Retail banks like Lloyds (LSE: LLOY) are meant to do better when there are high interest rates. Still, it’s underperformed its parent index, the FTSE 100 this year, and is down about 10%. With worries of the Lloyds share price dropping further in 2023, here’s why I think such fears are unwarranted.

1. Strong balance sheet

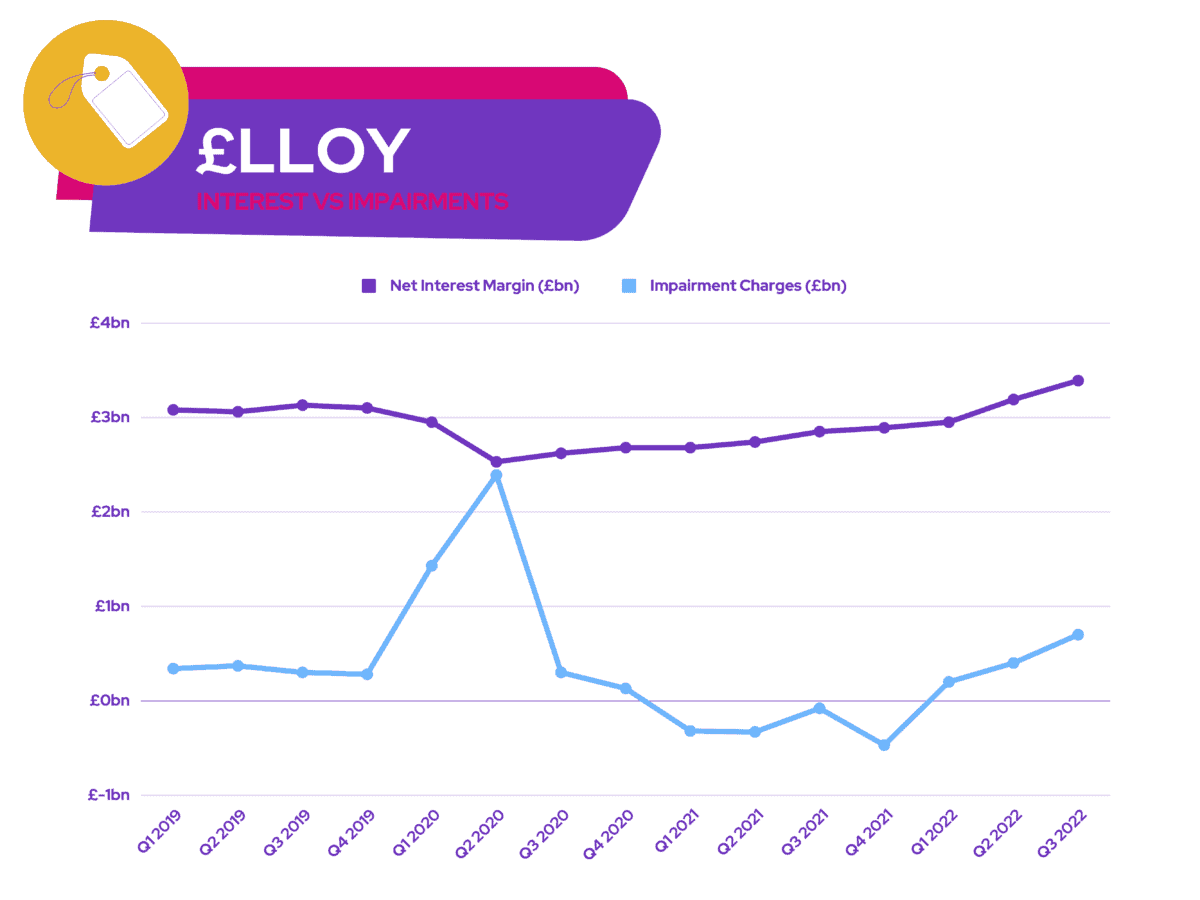

Investment banks tend to fare worse during a bear market when trading volumes are muted. That’s why Lloyds has managed to outperform the likes of Barclays and even JP Morgan. The British bank earns the bulk of its income from net interest income (NII). This means that it’s more sensitive to interest rate rises.

With almost £80bn of its assets held in central bank reserves, it earns an additional £200m for every 0.25% by which the Bank of England (BoE) raises its bank rate. Given that the BoE has increased interest rates to 3.5%, Lloyds is estimated to receive £2.8bn from those deposits.

Although impairment charges are on the rise, Lloyds is still in a healthy position to cover those bad debts comfortably. The bank’s balance sheet has an excellent CET1 ratio of 15%. That’s the amount of liquid assets it has to cover its risky liabilities. For context, the minimum requirement for a healthy CET1 ratio is 4.5%. Additionally, it’s got a high liquidity coverage ratio of 146%. This shows the group has sufficient cash to hand out in the event of mass withdrawals.

2. No housing market ‘crash’ expected

Lloyds is the UK’s biggest mortgage provider. For that reason, it’s important to keep a close eye on house prices and mortgage rates. Higher rates could benefit Lloyds shares. But it can also result in higher bad debts, as is the case now.

Nonetheless, fears surrounding a housing market crash are unfounded so far. A smaller ‘correction’ seems more likely. Most banks and building societies don’t think average house price will drop by more than 15% next year, which is in line with the Office for Budget Responsibility estimates.

With that in mind, the firm should start seeing bad debts bottoming sooner rather than later. This is also because the BoE is starting to slow down its rate hikes, which could even mean mortgage rates declining at some point.

3. Positive upside

Another reason why I think Lloyds shares will do just fine next year is the scenario it expects to play out for the UK economy. In its Q3 update, the high street bank laid out a variety of upside and downside scenarios. And given its base case, I think Lloyds shares have upside potential in 2023, as I don’t see unemployment running as high as 4.9%, and for the bank rate to drop to 4%.

| Metrics | Base case scenario |

|---|---|

| GDP | -1.0% |

| Unemployment rate | 4.9% |

| House price growth | -7.9% |

| Commercial real estate growth | -14.4% |

| Bank rate | 4.0% |

| CPI inflation | 6.2% |

For those reasons, I think Lloyds shares won’t get hammered next year. After all, the likes of Deutsche and Berenberg have an average ‘overweight’ rating on the shares, with an average price target of 59.5p.

That being said, I’m not a big fan of bank shares given the cyclical nature of their businesses. While Lloyds has short-term upside potential, I don’t see it producing earnings growth over the next decade. So I won’t be investing in the bank.