Warren Buffett’s holding company, Berkshire Hathaway, owns shares in many companies. Here are three Warren Buffett stocks I’m considering buying, which could see significant upside in 2023 and beyond.

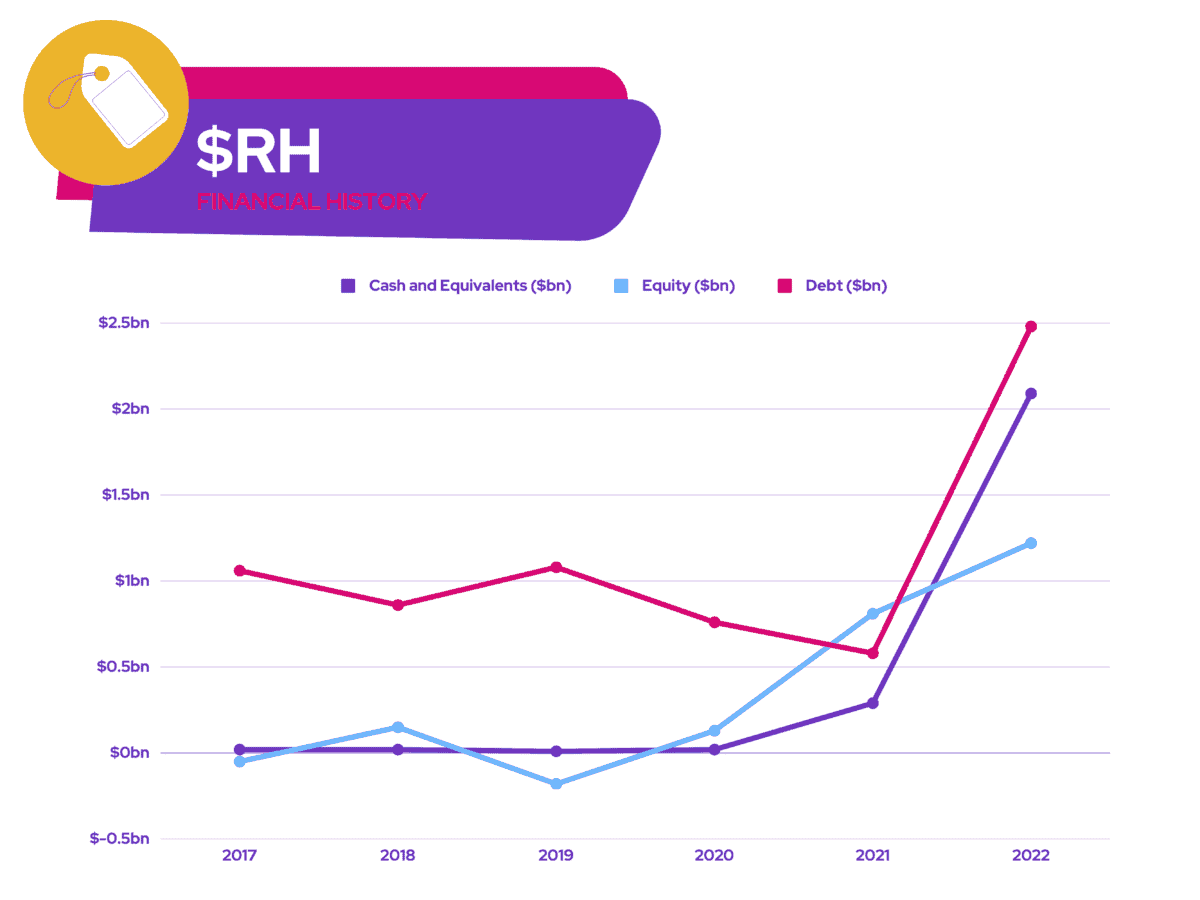

1. TSMC

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is a semiconductor foundry that makes chips for leading tech companies like Apple, AMD, and Qualcomm.

Amid declining chip demand this year, Buffett practiced what he always preaches — “Be greedy when others are fearful”. The Oracle of Omaha took the opportunity to take advantaged of the stock’s discounted price, and bought a big position worth $4.1bn.

The company has solid growth potential. Demand for faster and more powerful processors keeps increasing every year, and there are few other semiconductor manufacturers that can match TSMC’s production capability. Additionally, it’s been growing its profit margins over the past decade.

The foundry also has ambitions to diversify its geopolitical risks. It’s planning on building two factories in the US in the coming years, which could ease investors’ worries about a Chinese invasion of Taiwan.

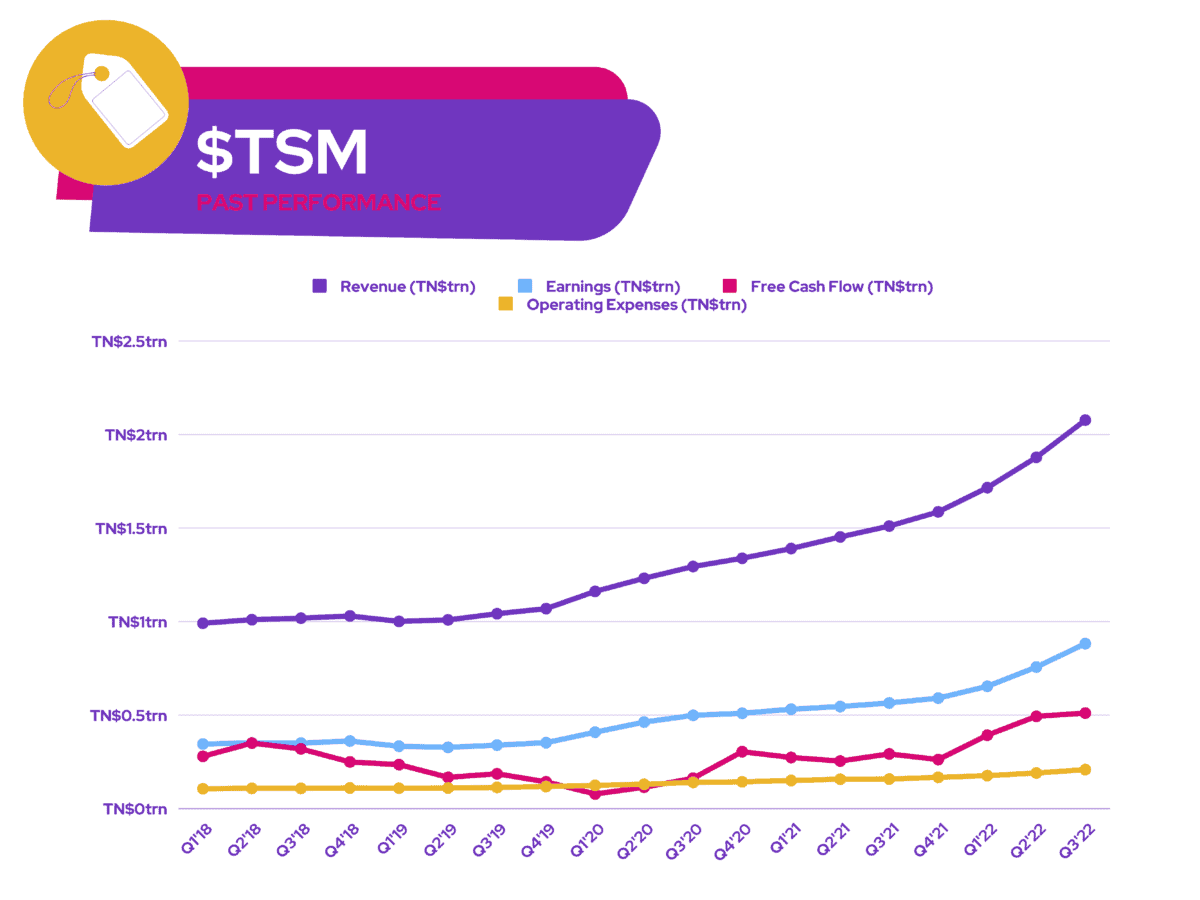

2. Paramount

Warren Buffett’s investment in Paramount (NASDAQ: PARA) is a fascinating one. That’s because it’s one of the few big tech investments that he’s made. The film studio and broadcaster owns the rights to renowned films such as Mission Impossible, Star Trek, and The Godfather. It’s also seeing the benefits from producing shows for streaming services such as Netflix and Amazon Prime Video.

Advertising revenue is expected to drag the company’s overall revenue in the next couple of quarters, but its long-term outlook looks positive. This is due to the studio’s strong moat and presence across media channels in the US.

Having said that, I’m paying close attention to the state of its balance sheet. While its debt-to-equity ratio isn’t staggeringly high, it’s worth noting that its cash and equivalents don’t cover its total debt. This is even more worrying when taking into account its negative free cash flow.

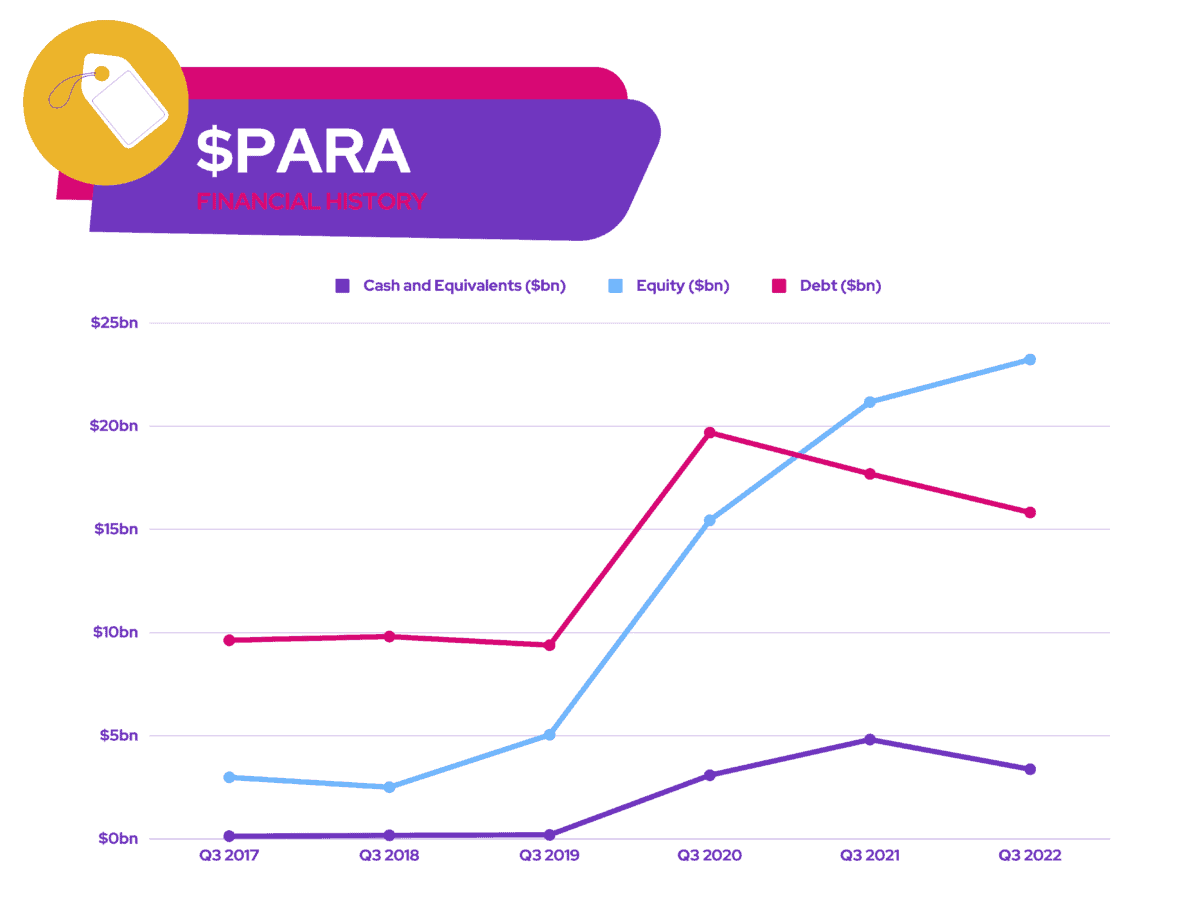

3. RH

Restoration Hardware (NYSE: RH) is a luxury furniture and home-decor retailer. It’s managed to stay afloat in an increasingly competitive retailing landscape.

Its success can be attributed to a well thought-out omni-channel strategy. Its top line figures grew by 32% this year, thanks to its new, modern, and convenient shopping experience for customers.

Headwinds for the furniture conglomerate can’t be ignored, as housing activity continues to decline. However, RH’s long-term outlook remains strong given its pipeline of luxury ideas. This is evident through its recent expansion into other categories, which include modern, teen, and hospitality. These are areas its competitors have barely touched. If successful, this could help RH capture incremental market share.

The firm’s balance sheet isn’t terrible, but it’s not the best either. It’s got a high debt-to-equity ratio of 203.5%, but its cash and equivalents are sufficient to cover its short-term debt. Even so, its declining free cash flow is something I’m keeping a close eye on.