Rolls-Royce (LSE: RR.) shares have been a poor investment for the past half-decade. Investors who entered their positions five years ago would be nursing a 66% loss today. Ouch.

Yet the stock’s made a flying start to 2023, lodging an 8% gain to date. It has the accolade of being a top FTSE 100 riser during the first trading days of the new year.

So, could investing in the aviation and power technology pioneer make me rich? Here’s my take.

Improving investment prospects

Civil aviation is the lifeblood of Rolls-Royce’s business. The company is sensitive to international travel demand. This has a significant impact on orders from its customers, including the likes of Footsie airline IAG, which owns the British Airways brand.

In this context, I’m encouraged that the global travel market is recovering at pace, according to the latest data from the International Air Transport Association (IATA). In November, total air traffic reached 75.3% of pre-pandemic levels globally. That’s a 41% rise from 2021.

Another tailwind for the Rolls-Royce share price is rising defence spending in developed countries, prompted by security concerns arising from the war in Ukraine.

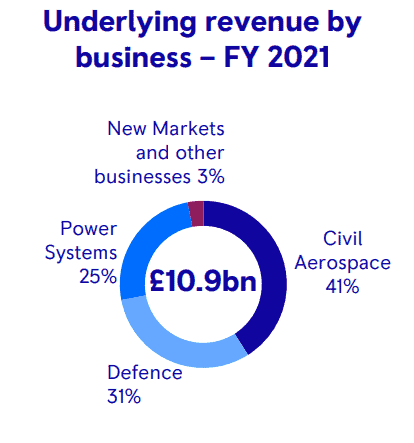

The company’s defence arm generated nearly a third of its underlying revenue in 2021. Elevated geopolitical tension should continue to support defence demand in my view.

The other major division, power systems, is benefitting from an “exceptionally strong order book“, according to the latest trading update. Rolls-Royce highlights “a record order intake” for 2022 and “good revenue cover for 2023 and beyond“. This sounds promising.

The power systems unit develops climate neutral solutions for standby power used in safety-critical plants and integrated drive and propulsion systems for ships and heavy-duty land vehicles.

Risks

I’m concerned by the debt mountain on the aerospace giant’s balance sheet. Its drawn debt outstanding totals £4bn, maturing between 2024 and 2028. This could limit the company’s growth prospects over the coming years.

A key condition of the debt repayment terms was a restriction on dividend payments until 2023. The company last delivered shareholder distributions before the pandemic.

While Rolls-Royce could in theory recommence dividends this year, I expect it’ll be a negligible yield — if anything. This isn’t a stock to buy for meaningful passive income anytime soon.

I’m also worried the company’s extensive cost-cutting measures during the pandemic could hamper its ability to meet production demand going forwards. If so, this could slow any meaningful recovery in the share price.

Can Rolls-Royce shares make me rich?

Despite an improving outlook for Rolls-Royce shares, I’m conscious the company has a history of disappointing investors. Having said that, I see a great deal of upside potential, as well as some notable risks.

Accordingly, I’d temper any expectations of making a fortune from an investment. I’m happy to settle for a respectable return instead.

Rolls-Royce probably isn’t my golden ticket to glorious riches. Nonetheless, I think the stock is an attractive buy for my diversified portfolio. Let’s hope the business breaks the pattern of negative returns and the positive momentum can be sustained.

I’ll prepare for the worst and be pleasantly surprised if the shares can turbocharge my returns in 2023 and beyond. Wish me luck!