The Rolls-Royce (LSE:RR) share price is rising strongly at the start of 2023. In fact it’s leading the FTSE 100 higher in Friday trade and was last 3.8% higher on the day.

At 108p, Rolls shares are now up 14% in start-of-year trading. Can the engineering giant continue to recover ground? And should long-term investors like me buy the business for their investment portfolios?

The case for

A bright outlook for the civil aviation and defence markets provides a good reason to buy Rolls-Royce shares today. Collectively these industries account for around three-quarters of group revenues.

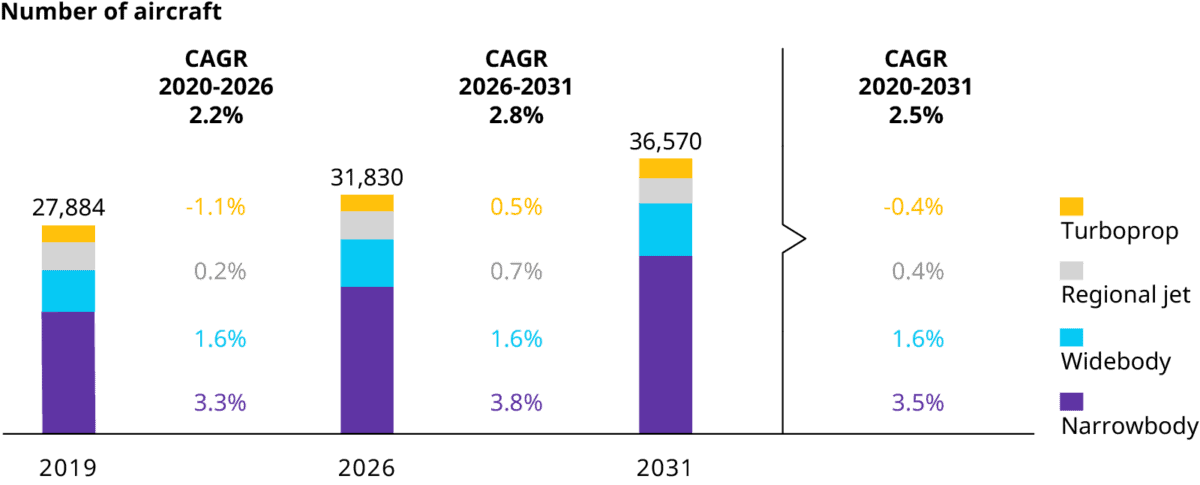

Commercial passenger numbers from emerging markets are tipped to soar over the next decade. As a consequence the number of planes in the air should grow strongly, too, as the graph from consultancy Oliver Wyman below shows.

Rolls can also expect demand for its engines to grow as military budgets are stepped up.

Tension in the West over Chinese and Russian expansionism pushed global arms spending above $2trn for the first time in 2021. Governments across the world have pledged to boost weapons expenditure further following Russia’s invasion of Ukraine, too.

Having exposure to growing markets doesn’t on its own make a stock worth investing in. Massive competitive pressures can still take a big bite out of a company’s earnings and damage shareholder returns.

The beauty of Rolls-Royce is its formidable barriers of entry. It has decades of experience building plane engines and servicing them, making it a go-to hardware supplier for plane manufacturers and militaries. It also operates in a highly capital-intensive industry. New rivals aren’t going to appear overnight to steal its customers.

The case against

Having said all of that, I still have massive reservations over buying Rolls-Royce shares. My main concern is its huge financial obligations (undrawn net debt rang in at £4bn as of September).

The cost of servicing this is huge and set to rise further as interest rates increase. These huge debts also casts a shadow over the firm’s R&D spending in areas like green technology. And they are particularly worrying to me given the uncertain near-term outlook for the aviation industry.

Airline profits have rebounded strongly following the end of Covid-19 lockdowns. But they could cool sharply as the global economy splutters. Travel spending from holidaymakers and business passengers might hit the buffers in 2023, damaging the revenues Rolls makes from its servicing activities and hitting its ability to pay these debts down.

The verdict

As a value investor, I think Rolls-Royce shares look highly attractive right now. City analysts think the engine builder will grow earnings 292% in 2023. This results in a rock-bottom forward price-to-earnings growth (PEG) ratio of 0.1. Any reading below 1 indicates that a stock is undervalued.

However, there are many other FTSE 100 value stocks for me to choose from today. And I’m put off by Rolls’ high debt levels as well as the prospect of strong and sustained cost inflation. High costs forced it into a £1.6bn loss in the first half of 2022.

All things considered I’d rather invest in other cheap UK shares right now.