The Prudential (LSE:PRU) share price fell 12% over the course of 2022. But the life insurer bounced back in the final months of the year on hopes of improving profits in China.

The overwhelming view among City brokers is that now is a good time to buy the FTSE 100 company too. Of the 19 analysts with ratings on Prudential shares, a whopping 17 rate the company as a ‘buy’. One person is neutral on the business while one has placed a ‘sell’ on it. That’s according to stock screener Digital Look.

Will the Prudential share price continue to rebound? And should I buy the Asia-focussed business for my portfolio in 2023?

3 reasons to buy

The ongoing battle against Covid-19 in China weighed on investor appetite for ‘The Pru’ last year. But news from the company’s flagship marketplace has been much more encouraging in recent months.

Beijing has now dropped its zero tolerance approach to infections and ended lockdowns. There are rumours too that lawmakers may reopen the border between the mainland and Hong Kong, possibly as soon as next week.

Improving economic conditions in China and South-East Asia are critical for Prudential. It’s bet big on Asia and hived off its UK and US operations to concentrate on this underexploited territory. It’s a strategy that could pay off handsomely as wealth levels in these emerging markets steadily grow.

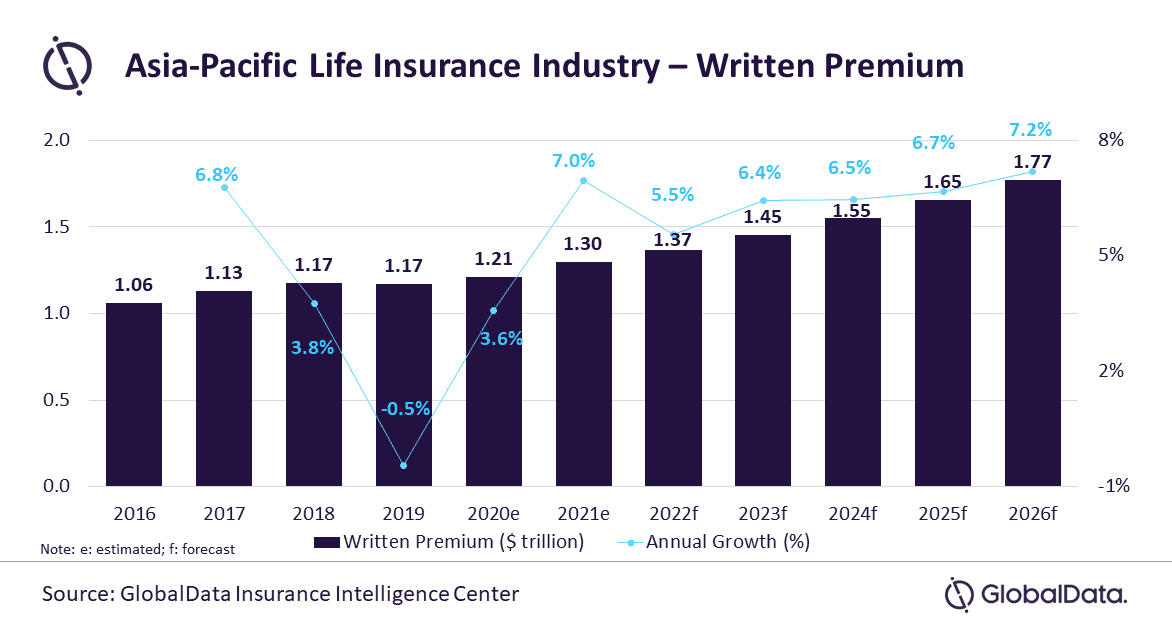

Analysts at GlobalData reckon life insurance written premiums in Asia Pacific will rise at a compound annual growth rate (CAGR) of 6.5% between 2021 and 2026.

I think Prudential’s exceptional brand power gives it an edge in this fast-growing market as well. Brand recognition is a particularly potent weapon when it comes to financial services. And the business has spent 175 years building its reputation as one of the most trusted life insurance providers out there.

2 reasons to avoid

The story of Prudential’s share price in 2023 will be dominated by the coronavirus crisis in China. And while things are moving in the right direction, a fresh explosion in infection numbers could see mass lockdowns reintroduced.

The subsequent hit to life insurance demand could pull the company’s share price lower again. It could also affect the level of dividends the company pays out if profits tank.

It’s also important to consider that other financial services companies are also aggressively investing in Asia. Prudential may have a difficult time trying to grow earnings as major rivals like Allianz and Ping An expand.

The verdict

On balance however, I think the life insurer is a great stock to own for for the long term. It’s why I continue to hold the shares I first bought two years ago.

City analysts think Prudential’s earnings will rebound 80% in 2023. This leaves the company trading on a forward price-to-earnings growth (PEG) ratio of just 0.2, well below the bargain benchmark of 1. At these prices I’m considering buying more shares this January.