Buy-to-let has been in sharp decline in recent years. Many of these property investors have instead bought shares in real estate investment trusts (REITs) to make a healthy passive income.

Having said that, recent evidence shows that buy-to-let is enjoying a resurgence. Should I join in and grab a slice of the private residential rentals market? Or would investors like me be better off buying REITs in a stocks portfolio?

Landlords return

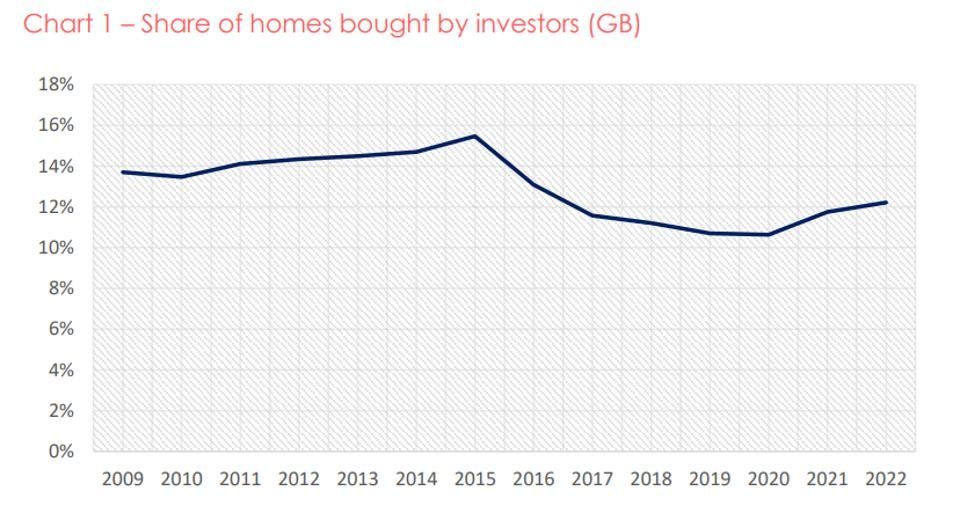

New data from Hamptons International shows that the share of buy-to-let investors buying homes has hit its highest since 2016.

The estate agent says 12.2% of residential property purchases so far in 2022 have been made by private investors. It notes that landlords are returning to the cooling housing market to pick up unsold bargains.

Buy-to-let investors are also coming back to capitalise on rising rents, Hamptons says. It notes that the average residential rent rose 7.9% year on year in November.

The BTL verdict

Buying unsold homes at a discount could prove a wise strategy for long-term investors. I’m confident that when economic conditions improve residential property values will start rising strongly again.

I’m expecting prices to rise due to weak housebuilding activity and favourable lending conditions. It’s why I continue to hold shares in several FTSE 100 housebuilders despite the market downturn.

However, the prospect of rising home prices alone isn’t enough to encourage me to invest in buy-to-let. Rents are rising strongly, but a large part of these increased profits are being absorbed by rising costs.

Tax changes in recent years are also taking a bite out of landlord profits. The 3% stamp relief levy slapped on second-home owners, for example, and the cancellation of tax relief on mortgages, have both damaged investor returns.

REIT benefits

This is why I think investing in REITs is a better way to make passive income. This requires less day-to-day commitment than buy-to-let, to name one advantage. It also means not having to waste time acquiring the property and then managing it during the tenancy. The more properties owned, the more time consuming this process becomes too.

I also like REITs because they don’t require the huge upfront costs that come with buy-to-let. I can start building a position in UK property using just the spare cash I have left over at the start of the month.

Plenty of choice

REITs also give me a chance to invest in many parts of the property market, lessening the risk I face. Buy-to-let puts all my eggs in one basket and leaves me exposed to a possible house price crash.

Investing in commercial landlord The PRS REIT can make me money from the residential lettings market. But I can also get exposure to lucrative retail parks, office buildings, healthcare facilities, and more. There are more than 50 REITs on the London Stock Exchange for me to choose from.

Finally, under current regulations, REITs have to pay a minimum of 90% of annual profits out by way of dividends. This can make them an ideal way for investors to make passive income.