Luxury brands tend to do well during times of high inflation. That’s because they are able to pass costs on to their customers, who are generally less sensitive to rising prices. Hence, Burberry (LSE: BRBY) has managed to outperform the FTSE 100 this year. So, here’s why I think it has the potential to do it again in 2023.

Returning revenue

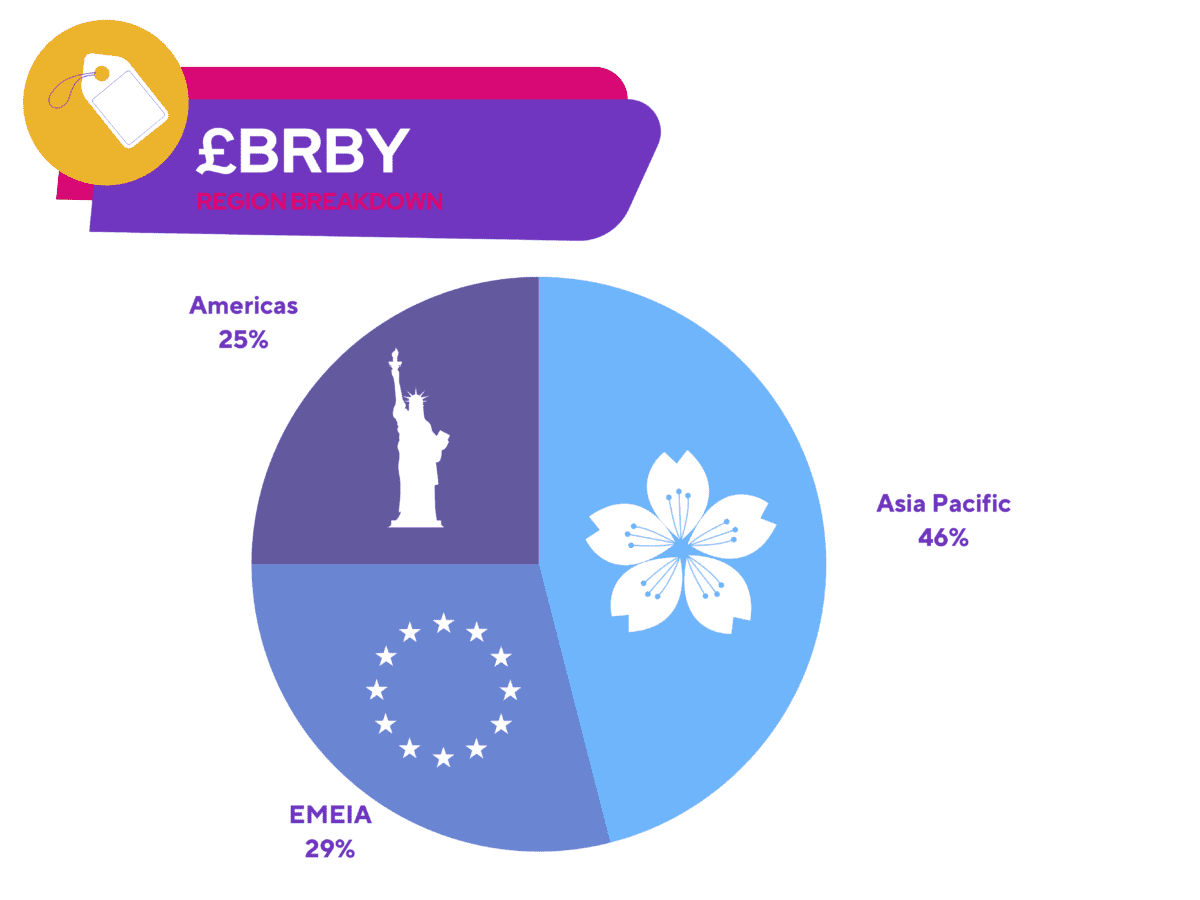

Over the past few years, Burberry has been pivoting more of its focus towards China. This is because the total addressable market there is more lucrative due to its increasingly affluent population. Asia Pacific constitutes almost half of Burberry’s total sales.

That being said, China’s zero-Covid policy has tanked revenues in the region by 19%. However, this could all be about to change as China abandons its zero-Covid policy.

A recent McKinsey survey indicates that urban households have been building up savings, which have reached their highest levels in almost a decade. With a further 71m households entering the upper-middle and high-income class, this could act as a tailwind for Burberry.

A need to check itself

Over the past few years, Burberry’s revenues have been falling on an annualised basis. That was up until its most recent financial year. But why has that been the case?

Due to a lack of uniqueness in its brand identity, several of its products have fallen out of favour. As such, Burberry hasn’t been able to increase its prices as steeply and rapidly like its peers.

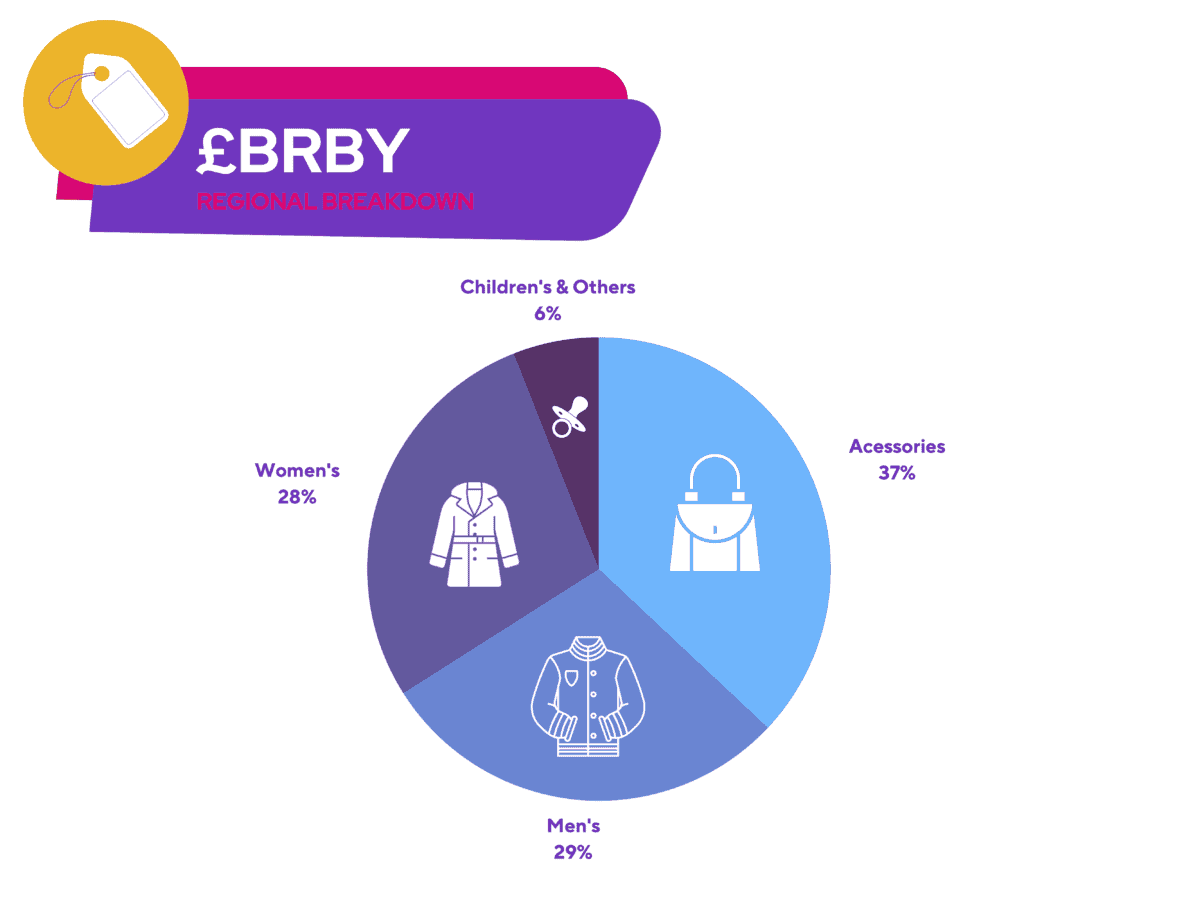

Nonetheless, CEO Jonathan Akeroyd recently devised a plan to turn this sluggishness around. He plans on doubling sales for leather goods, shoes, and women’s wear in the medium term, while doubling online sales volumes as well.

This should see the fashion house hit £5bn in annual revenue by FY25, up 77% from FY21 levels. Moreover, he strives to grow the group’s profit margins (15%) in an attempt to catch up to the likes of Kering and LVMH (18%).

Either way, luxury brands need to maintain their appeal through its brand identity. Unfortunately, Burberry has lost that somewhat over the years. Incoming CCO Daniel Lee should look to take advantage of the designer’s rich British history and classic check design, and breathe new life into its products, which would give it the platform to elevate itself as a luxury player.

Expensive multiples?

Given the tailwinds from robust travel demand and a reopening Chinese economy, I’m expecting Burberry shares to benefit massively in 2023. Having said that, are its shares worth buying after a 35% rally from its bottom this year?

On the face of it, its current price-to-earnings (P/E) ratio stands at 18, which is higher than the FTSE 100’s average of 12. On the flip side, a low price-to-earnings growth (PEG) ratio of 0.5 indicates good value. Considering that I’m investing for future growth, I think PEG is a more appropriate multiple.

Barclays and Deutsche rate Burberry shares a ‘hold’, with an average price rating of £21.25. Nevertheless, these ratings were given before China opted to abandon its zero-Covid policy. For that reason, I’m more likely to side with Goldman Sach‘s price target of £25.50, as I see more potential. Thus, I’ll be buying Burberry shares when I’ve got more spare cash.