I’m currently looking for dividend shares with discounted valuations to boost my passive income streams. While the FTSE 100 index flirts with an all-time high, the FTSE 250 is anchored below its 2021 peak.

In that context, I’ve identified two mid-cap shares trading near levels not seen for almost a decade. What’s more, these companies have track records of increasing or stable dividends for at least 10 consecutive years.

Could the beaten-down share prices of these dividend stocks present a rare chance to make me rich? Let’s explore.

Moneysupermarket.com

At 214p, the Moneysupermarket.com (LSE:MONY) share price is below where it’s been for most of the past decade. The price comparison website currently sports a 5.45% dividend yield.

The cost-of-living crisis is generally regarded as a headwind for most stocks due to cost-conscious consumers cutting back on spending. Moneysupermarket might be a rare exception.

People are increasingly searching for the best deals on everything from home insurance and mobile phone contracts to budget-friendly holiday packages. In this climate, the company is well placed to benefit.

The results for Q3 2022 suggest as much. Revenue growth of 33% shows positive momentum, building on 31% and 8% in the previous two quarters. The board expects full-year EBITDA to be at the upper end of market expectations.

In addition, the popularity of the firm’s MoneySavingExpert brand is another positive aspect for me. I think consumer finance champion Martin Lewis is a big asset, boosting the company’s media exposure with a regular slot on ITV‘s Good Morning Britain programme.

The business does face risks from competition. Amazon recently announced a foray into the price comparison space, which could disrupt the market. Nonetheless, Moneysupermarket has strong brand recognition and I believe the US tech giant faces a difficult task in capturing market share.

Ashmore Group

At 266p, the Ashmore Group (LSE:ASHM) share price is also trading near a 10-year low. It has fallen 24% compared to a decade ago. Currently, the investment manager offers a 6.33% yield.

This specialist investment manager offers a chance to increase my exposure to emerging markets. It focuses on external debt, local currency, corporate debt, equities, and alternatives.

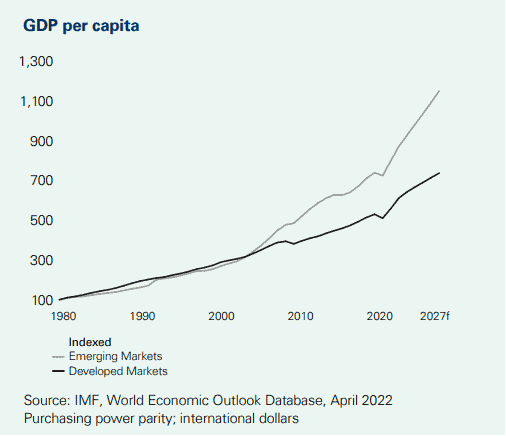

GDP growth in emerging markets has outpaced developed markets over recent decades and many analysts expect this trend will continue.

The group has faced challenges from a strong US dollar and the Russo-Ukrainian war. Its assets under management shrank to $64bn in 2022 from $94.4bn in 2021.

I expect the war will remain a headwind this year. Conversely, there are signs the dollar is beginning to weaken. Traditionally, this is viewed as a bullish factor for emerging markets.

Encouragingly, the company’s solvency ratio increased to 530% last year, up from 391% the year before. The firm’s strong balance sheet suggests the dividends look safe to me for now.

Can these dividend shares make me rich?

Given the poor performance of these stocks over the past decade, I’m wary they may not be my golden ticket to get rich.

Nonetheless, with the share prices near 10-year lows, I think this could still be a good time to buy cheap shares with high yields.

If I had spare cash, I’d buy both shares today.