I’m searching for the best Alternative Investment Market (AIM) shares to own for the next decade. Here are two low-cost small-caps I’d buy it if I have cash to spare.

Agronomics

Companies that remove animals from the food chain could thrive over the next decade. Rising consumer concerns over livestock welfare, allied with a growing desire among lawmakers to reduce farming’s environmental impact, could see a radical change in our diets.

This is where Agronomics (LSE:ANIC) comes in. The venture capital business is invested in more than 20 early-stage companies that are creating products from animal and plant cells. We’re talking beef, chicken, seafood here and even cotton, leather and palm oil.

Investing in early-stage companies like these can be highly risky. For one, it can be hard to slap an accurate valuation on them and investors can easily pay over the odds.

But I believe the rate at which lab-grown meat demand is projected to grow still makes this AIM share an attractive stock to buy. Research suggests the global cultivated meat market will record a heady compound annual growth rate (CAGR) of 11.4% between 2022 and 2028.

What’s more, Agronomics shares look especially cheap based on current broker forecasts. Today the company trades on a forward price-to-earnings growth (PEG) ratio of 0.1.

A reading below 1 indicates that a share is undervalued.

Team17 Group

Investing in games studios like Team17 Group (LSE:TM17) isn’t danger free either. The industry is highly competitive and disappointing sales can smack profits hard.

The threat is particularly high for smaller operators like this too. They don’t have the colossal R&D and marketing budgets of big beasts like Take-Two Interactive, Activision Blizzard and Supercell.

However, Team17 is embarking on rapid expansion to take the fight to its rivals. The acquisitions of StoryToys and astragon in the past two years has significantly grown group sales. Revenues jumped 33% in the first half of its fiscal year to a record £53.2m.

Its successful expansion drive makes the AIM highly appealing, in my view. So does the pace at which the games industry is tipped to grow. New console launches and an improving regulatory environment in China entertainment mean entertainment software sales are tipped to soar over the next 10 years.

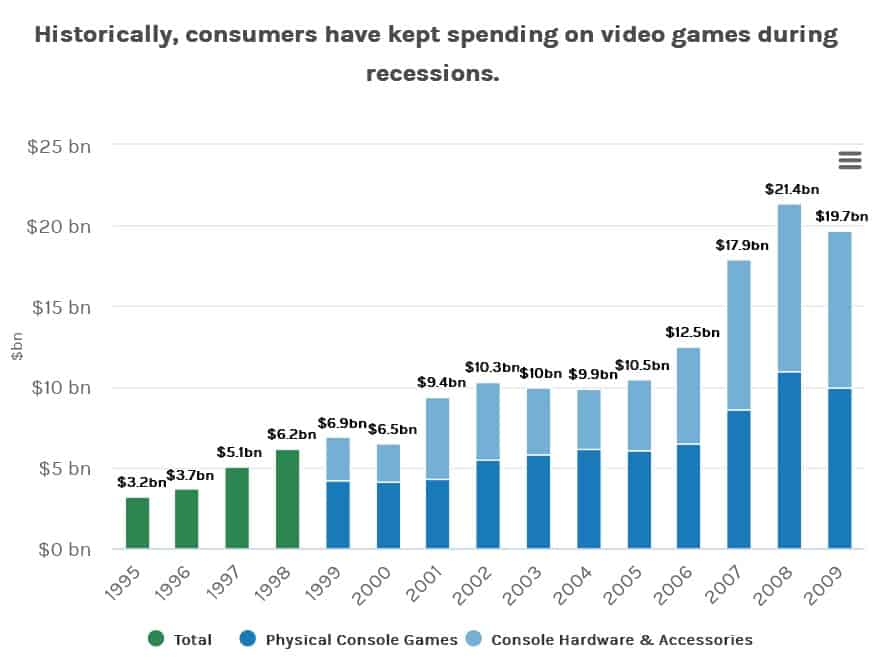

Buying games developer shares could be a good way for me to protect myself during this economic downturn too. As analysts at Morgan Stanley comment: “Staying at home fighting zombies is generally cheaper than a night out with friends, even with the initial investment in games and consoles”.

Finally, I like Team17 shares because of the company’s vast exposure to the mobile games market. This segment is growing particularly rapidly, driven by the rollout of 5G technology

At current prices, the tech share trades on an historically-low price-to-earnings (P/E) ratio of just 18.3 times. Like Agronomics, I think Team17 is a top value stock to buy right now.