Bank stocks tend to fare better during times of high interest rates. This is why Lloyds (LSE:LLOY) investors would have been disappointed to see its shares finish the year down 8%. Nonetheless, I believe the following three catalysts could bring upside potential to the stock in 2023.

1. Better-than-expected economic data

Government and economic organisations are all predicting that Britain will plunge into a recession this year. However, Lloyds’ Q3 report suggested otherwise. Management listed a base case scenario for how it expects the UK economy to perform in 2023. Additionally, an upside scenario was also laid out. Provided the majority of these metrics can be met, Lloyds shares could stand to benefit.

| Metrics | Base case | Upside case |

|---|---|---|

| GDP | 3.4% | 3.6% |

| Unemployment rate | 3.7% | 3.3% |

| House price growth | 5.0% | 6.1% |

| Commercial real estate price growth | 2.8% | 8.7% |

| Bank rate | 2.06% | 2.16% |

| CPI inflation rate | 9.1% | 9.0% |

2. Net interest margin widens

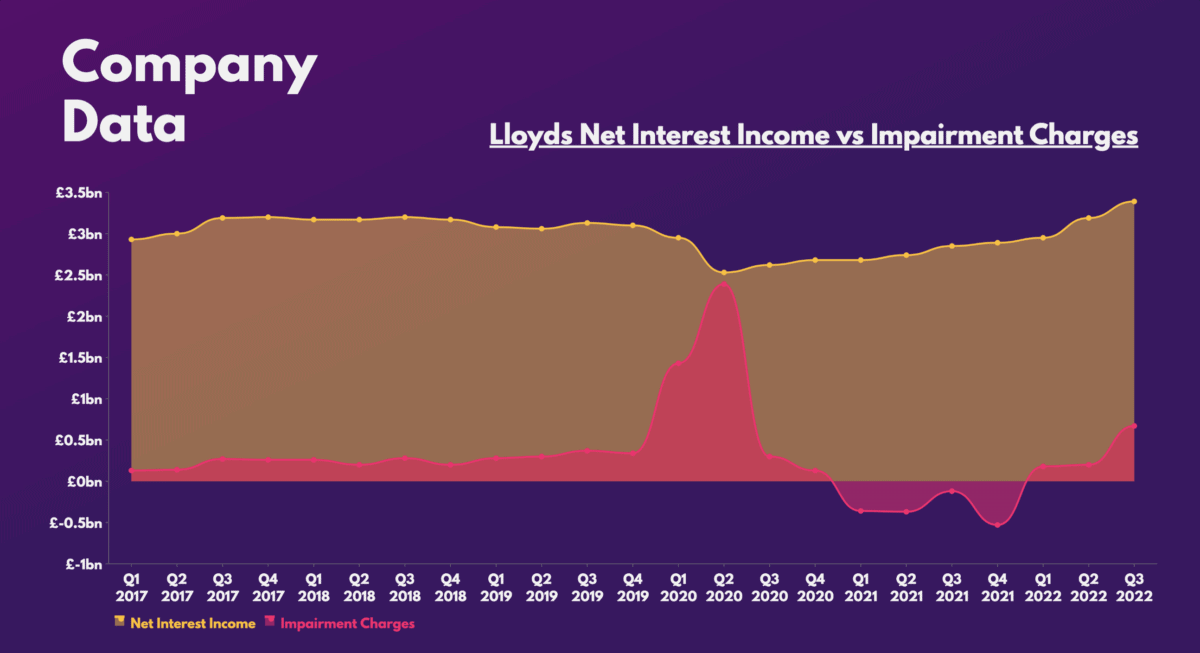

The Black Horse bank earns the bulk of its income from net interest income (NII). This means the Lloyds share price is more sensitive than most other banks to interest rates.

With approximately £80bn of assets held in central bank reserves, it earns additional income for every rise in the bank rate. Given that the Bank of England (BoE) could still increase rates a little this year, Lloyds is estimated to see its NII margins widen further. Provided the BoE doesn’t drop the bank rate lower than 2% later in the year, Lloyds shares could see limited downside risks.

Moreover, the bank’s balance sheet is in a healthy position to cover the rise in bad debts comfortably. This is due to its excellent CET1 ratio of 15%, which well above the minimum requirement of 4.5%. That’s the amount of liquid assets it has to cover its risky liabilities.

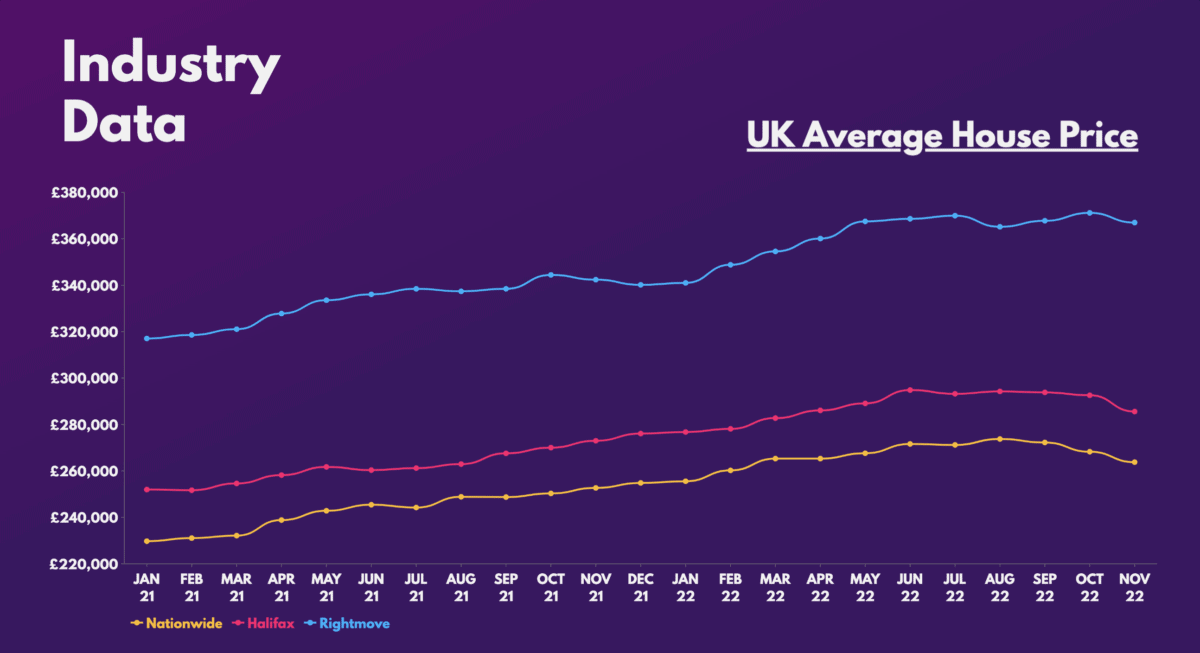

3. House prices don’t crash

Having said that, the firm will also be paying close attention to the housing market. As the nation’s biggest mortgage lender, a housing market crash could see Lloyds’ income quickly deteriorate, along with its share price. After all, alarm bells have started ringing as the latest market data is starting to show weakness.

Nevertheless, a smaller ‘correction’ seems more likely. Most banks and building societies don’t think average house prices will drop by more than 15% this year, which is in line with the Office for Budget Responsibility’s estimates. In the event that the housing market remains stronger than expected, I can see Lloyds shares benefiting as mortgage affordability catches up to sky-high house prices.

That being said, I’m not as bullish as the board for the year ahead. The company’s share price is closely linked to the British economy with little to no diversification in its income stream, and that’s something that’s unappealing to me. Lloyds could very well benefit in the short term, but its long-term outlook remains extremely ambiguous. As such, I don’t see myself being an investor any time soon.