A Stocks & Shares ISA can be a great medium for me to grow my spare cash over several years through buying equities. With a new financial year dawning upon us, here are a couple of reasons why I’ll be starting an account in 2023.

1. Exemptions from incoming tax increases

One of the main perks of a Stocks & Shares ISA is its tax benefits. Mainly, it helps to reduce or even eliminate capital gains tax liabilities. It can also provide tax relief on investment income such as dividends. Even more so when I’m planning to invest in FTSE 100 shares with high dividend yields.

Investors are currently allowed to invest up to £20,000 a year, tax free. This allows me to make greater use of my returned capital and potentially earn more from my investments over the long term. The current tax-free allowance outside of an ISA for capital gains and dividends is £12,300 and £2,000, respectively.

Both capital gains and dividend allowances are set to decline massively through to FY24. As such, there’s even more of a reason for me to start a Stocks & Shares ISA. This is especially the case as a long-term investor practicing Foolish principles.

| Tax-free allowance | FY22 | FY23 | FY24 |

|---|---|---|---|

| Capital gains | £12,300 | £6,000 | £3,000 |

| Dividends | £2,000 | £1,000 | £500 |

2. A banging year ahead

If not for an ISA, I could be losing quite a bit of my gains if I were to sell my shares, especially when the stock market is expected to rally this year, and beyond that.

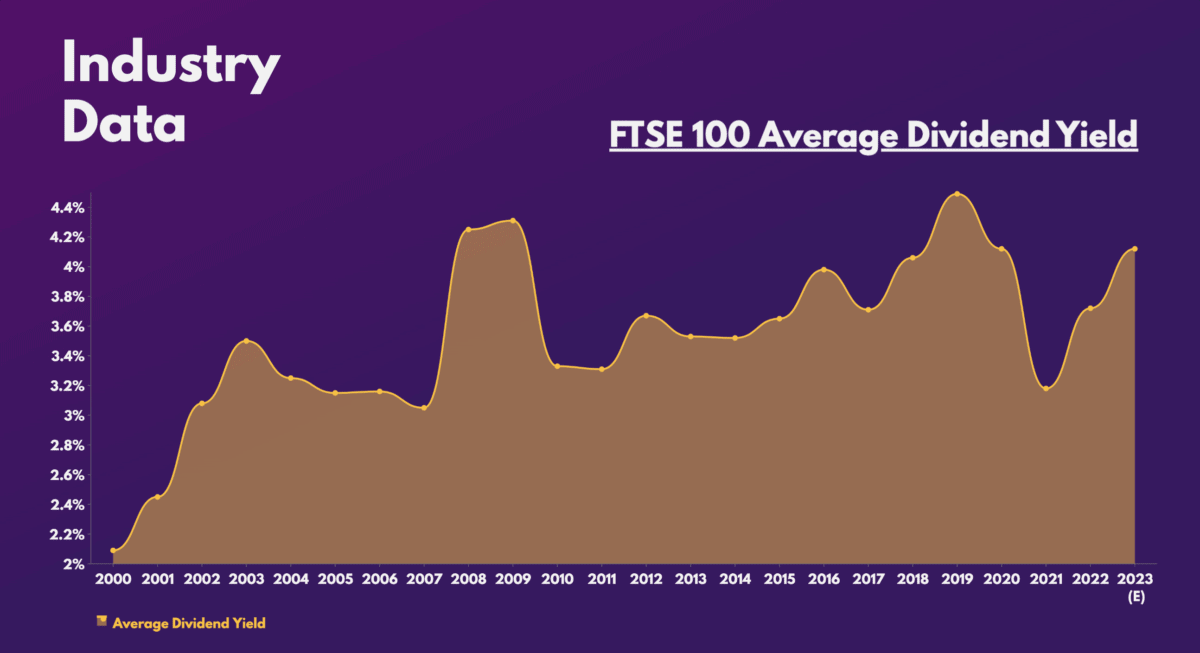

Broker AJ Bell is forecasting the FTSE 100 to hit an all-time high this year. In fact, Britain’s leading index has already hit a six-month high this week. Analysts are predicting that the index’s biggest sectors will outperform in 2023. Consequently, pre-tax profits and dividends are anticipated to grow substantially.

| Sector | Pre-tax profit growth | Dividend growth |

|---|---|---|

| Oil & Gas | 24% | 23% |

| Financials | 23% | 18% |

| Mining | 16% | 16% |

| Consumer staples | 12% | 12% |

| Industrials | 7% | 8% |

Therefore, if I were to invest £20,000 into stocks and shares in these sectors, I may have to pay a hefty amount of taxes from the increment in dividends without an ISA. After all, dividend yields in miners and energy companies are already relatively high.

That being said, most of my current positions are in US growth and tech stocks. Despite analysts not being so bullish on US equities this year, I’m still continuing to dollar-cost-average on names such as Alphabet and Pinterest, which have huge upside potential. Thus, an eventual surge in their share prices could see me paying a hefty fee if I do decide to sell my shares at higher valuations one day.

So, in order to avoid paying Uncle Sam his pay cheque, I’ll be aiming to start a Stocks & Shares ISA for my investments before the new financial year begins in April.