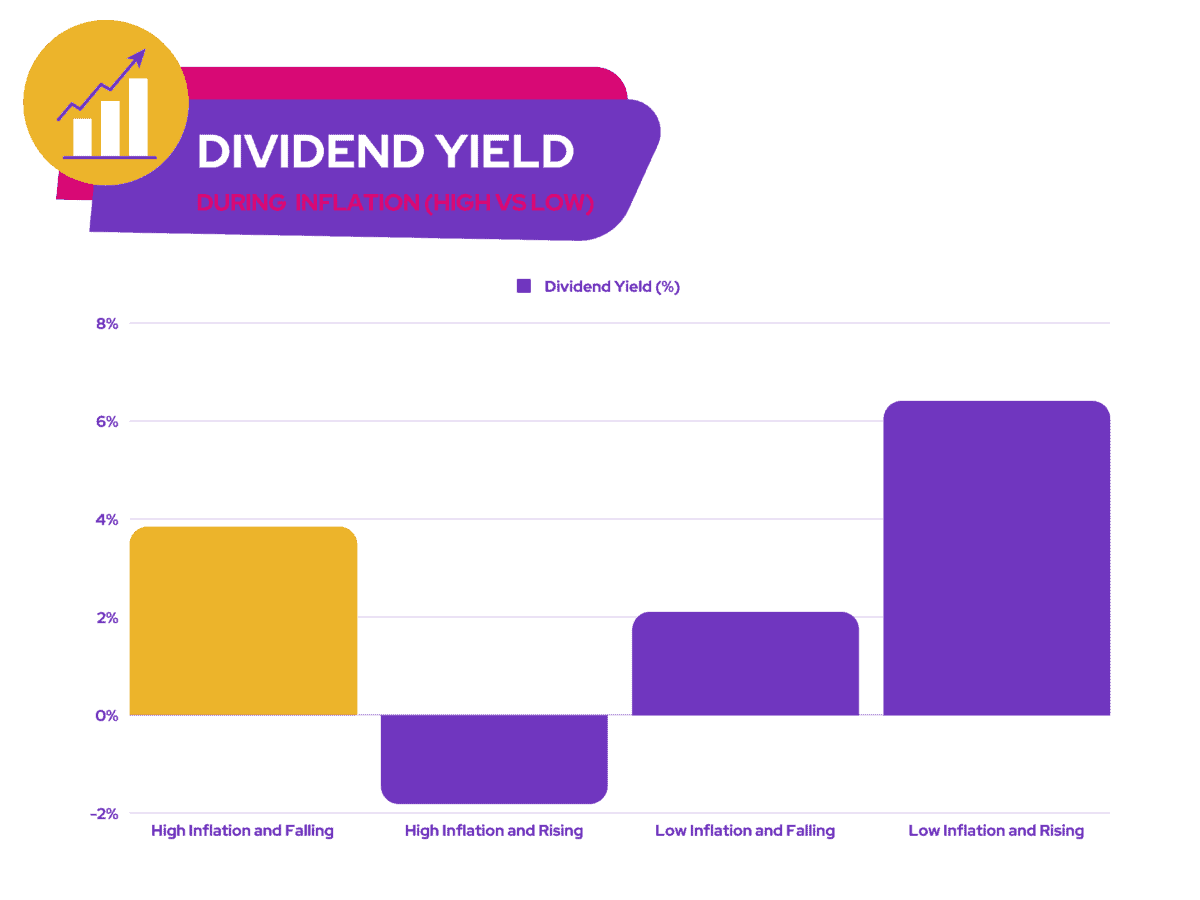

According to Morgan Stanley, high dividend yield stocks tend to outperform their lower yield counterparts when inflation is elevated but falling. So, here are three US stocks with attractive yields that I’m considering buying to protect my portfolio from a decline during this bear market.

1. AT&T

First up is AT&T (NYSE: T). Telco companies tend to underperform the overall market during normal times. But as the US braces for a recession, the likes of AT&T are likely to outperform due to having defensive attributes. It’s for this reason that the S&P 500 stalwart’s share price has remained steady this year.

As such, this dividend stock could be an attractive place for me to invest my money. That’s because telecommunication services have rather inelastic demand. Management confirmed this in its latest earnings report, as it saw customer demand remain relatively healthy.

For that reason, I’m expecting its current dividend yield of 5.8% to remain robust. Meanwhile, Morgan Stanley is projecting the firm’s dividend yield at 6% in 2023. This minuscule growth isn’t too far fetched considering the state of its current balance sheet, which can barely cover its dividends at -0.4 times.

2. Philip Morris

Next is Philip Morris (NYSE: PM), one of the world’s most popular dividend stocks. Although operating in a sunset industry, the tobacco giant has performed admirably this year, beating the S&P 500 by 22%. The company has also been diversifying its business model to venture into other industries, such as food and beverage. This acts as a bonus for me, as it allows the conglomerate to hedge against the tobacco industry’s declining prospects.

Most importantly, its current dividend yield of 5% puts it higher than the S&P’s average, and is an attractive proposition for me given the current market conditions. Additionally, Morgan Stanley projects the company’s dividend yield to tick up to 5.7% in 2023, which it can comfortably cover with its strong cash flow and dividend cover of 1.1 times.

3. Energy Transfer

Finally, there’s Energy Transfer (NYSE: ET). The Houston-based firm is one of the leading suppliers of natural gas from the US. Given the elevated oil and energy prices this year, it’s no surprise that its stock is up 40%, while being able afford a dividend yield of 8.5%.

This makes Energy Transfer one of the highest dividend yielding stocks out there. In fact, its current dividend yield is more than three times the S&P 500 average. Beyond that, Morgan Stanley is also projecting its dividend yield to grow to 10.3% in 2023. With a robust dividend cover of 1.3 times, this is highly likely. Therefore, this makes it an attractive play for me, especially when natural gas is in high demand given the sanctions imposed on Russia.