Marks and Spencer (LSE:MKS) shares have fallen over the years, and the stock is now trading near its all-time low. This is partly a result of poor management and inability to adapt to evolving consumer trends. But with an improved management team and revised plan, I believe the retailer is set for a strong rebound in 2023.

Marking its position

Marks and Spencer pulled the rabbit out of the hat in its latest earnings report, bucking the trend of consumers downtrading. While its bottom line suffered like the rest of the industry due to high energy and labour costs, it still saw many of its key metrics grow in comparison to the likes of Tesco and Sainsbury’s, which saw declines.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Statutory revenue | £5.56bn | £5.11bn | 9% |

| Profit before tax | £209m | £187m | 11% |

| Adjusted basic earnings per share (EPS) | 7.8p | 12.1p | -34% |

| UK footfall per week | 14.6m | 13.2m | 11% |

| UK transactions per week | 10.5m | 9m | 17% |

| Grocery market share | 3.6% | 3.2% | 0.4% |

In fact, the general merchandise and supermarket stock saw its market share grow. This is because its more affluent customers could still afford higher-quality produce despite the cost-of-living crisis. And it’s in a unique position to take advantage of the Veblen effect. That’s consumer behaviour caused by the belief that higher prices mean higher quality or value.

Threading through the competition

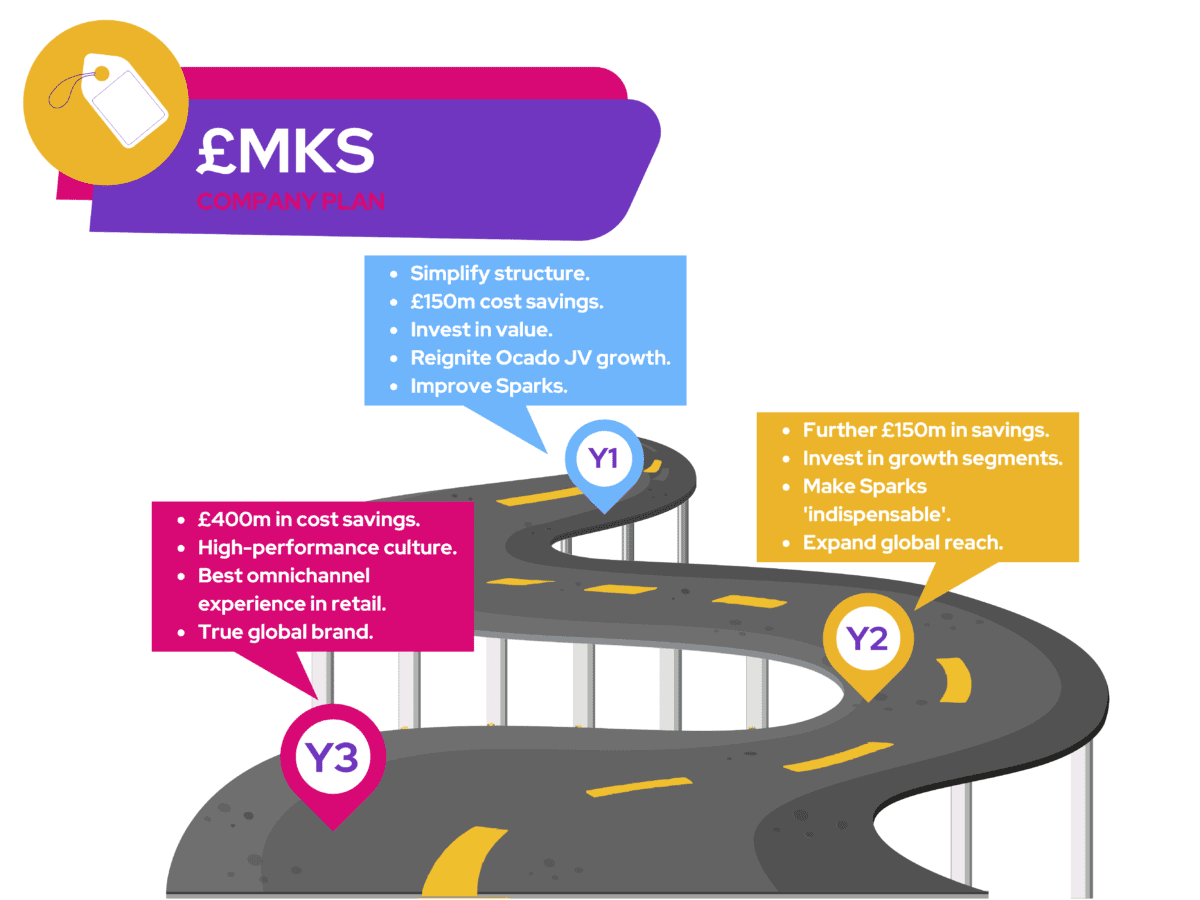

The board has established a turnaround plan for one of Britain’s oldest retailers, and this seems to only be the beginning.

Like many retailers, the FTSE 250 firm also has its own loyalty programme called Sparks. This was very slow to take off in its early stages, but has got better with improved offerings through a refreshed M&S app.

The company has seen customers using the loyalty card increase from 6m to 16m in just two years. And the great thing is that the retail giant isn’t stopping there either. Its recent acquisition of personalisation specialist Thread just shows how serious management is on capitalising on the current momentum to expand and grow its business.

The business’s current personalisation techniques drove additional sales of around £20m over the past year, which is decent. But co-CEO Katie Bickerstaffe expects the acquisition to help boost this number to £100m a year.

Dividend dispenser?

Marks and Spencer is forecasting a positive Christmas and is expecting its more affluent customer base to be spending more despite JP Morgan citing a “material outflow” from its shoppers. After all, Kantar is predicting supermarkets to benefit from the biggest ever spending period for take-home groceries. With inflation tapering off and grocery prices falling for the first time in nearly two years, all indicators are pointing in the right direction.

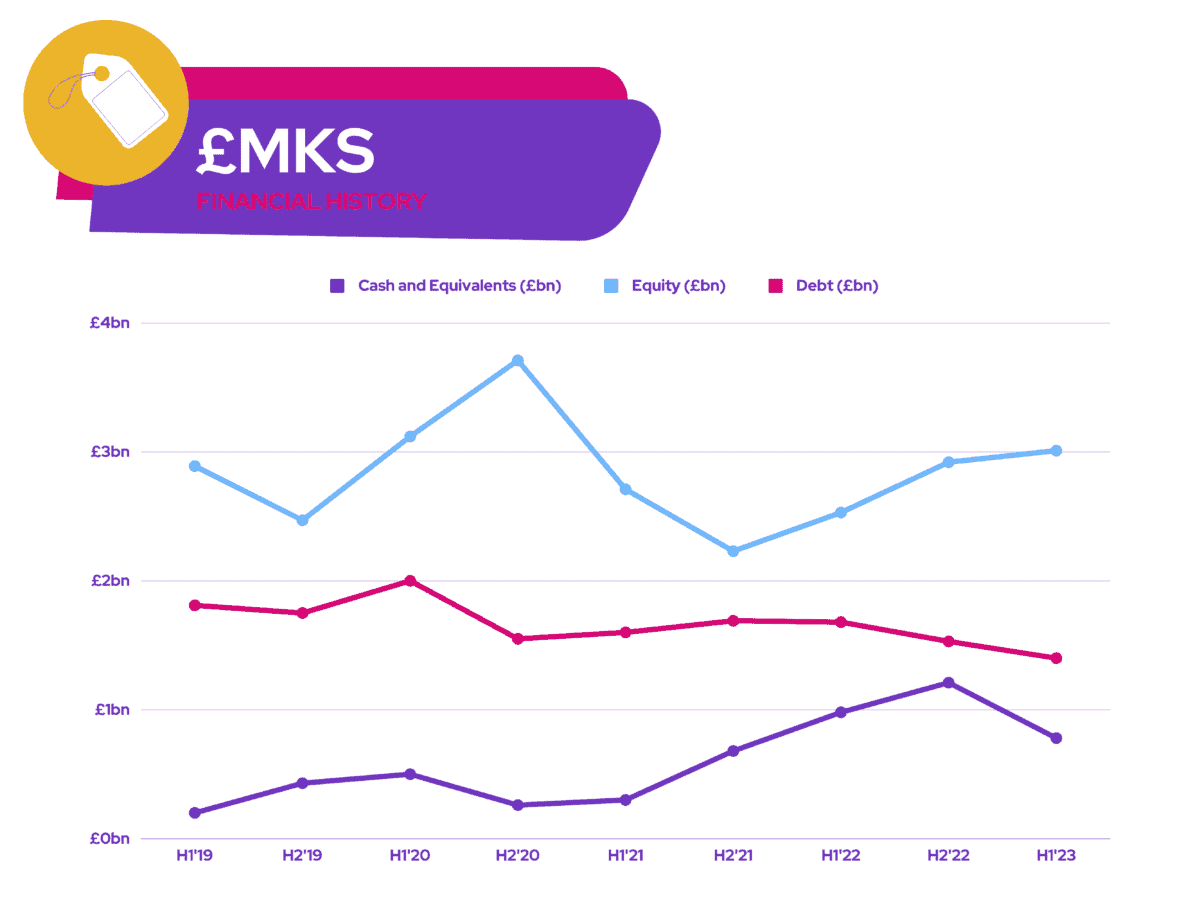

Provided M&S has a good festive season, it could end up reinstating its dividends in the coming months as well, which would bring additional value to shareholders. Given the state of its improving balance sheet, this could be possible.

It’s for the above reasons that Barclays has an ‘overweight’ rating with an average price target of £1.55. This means that if I were to buy Marks and Spencer shares today, I might be able to capitalise on a potential upside of 28%.

So, with a price-to-sales (P/S) and price-to-book (P/B) ratio of 0.2 and 0.9, I think its stock is currently undervalued and could yield me high returns even without the reinstatement of dividends. Therefore, I’ll be investing in its shares when I’ve got more spare cash.