Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) stock had a terrible time last year, declining almost 40%. So, here are five things to look out for in 2023, as these could serve as potential catalysts to send the tech stock back above $100.

1. A Fed pivot

Coming into 2023, the Fed funds rate stands at 4.5%. This is the official interest rate in the US. Consequently, consumer activity has taken a hit, impacting the earnings of tech stocks.

While the Federal Reserve isn’t expecting to pivot on its rate hikes this year, a pause could be on the cards as soon as the committee’s next meeting. Nonetheless, even a pause could spark a relief rally and send Alphabet stock upwards.

2. Return to advertising

Why would that be the case? It’s because consumer sentiment will most likely start to rebound when the Fed decides to pivot as mortgage rates and borrowing rates come down. Consumers will have higher discretionary spending and businesses will be more inclined to take on debt and spend money to grow their companies.

Much of that money should end up going into advertising as businesses push to sell their products and services. And there’s no better stock to capitalise on this than Alphabet, I feel.

3. Monetisation on Shorts improves

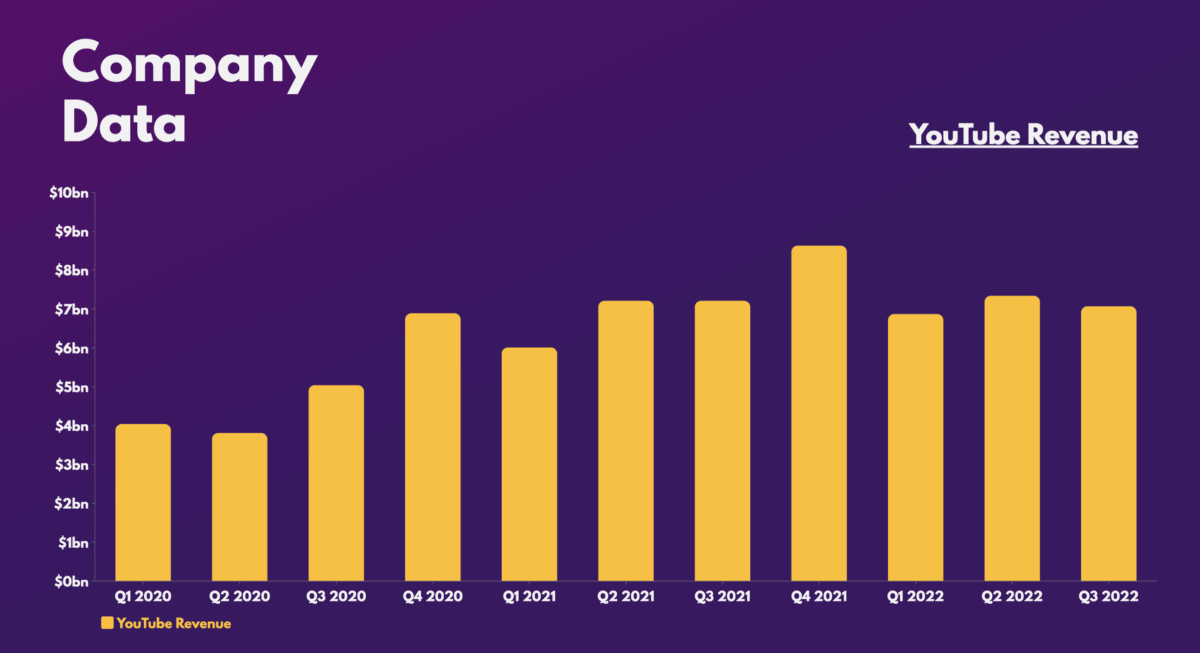

Speaking of advertising, investors like myself will be keen to see YouTube returning to growth. In Alphabet’s Q3 earnings report, the video platform suffered a downturn in advertising revenue as TikTok continues to snatch viewers.

Additionally, YouTube seems to be unintentionally cannibalising its own business model through the introduction of Shorts. This is because watch minutes are being redirected to short-form content which isn’t as monetisable as long-form videos.

For those reasons, Alphabet stock would definitely benefit from an improvement in YouTube’s top-line numbers, in both short and long-form video content. Whether it happens remains a big question.

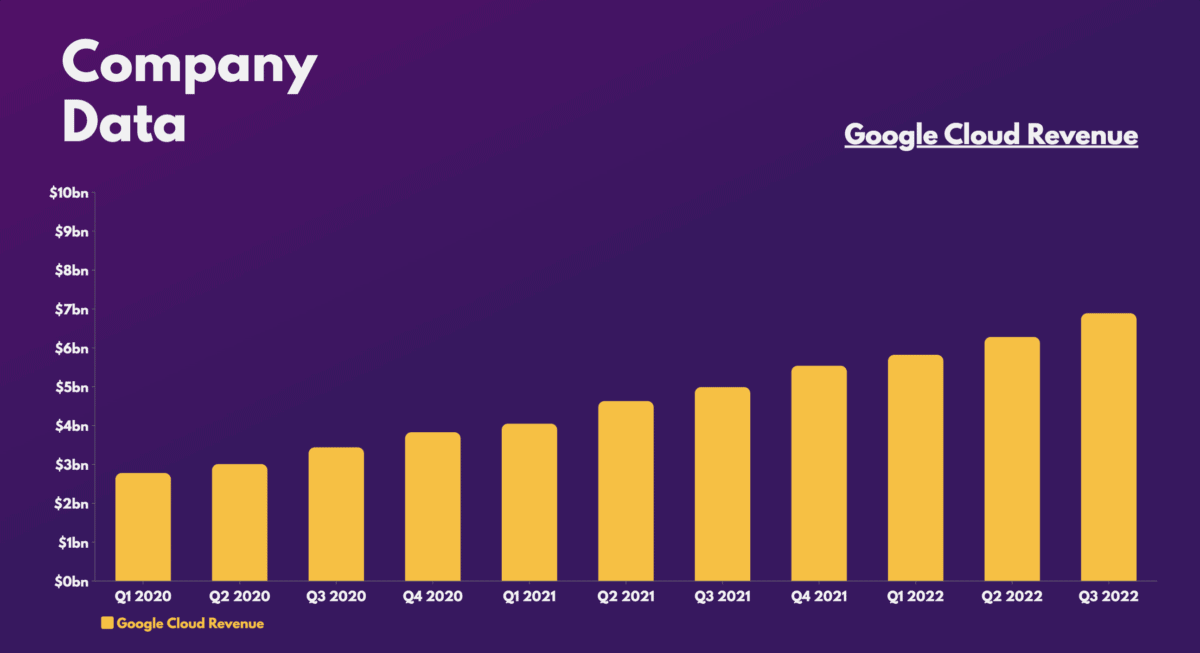

4. Cloud gets closer to profitability

Although Google Cloud’s growth rate slowed slightly in 2022, renewed growth this year would put a smile on my face. That’s because it operates on economies of scale. More customers would translate into lower operating cost per unit, which would push the segment closer towards profitability.

Moreover, steep revenue growth would indicate that the cloud service is successful at gaining clients in a competitive market filled with giants such as Amazon, Microsoft and IBM. This would show Alphabet is able to capture market share through its own unique selling point(s).

5. Headcount slows down

One of Alphabet stock’s biggest turn-offs last year was headcount growth. Investors were questioning this given the economic climate, especially when the conglomerate should be cutting costs. This was the leading reason behind Google’s parent company missing earnings estimates for three straight quarters. Therefore, a slowdown in recruitment/staffing cost would be welcomed.

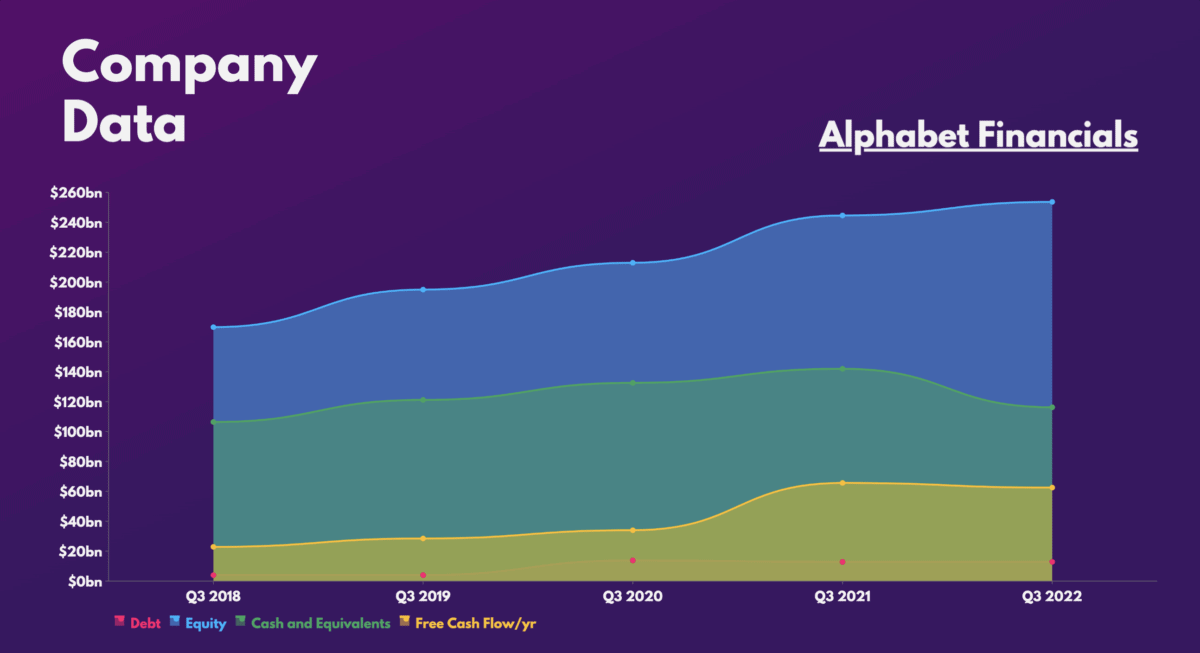

That said, I’m still heavily invested in Alphabet. With an immaculate balance sheet and headwinds turning into tailwinds, I believe its share price will start to rebound this year. Most importantly, the stock currently trades at relatively cheap multiples, which is why I’ll be dollar-cost-averaging at these levels.