Rolls-Royce (LSE:RR) shares have been trading in pennies since April. With a 35% rise from its bottom of 66p, I believe the stock can continue its strong momentum and breeze past £1 in the coming year.

Gathering speed

Rolls-Royce has seen some positive tailwinds. These have helped it recover from the abyss-like depths it was at some months back. The company is turning around its operations faster than expected. In its November update, it announced that its cash position had improved significantly. This was due to strong cost-cutting efforts and enhanced working capital management.

A resumption in air travel, though at lower levels due to the pandemic, has helped its engine services business, from which it earns the bulk of its revenue. Although this still stands at 65%, travel demand is showing no signs of slowing down. Pair this with the gradual reopening of China and Rolls’ revenue could see a steep boost very soon.

A storm of contracts

Aside from its Civil Aerospace division, there’s also been plenty of excitement in recent weeks over its Defence segment. Rolls-Royce managed to secure a couple of bumper contracts that got investors excited.

The first is the US army awarding its Future Long-Range Assault Aircraft (FLRAA) to Textron‘s Bell V-280 Valor helicopter. The helicopter’s engines will by powered by the British engineer. This is estimated to bring 3.4p worth of value per share, according to analysts at Jefferies.

The second, and potentially even bigger piece of news is the manufacturer’s latest project, Tempest. This is a collaborative effort between the Ministry of Defence in Britain, BAE and Rolls-Royce. It’s a fighter engine programme that could eventually result in the manufacturer being contracted to supply the engine for the UK’s sixth-generation fighter jet project.

Add these contracts to the group’s already fat order book and it’s easy to understand why the stock has enjoyed a jump lately.

Positive flow is a priority

Nonetheless, it’s worth noting that revenues from these contracts are only expected to flow in over the course of multiple decades. For instance, Jefferies assumes a delivery timeline between 28 and 38 years for the 1107F engines. Therefore, these new contracts are going to have a very limited impact over the short term. As such, the focus for Rolls-Royce remains its Civil Aerospace arm.

Guidance from the board was positive in its November update. Free cash flow is expected to come in at a level that’s “modestly positive”. Additionally, revenue is anticipated to grow between 3% and 6% on an annualised basis. And management sees an operating profit margin of approximately 3.8%.

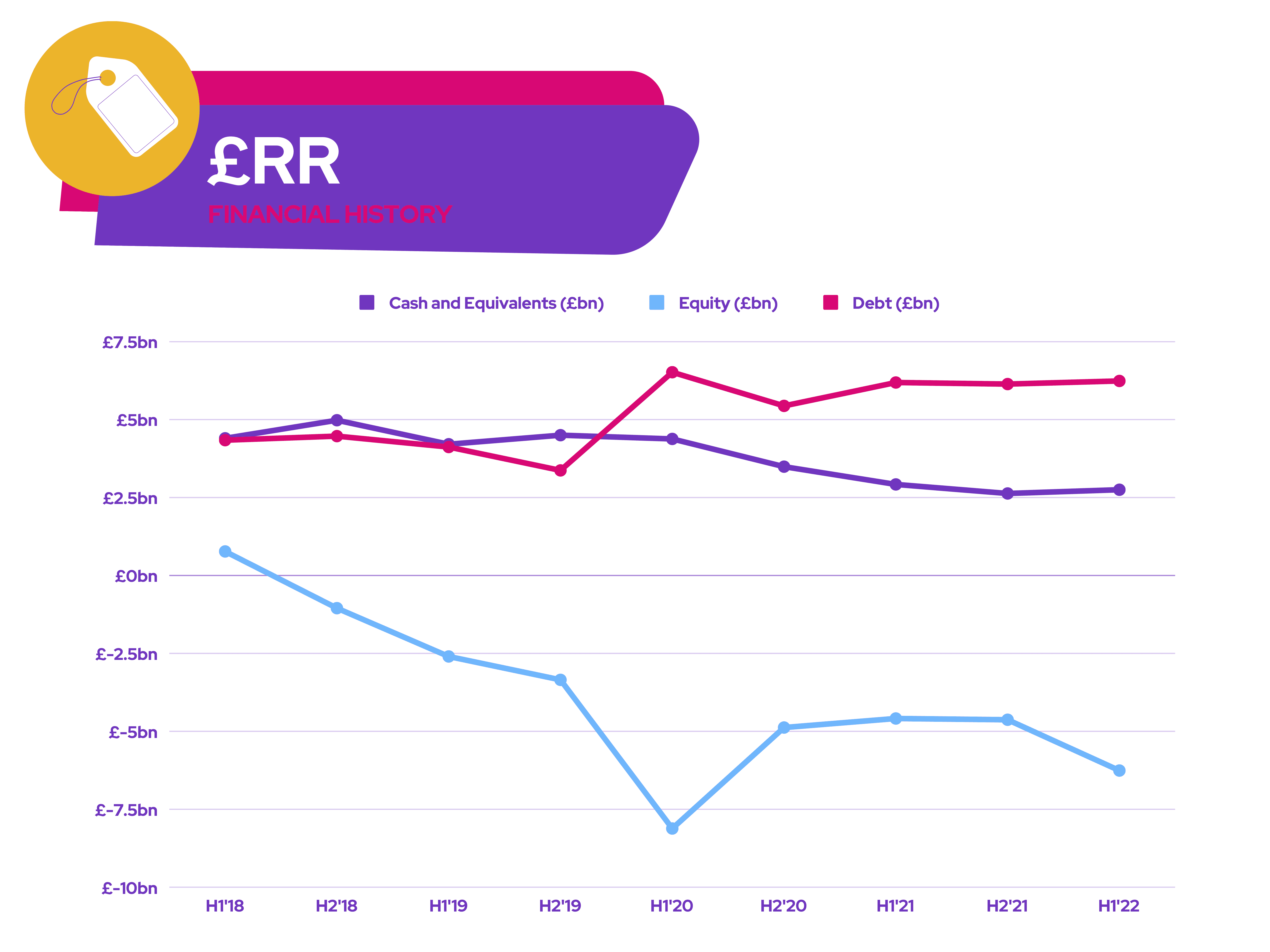

Provided these numbers turn out to be accurate, the FTSE 100 firm may begin to lighten up its atrocious balance sheet. Although in tatters, it’s worth noting that Rolls has no significant debt obligations due until 2024. Pair this with an incoming CEO known for value creation, and things are looking more likely the growth stock could overcome its biggest financial hurdles.

A recently upgraded ‘buy’ rating from Barclays and a price target of £1.10 suggest to me that Rolls-Royce shares could very well hit £1 soon. With that in mind, I’ll strongly consider buying the stock when I’ve got more spare cash.