I don’t have a bottomless reserve of cash with which to buy FTSE 100 shares. But there are plenty of top stocks I’d want to buy if I have spare cash in my pocket.

Here are three dirt-cheap UK shares I’d buy with £5,000 today.

Airtel Africa

As a long-term investor, I’m tempted to snap up Airtel Africa (LSE: AAF) shares for my portfolio. I think recent heavy share price weakness represents an attractive dip buying opportunity for me.

Today, the telecoms titan trades on a forward price-to-earnings (P/E) ratio of just 7.7 times. It also carries a 4.1% dividend yield, beating the FTSE 100 average of 3.9%.

Demand for telecommunications and financial services is soaring in Africa. This reflects low product penetration rates and leaping wealth levels on the continent.

It’s my belief that Airtel should generate terrific profits growth on the back of this. It is Africa’s second-largest telecoms company with operations in 14 countries. It is also rapidly expanding its mobile money business and recently launched its services in Nigeria.

Airtel grew its customer base almost 10% between April and September, to 134.7m. Revenues and EBITDA rose 13% and 14% respectively during the period. I’d buy the business even though adverse currency markets pose a threat to future earnings.

CRH

Building materials supplier CRH (LSE: CRH) faces massive uncertainty as the global economy cools. It could endure a sharp fall in earnings if construction activity flatlines.

But I’m tempted to buy the FTSE 100 share at current prices. Today, it trades on a forward P/E ratio of just 9.9 times.

Disclosure time. I already own CRH shares in my Stocks and Shares ISA. I bought it because I think its share price will soar over the next decade as construction activity takes off in developed and emerging markets.

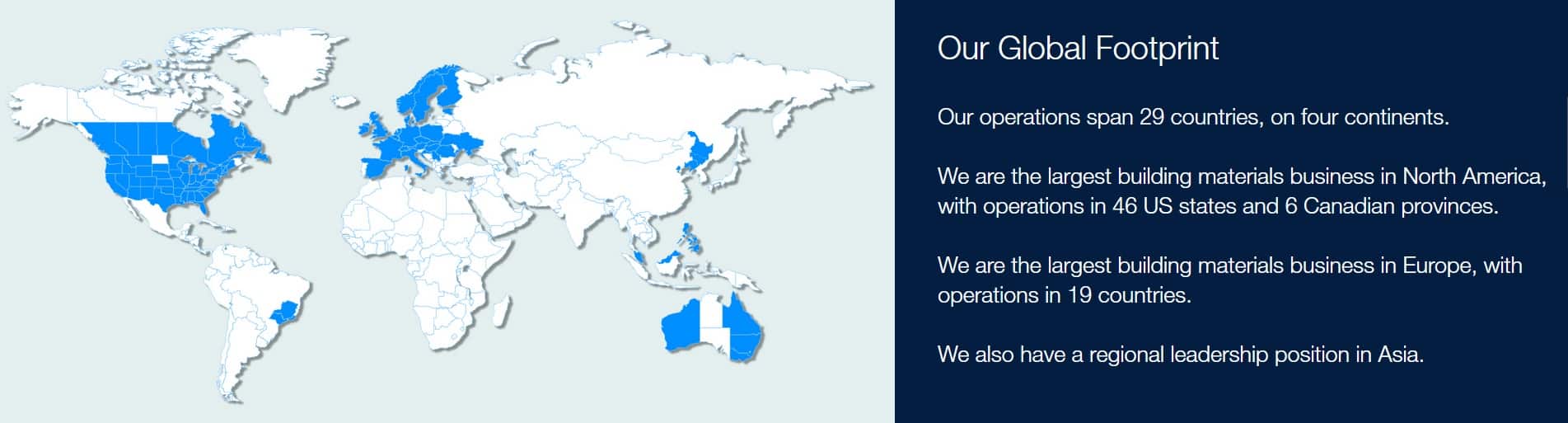

The business sells a wide range of products including concrete, cement and asphalt all across the world. I’m expecting demand for these materials to grow strongly as infrastructure is updated in the West and urbanisation rates grow in developing nations.

A handy 3.7% dividend yield adds an extra sweetener to the company’s investment case.

WPP

Advertising agency WPP (LSE: WPP) could be considered particularly risky today. This is because marketing budgets are one of the first things to be slashed by companies when times get tough.

But I’d still buy the FTSE 100 firm as its transformation programme continues to impress. Heavy investment in areas like digital could provide the spark for exceptional long-term growth.

I also believe the market may be overly pessimistic over WPP’s near-term earnings prospects, meaning its heavy share price fall in 2022 might also be unwarranted.

As analyst Derren Nathan of Hargreaves Lansdown commented: “The breadth of value-add services that allows it to win multi-billion dollar remits from the likes of Coca Cola [make it] more resilient than mere vendors of advertising space.”

Today, the company trades on a forward P/E ratio of just 8.6 times. It also carries a market-beating 4.7% dividend yield.