I don’t have mountains of spare cash with which to invest. But here are three FTSE 250 dividend stocks that I’d love to buy for my portfolio today.

I think these companies could provide exceptional returns for many years. And at current prices I think they could be too cheap for me to miss.

Target Healthcare REIT

Care home operator Target Healthcare REIT (LSE:THRL) is a FTSE 250 share I already own. And following recent heavy share price weakness I’m considering buying more of its stock.

Today the firm trades on a forward price-to-earnings growth (PEG) ratio of 0.5. This is well below the value benchmark of 1. The property stock also sports a big 8.8% dividend yield.

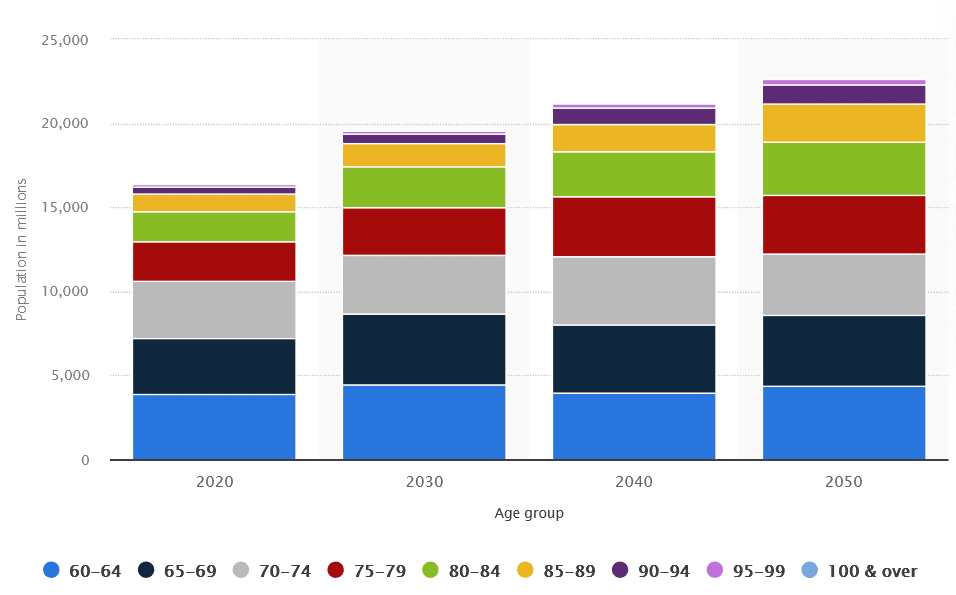

Target has enormous profit opportunities as Britain’s elderly population booms. The number of over-65s jumped to 11m in 2021, according to the latest census. Further steady growth means demand for specialist care homes is likely to boom.

I think Target’s a top buy despite the risks created by its acquisition-driven growth strategy. Such a programme can erode shareholder value if new assets create unexpected costs or generate disappointing revenues.

NextEnergy Solar Fund

Renewable energy stock NextEnergy Solar Fund (LSE:NESF) also offers excellent all-round value. It trades on a forward price-to-earnings (P/E) ratio of 6 times and carries a 6.9% dividend yield.

NextEnergy owns solar assets in Europe, the US and Asia. And it has raised annual dividends every year since its IPO back in 2014. City analysts are expecting payouts to keep growing until the end of fiscal 2025 too.

Dividend growth could be reduced if asset construction costs continue to balloon and profits suffer. But I believe the rate at which renewable energy demand is rising offsets this risk.

The International Energy Agency predicts that wind and solar will account for over 90% of new renewable energy capacity over the next five years.

TBC Bank Group

The Georgian economy is tipped to grow strongly over the long term. This provides exceptional earnings possibilities for local financial services businesses like TBC Bank (LSE:TBCG).

This FTSE 250 firm is Georgia’s largest bank with a market share of almost 40%. It also owns a fast-growing payments business in neighbouring Uzbekistan. During the third quarter, pre-tax profits across the group soared 55% year on year. This was driven by a 19% increase in the size of its loan book.

Sanctions placed on Russia following its invasion of Ukraine represent a threat to TBC Bank in the nearer term. Georgian economic growth is helped by strong economic conditions within its northern neighbour.

But at current prices I still think it’s a top share to own. Today it trades on a forward P/E ratio of 4 times. And its corresponding dividend yield sits at an eye-catching 7.6%.