Beating the market is a difficult task. In fact, only 5% of fund managers are successful at doing so. Nonetheless, one can’t blame me for trying. So, here are three methods I’m thinking of implementing for my portfolio to potentially beat the FTSE 100 next year.

Dividend mines

Britain’s main index only grows by approximately 6.5% every year. It also has an average dividend yield of 3.7%. Assuming the average rate of growth for the FTSE 100 next year, one way I could beat the index is to invest in high yielding dividend stocks with decent growth potential. With the UK being home to some of the world’s largest dividend paying companies, one particular name stands out to me.

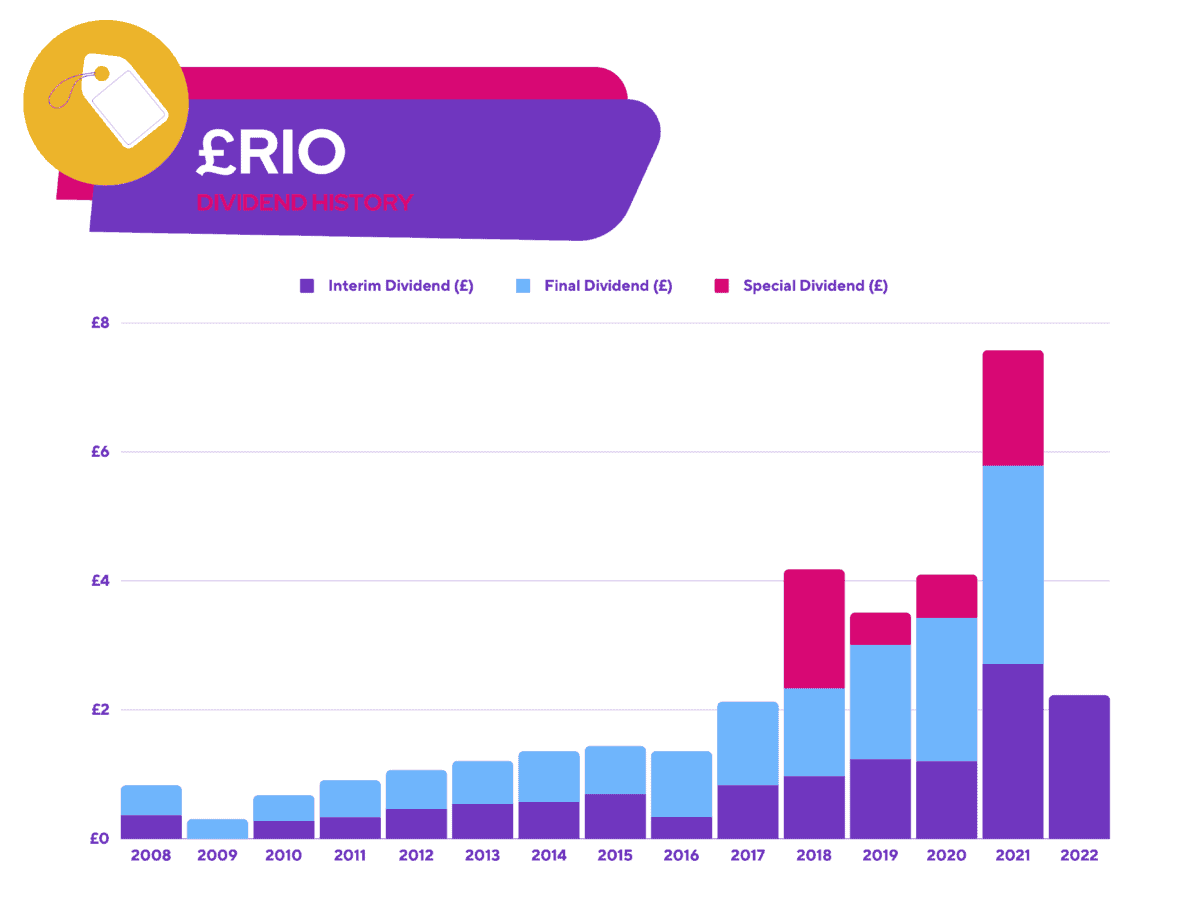

Dividend aristocrat Rio Tinto has been handing mega payouts over the last few years, and currently has a dividend yield of 9.5%.

Brokers like Berenberg are bearish about the stock and are forecasting a dividend decrease due to lower demand from China. Having said that, investing in the miner now, while its shares are down, could be an opportunity for me to capitalise on a potential rebound in commodity prices in the coming months.

China is slowly easing its COVID restrictions after all, which could see construction rates tick up. Consequently, Rio shares could see tremendous upside and a return to higher dividends, and is why I’ll be buying them for my portfolio.

Stocking up on valuable tech

Growth-turned-value stocks such as Alphabet and Microsoft have fallen out of favour this year. Yet, these conglomerates have fundamentals and a competitive edge that still give them plenty of upside potential, especially over the long term.

Additionally, buying these stocks now offers the potential for me to benefit from the “second wave” of the tech revolution. This is when traditional companies turn to digital technologies and applications to remain competitive.

These stocks have also proven to be resilient over the past decade and have outperformed the FTSE 100 consistently. Not to mention, Alphabet and Microsoft have average upsides of 27% and 16%, for the upcoming year. Therefore, investing in both these stocks could generate strong returns for my portfolio.

The leading index

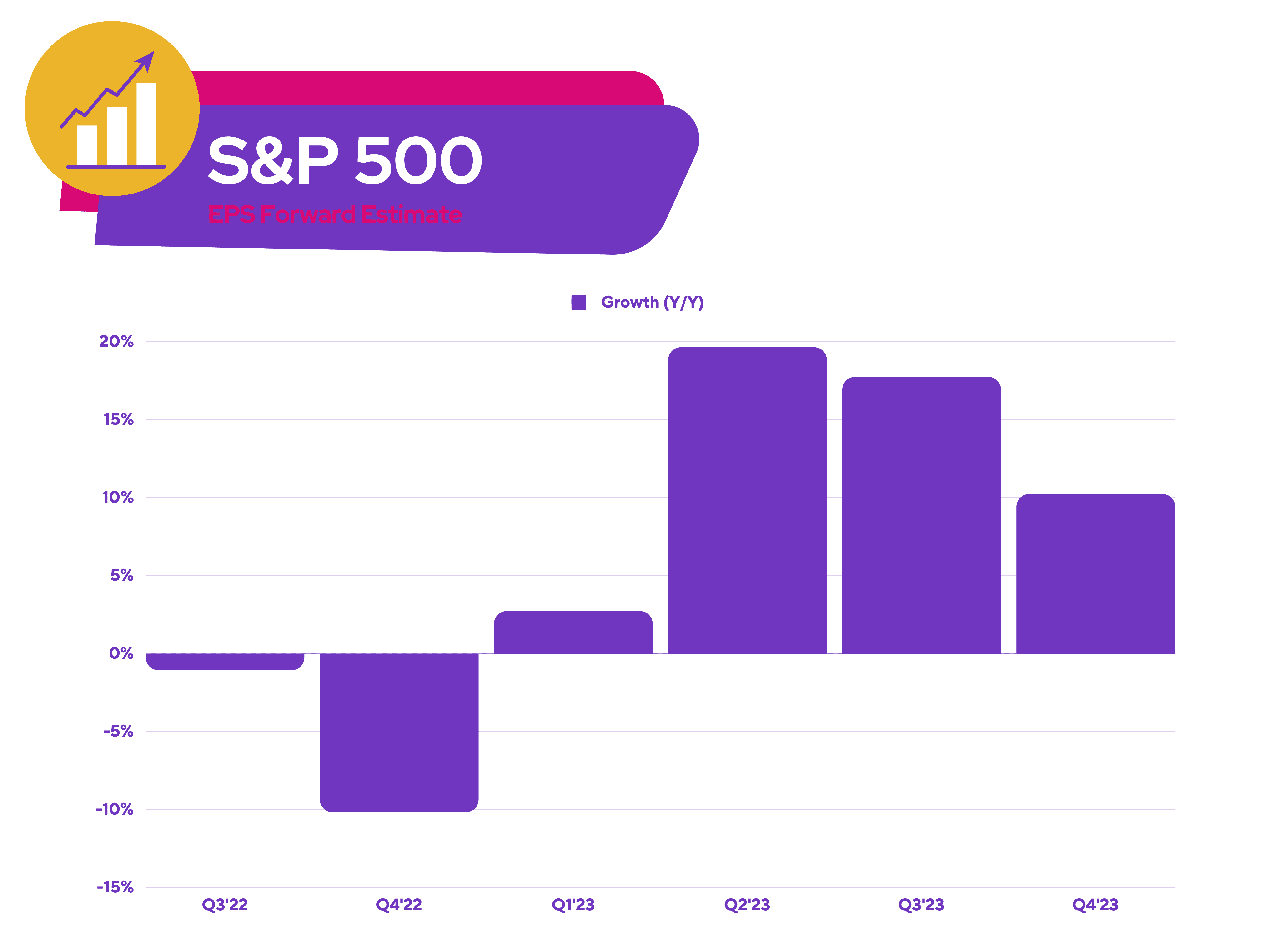

Another less risky alternative for me is to invest in an S&P 500 index fund. On average, the world’s most popular index only generates an average return of 7%-9% with an average dividend yield of 1.7%. If I were to tally the figures, investing locally would be a much better option. The US is also likely to fall into a recession, which would make this strategy odd.

However, there are a number of factors to account for, which could see the S&P rebound by double digits next year. For one, the US stock market always rebounds before or during a recession, and when earnings estimates hit a bottom.

Inflation also seems to have peaked, with the latest comments from Federal Reserve members indicating a potential pause on rate hikes soon. Moreover, equities tend to rally the year after mid-term elections, and even more so when there’s gridlock in government.

Ultimately, the historical trends and forecasts indicate that the strategies listed above could give me a decent chance beating the FTSE 100 in 12 months’ time. Until then, I’ll be hoping to join the 5% of investors who beat the market.