnings (P/E) ratio | 21.6 | 27.3 |

2. Marks and Spencer

Up an impressive 15% this year, Marks and Spencer (LSE:MKS) makes my list too. As was the case with easyJet, the UK retailer shared the joy with its investors last month, announcing an excellent Christmas update.

Aside from posting much healthier growth than Tesco and Sainsbury’s, M&S saw record sales figures during Christmas too. As a result, CEO Stuart Manchin reported market share gains in both its grocery and clothing businesses.

Nonetheless, higher energy and labour costs are bound to hit the firm’s bottom line in the short term. However, I’m invested for the long term, and the future certainly looks bright for the long-forgotten business.

Management has opted to accelerate its store rotation programme which has proven to be much more efficient in boosting its top line and margins. Moreover, the state of M&S’ financials are slowly improving, as are analysts’ price targets. And with cheap valuation multiples, I’ll be gobbling up as many shares as I can in February.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.1 | 1.3 |

| Price-to-sales (P/S) ratio | 0.3 | 0.3 |

| Price-to-earnings (P/E) ratio | 9.5 | 14.0 |

| Forward price-to-sales (P/S) ratio | 0.2 | 0.5 |

| Forward price-to-earnings (P/E) ratio | 10.2 | 12.1 |

3. Burberry

Unlike the other two UK shares I’ve listed, Burberry (LSE:BRBY) posted a mediocre update in January. Nevertheless, its guidance was enough to send the stock higher, finishing the month up almost 20%.

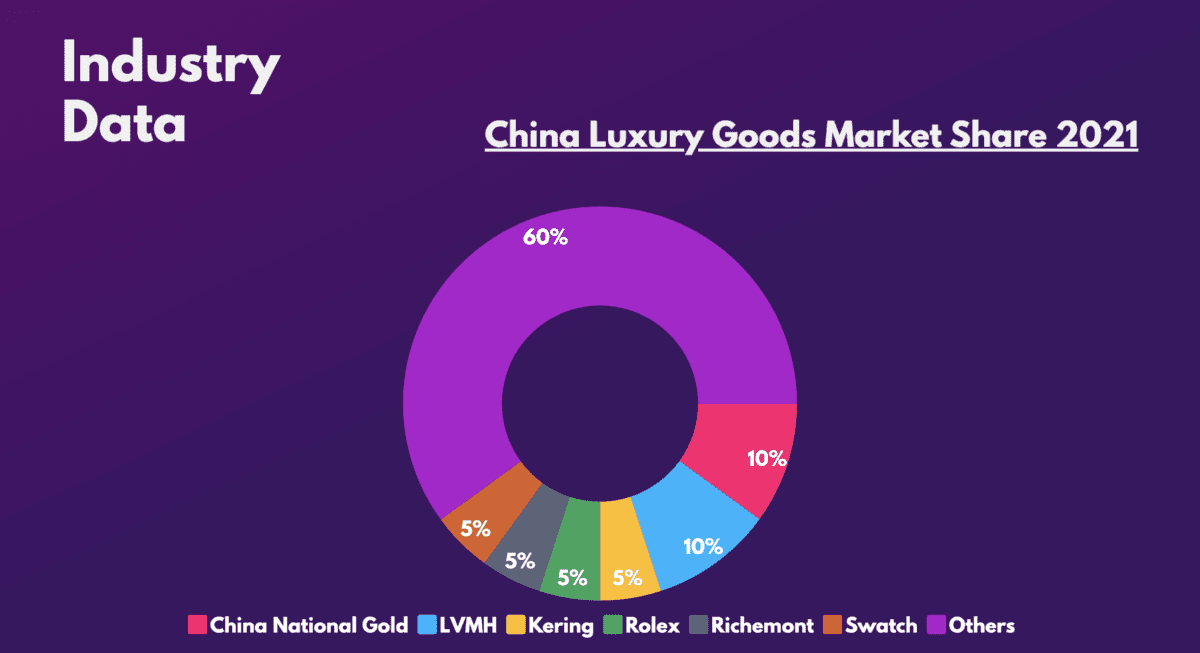

Given that the group earns the bulk of its revenue from China, revenues have been significantly weighed down over the past year due to the country’s strict zero-Covid strategy. Having said that, the recent reopening, high amount of household savings, and an increasingly more affluent middle class in China present strong tailwinds for the designer.

This presents a tremendous long-term investment opportunity for me as Burberry plans to expand its margins and Chinese market share in the medium term.

These catalysts have boosted sentiment surrounding the stock. Thus, it’s no surprise to see it trading at a higher P/E of 22. But despite the UK share’s pricier multiples, it’s still cheaper than its French peers. The Oracle of Omaha once said, “Price is what you pay, value is what you get”, and that’s what I feel like I’m getting with Burberry.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 6.1 | 8.0 |

| Price-to-sales (P/S) ratio | 3.1 | 6.1 |

| Price-to-earnings (P/E) ratio | 20.9 | 29.0 |