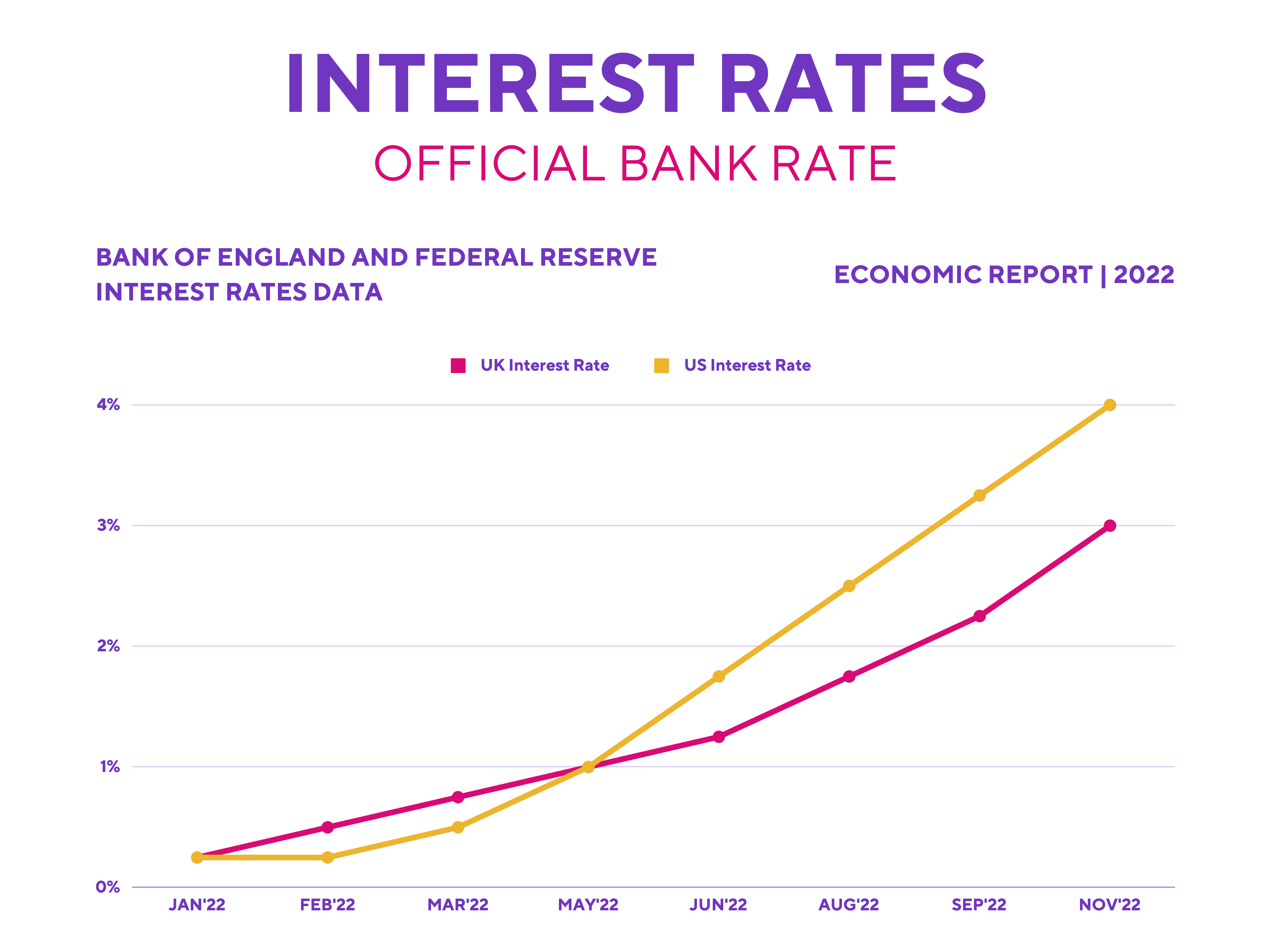

The Bank of England recently increased interest rates to 3%. Meanwhile in the US, the fed funds rate is expected to hit 5% next year. With that in mind, I interviewed DoubleLine CIO Jeffrey Sherman to get his insights and how to invest in the current market.

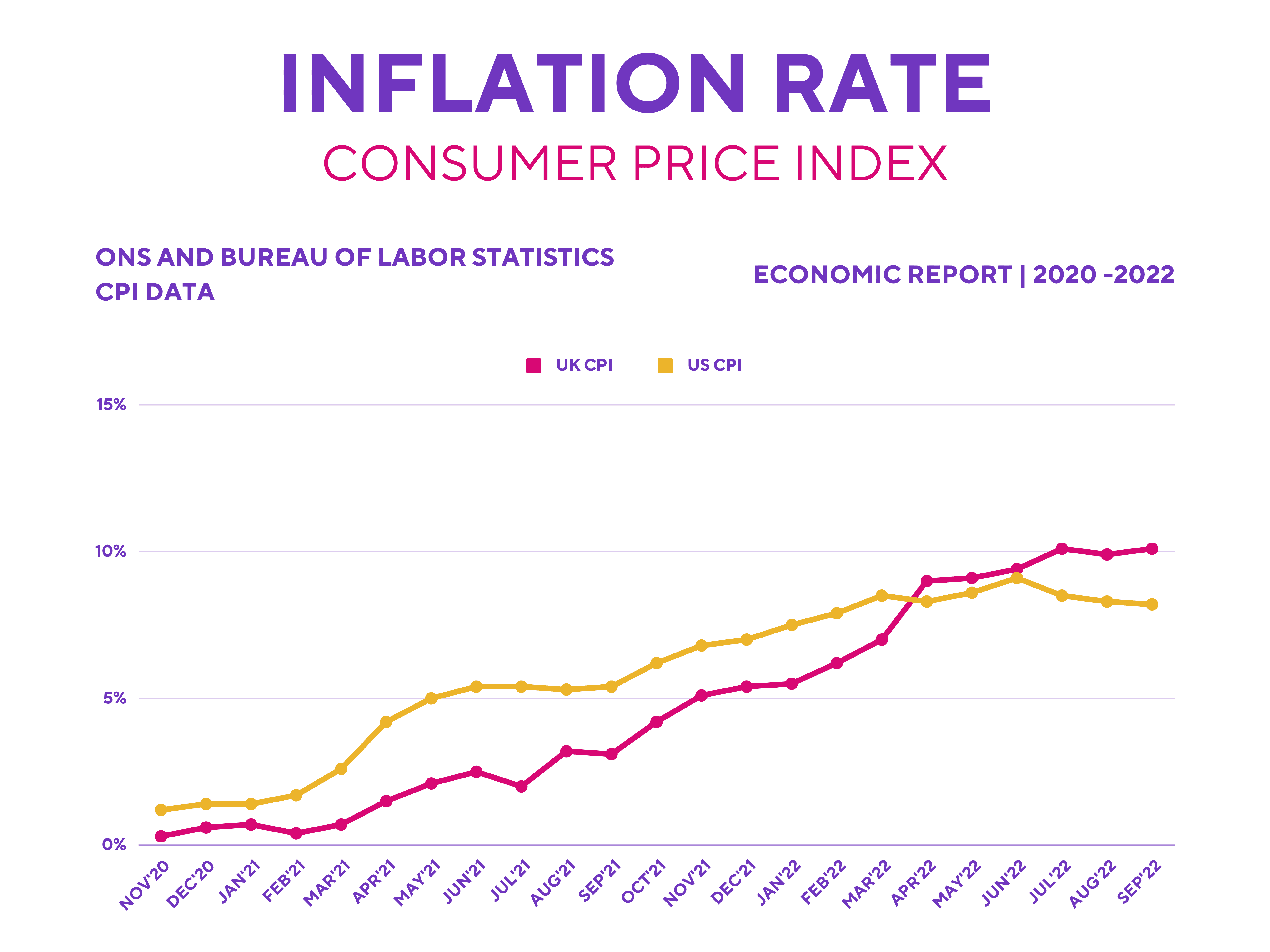

Has inflation peaked?

According to Sherman, it may have. Nonetheless, the path back down to an ideal rate of 2% remains sticky. In the UK, energy prices continue to remain at high levels. Meanwhile in the US, services inflation doesn’t seem to be tapering off. Food and rental prices remain stubbornly high and are the reason why its consumer price index remains elevated.

Where are interest rates going?

Fed Chair Jerome Powell is expected to continue hiking rates going into the New Year. Wall Street analysts are forecasting the Federal Reserve to only stop raising rates at 5.2%. Nevertheless, this is still a long way off as US interest rates currently stand only at 4%. Therefore, Sherman advocates a look at bonds to hedge against the losses in equities.

Why look at bonds?

Bonds are fixed income assets and are seen as ‘safer’ investments. Consequently, it normally generates a lower return than stocks. On the flip side though, investing in bonds during this volatile period could benefit my portfolio, as suggested by Sherman.

Due to the rapid increases in interest rates, bond yields have shot up. This is because those yields have an inverse relationship with bond prices. This comes on the back of investors selling the asset in fear that repayments can’t be made. As a consequence, the two-year US treasury bond which normally yields around 0.2%, now yields a staggering 4.7%.

Which bonds should I invest in?

One that really stands out to me is the three-month treasury bond, which currently yields a healthy 4.12%.

That being said, the stock market outperforms the bond market over the long term. As such, I’m more inclined to invest in short-term government bonds for the time being. This is because these have a very strong credit rating (AAA) and can generate a reasonable return within a short period of time. I’m also considering investing in the two-year treasury bill and selling it when interest rates come back down. This would allow me to potentially make a profit when the price of the bond goes back up, which is a strategy Sherman mentioned.

How should I manage my portfolio?

Due to the current economic climate, Sherman is advocating a larger position in bonds for my portfolio. Having said that, I’ll continue investing in stocks with strong financials and earnings potential to capitalise on the current bear market in the US.

On the equities front, he believes in investing in value names. These are companies with strong balance sheets, healthy margins, and the potential to rebound substantially. These include the likes of Alphabet, Microsoft, and PayPal. While Sherman didn’t specifically recommend these stocks, these are companies I believe fit the bill and plan to hold for the long term. But at the same time, I’ll also be investing some of my money in US treasuries for their low risk and healthy yields to protect my portfolio from further downside risks.