Tech companies haven’t had a good time this year. But not many have suffered as much as Meta stock (NASDAQ: META), which is down by a whopping 65% and is now trading at a six-year low. Some of its valuation multiples are at an all-time low. Despite its ‘cheap’ price, I think it could be a value trap.

Universal lows

Just last week, JP Morgan upgraded its rating for Meta stock, from ‘neutral’ to ‘overweight’. Additionally, the investment bank improved its price target for the Facebook owner, from $80 to $115. So, why did this happen?

Well, despite the company’s declining bottom line over the past few quarters, the fact remains that it still generates a profit. And according to JPM, shares in Meta are now trading at cheap valuations based on those numbers and future cash flows.

For instance its current price-to-earnings (P/E) ratio stands at 11. This is half the S&P 500‘s average of 22. Although this is a lagging indicator, its forward P/E also indicates value at 14. Pair this with a price-to-earnings growth (PEG) ratio of less than 1 and an EV-to-EBITDA ratio of less than 10, and it points towards Meta stock potentially being oversold.

Making dreams a reality?

Nevertheless, I believe its current multiples could be a value trap. This is because profits could decline further and push valuation multiples back into overvalued territory. After all, Meta has a number of headwinds to navigate through before it can restore investor confidence.

The biggest one is that it’s yet to convince investors that its Reality Labs arm can take off and claw back the massive losses it’s generated. I for one, am not. Capital expenditure for the branch has hit unreasonably high levels with little or nothing to show for it, and costs are expected to hit $250bn in 10 years. For context, only the Apollo Program has ever eclipsed such spending figures for a project. As such, it’s going to have to generate momentous profits to justify Mark Zuckerberg’s metaverse ambitions.

Apart from that, Facebook and Instagram are still having trouble navigating through Apple‘s new iOS privacy settings. This has limited the amount of advertising revenue it can make due to the lack of data it can collect.

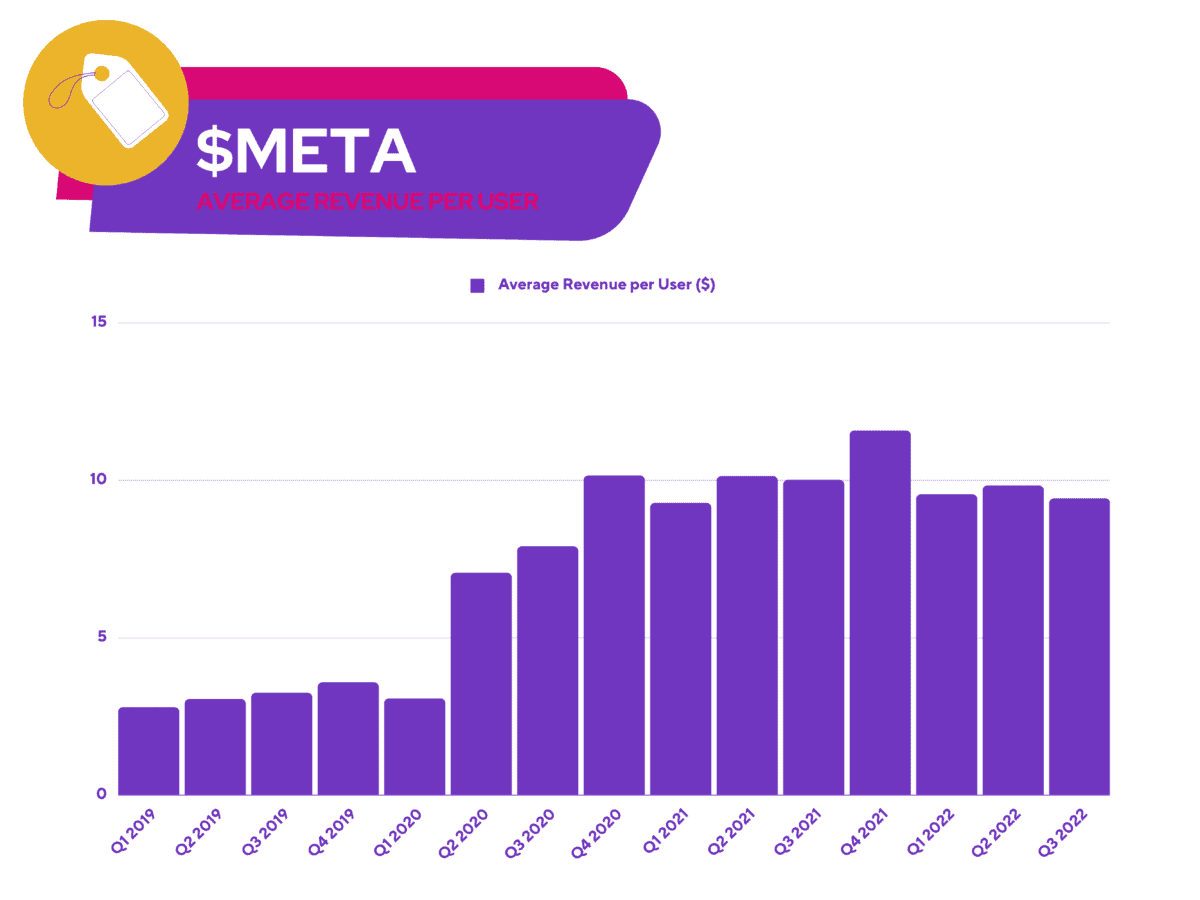

Not to mention, Facebook is facing a saturation problem. Growth in its average revenue per user (ARPU) seems to be peaking. In fact, it was already showing signs of this before the stock market crashed this year.

Meta spending

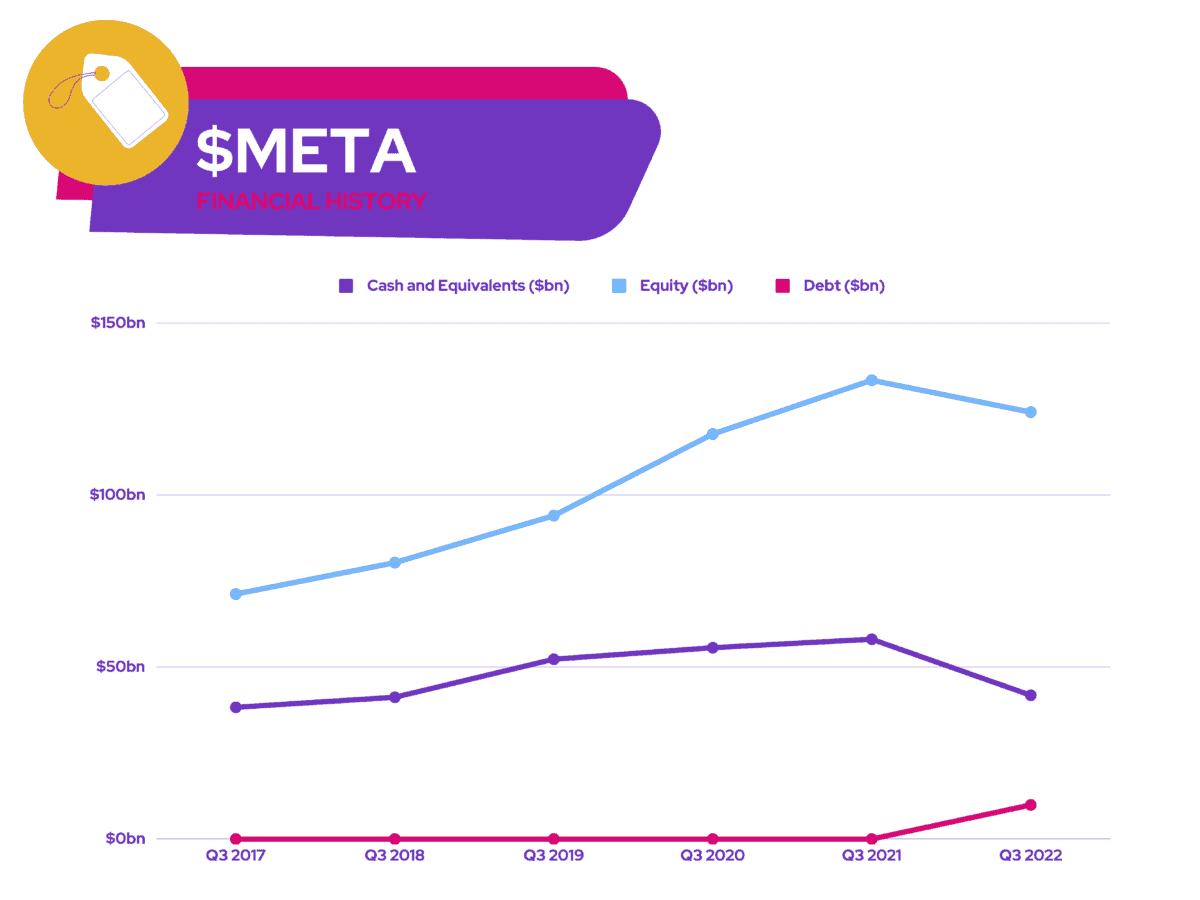

That being said, Meta’s balance sheet isn’t in the most precarious position. It’s got a healthy debt-to-equity ratio of 8%, which should allow it to weather the upcoming recession. Moreover, its cash and equivalents should give it enough runway to further explore its virtual reality plans without having to raise capital, although $10bn worth of debt was taken on in its more recent quarter.

Even so, I’m hesitant about buying Meta stock. Its multiples may look attractive, but the company is facing too many headwinds. The stock may have bottomed out and a turnaround is possible, but the risks are too high for me, especially when its free cash flow is declining at an alarming rate. Therefore, I’ll wait and watch the stock before considering buying.