Alphabet (NASDAQ: GOOGL) stock crashed after an unsatisfactory third quarter. Since then, shares in Google’s parent company have been exchanging hands below $100, and are down by more than 30% this year. As I break down the conglomerate’s third-quarter results, I’ll determine whether I think its shares are still worth buying for my portfolio.

Misses across the board

Alphabet missed analysts’ expectations by quite a large margin. The main point of disappointment was the monumental slowdown in revenue growth. This came in at 6% compared to 41% the year before. Meanwhile, its bottom line suffered a huge decline of 24%.

| Metrics | Analysts consensus | Q3 2022 | Q3 2021 | Change |

|---|---|---|---|---|

| Revenue | $70.59bn | $69.09bn | $65.12bn | 6% |

| Earnings per share (EPS) | $1.25 | $1.06 | $1.40 | -24% |

Advertising is Alphabet’s largest revenue generator. As such, it was a relief to see some modest growth there. But what was disappointing to see was the drop in YouTube revenue, which further soured investor sentiment surrounding Alphabet stock.

| Metrics | Analysts consensus | Q3 2022 | Q3 2021 | Change |

|---|---|---|---|---|

| Traffic acquisition costs | $12.38bn | $11.83bn | $11.50bn | 3% |

| Total advertising revenue | $57.6bn | $54.48bn | $53.13bn | 3% |

| YouTube revenue | $7.42bn | $7.07bn | $7.21bn | -2% |

Having said that, the board attributed the overall drop in revenue growth to a number of factors. The first was a decrease in overall ad spending from businesses. This was further exacerbated by a strong US dollar which made revenue conversion from foreign currencies to the greenback more expensive. Additionally, Play Store revenues saw a decrease as gaming interest declined.

Time is ticking on Shorts

Moving onto YouTube, it was refreshing to see the platform’s short-form content continuing to gain momentum. CEO Sundar Pichai also disclosed that ads on Shorts were launched in September, which finally opens up a revenue stream for the new segment. Moreover, YouTube will start sharing ad revenue with its creators from next year, in a bid to fend off competition from TikTok.

This news should’ve brought a jump to Alphabet stock. However, an excellent question from Morgan Stanley analyst Brian Nowak derailed any excitement. Nowak questioned whether the increased user time spent on Shorts was at the expense of YouTube watch time itself, to which CBO Philipp Schindler reluctantly confirmed.

Shorts viewership grew as a percentage of total YouTube watch time.

CBO Philipp Schindler

This was most likely one of the main reasons behind the drop in YouTube revenue in Q3. After all, traditional, longer YouTube videos have a tendency to generate more advertising revenue than its short-form counterpart.

Therefore, YouTube will have to find ways to monetise Shorts at the same rate as its traditional video formats, as TikTok continues to snatch revenue away. Either way, I’m expecting the introduction of new ad formats such as discovery ads, video action campaigns, product feeds, and live commerce to help YouTube’s revenue rebound.

Every Cloud has a silver lining

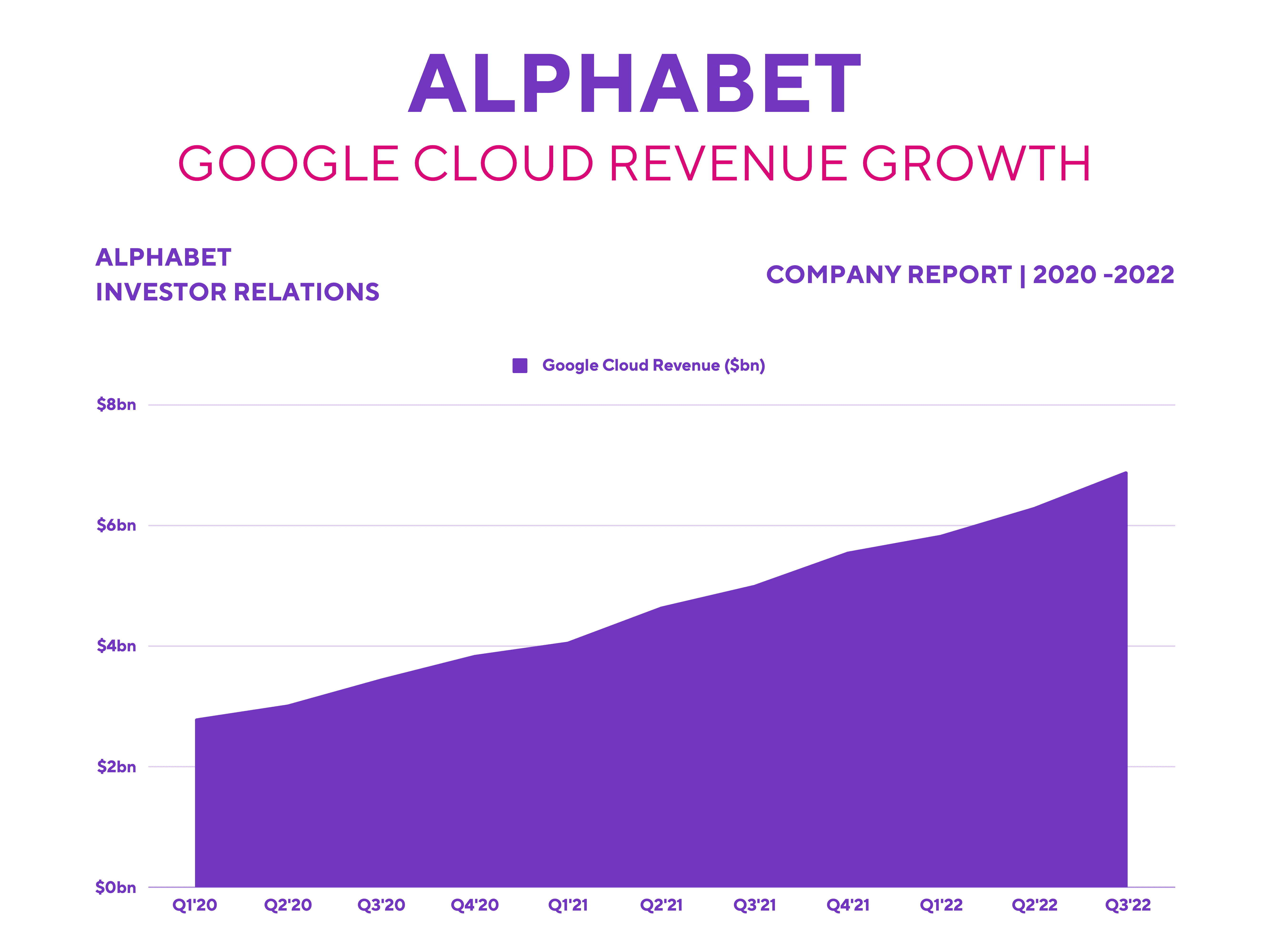

Despite the generally downbeat numbers, shareholders did have something to celebrate. Google Cloud has long been touted as a long-term growth catalyst for Alphabet stock, and its Q3 numbers showed just why, as revenue grew by an impressive 38%.

| Metrics | Analysts consensus | Q3 2022 | Q3 2021 | Change |

|---|---|---|---|---|

| Google Cloud revenue | $6.70bn | $6.87bn | $4.99bn | 38% |

Nonetheless, Cloud’s overall net income took a step back, as it finished Q3 with a $699m loss. Its revenue still grew at a faster pace than in previous quarters, however. Not to mention, given that the majority of its expenses were investments in data centres and recruitment, profitability should be achievable once expenditures start to taper off.

Furthermore, Google Cloud has a strong revenue backlog of approximately $26.2bn, ensuring strong future growth momentum, which should be further aided by the recent acquisition of Mandiant. This new asset adds cybersecurity to Cloud’s list of ever-expanding features as an open platform, improving the product’s competitive edge.

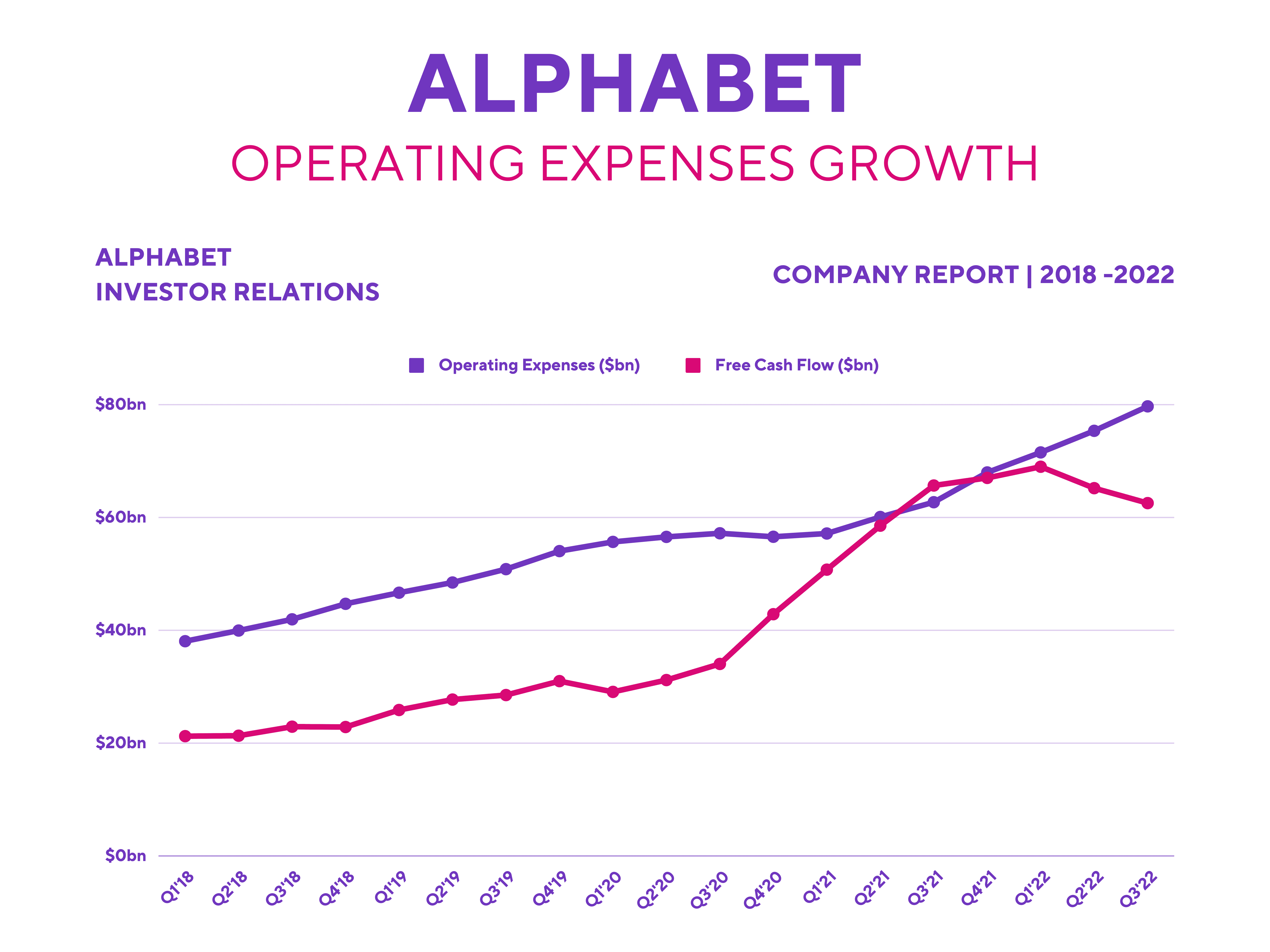

Ruthless costs

So, what were the reasons behind Alphabet missing its bottom line estimates then? Well, the company’s operating and capital expenditures saw increases of 27% and 33%, respectively. Most of these expenses were attributed to investments in data centres, so this is understandable given the aggressive growth in Google Cloud.

That being said, I’m puzzled by the acceleration in headcount growth. The Nasdaq-listed firm added 12,765 workers in Q3, when Pichai mentioned his intention to slow down hiring in Q2. On the earnings call, Pichai was asked to provide examples of internal key performance indicators or quantifiable analysis to justify the hiring. Instead, he gave a rather generic response, which doesn’t exactly soothe investors’ nerves when Alphabet stock is already down by more than 30% this year.

Talent is the most precious resource, so we are constantly working to make sure everyone we have brought in is working on the most important things as a company.

CEO Sundar Pichai

Buy the dip?

With all that in mind, do I still rate Alphabet stock a buy for my portfolio? Well, the firm didn’t have a terrible quarter as a whole, especially given the current recessionary backdrop. In fact, revenue actually grew 11% on a constant currency basis.

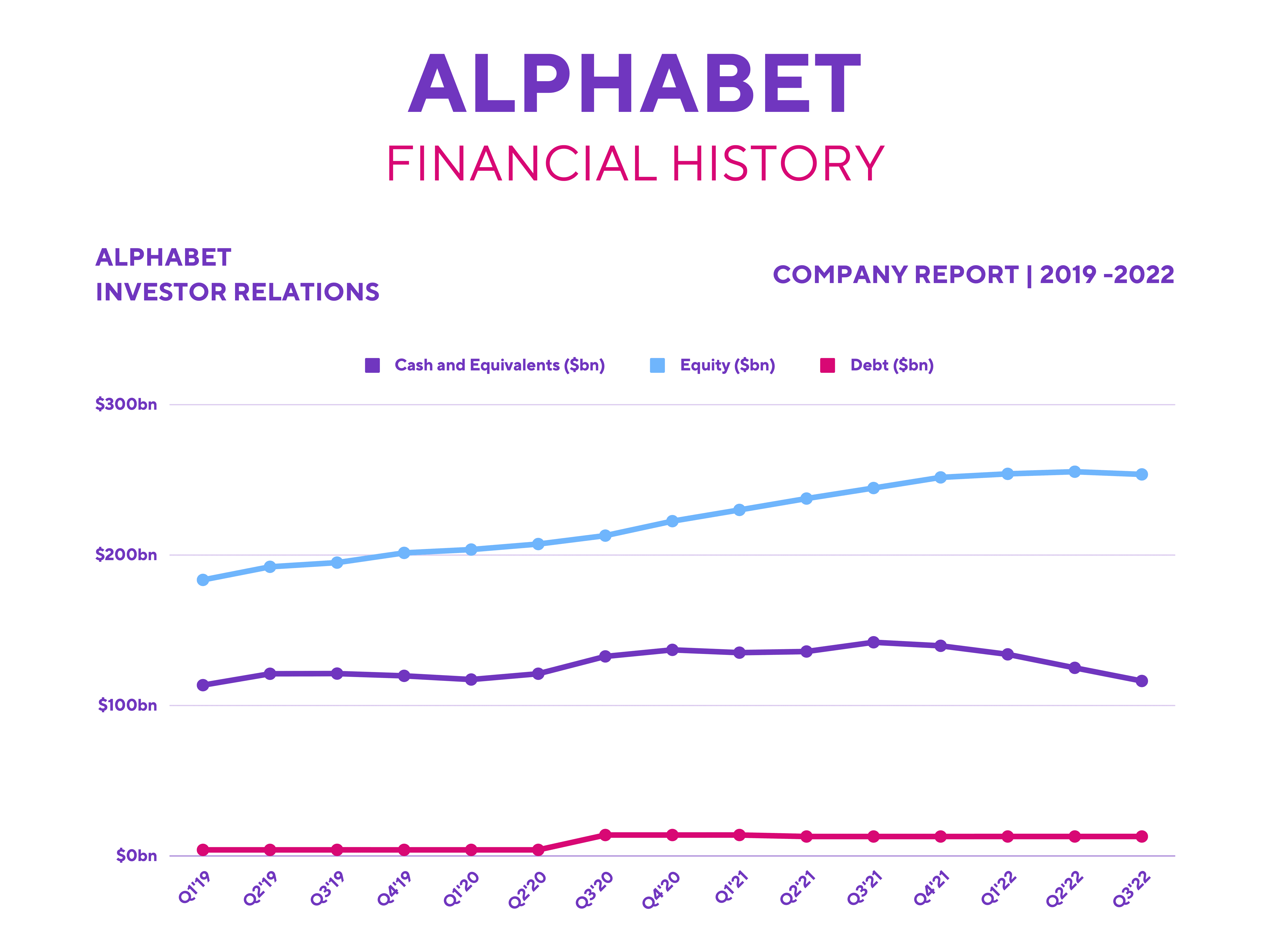

Besides that, further improvements in Search, Shorts, and Cloud show that the future remains bright. And with its balance sheet still in a robust state, I’ve no doubt that Alphabet will be able to plow through a potential recession without any issues.

On the flip side though, questionable decisions, particularly surrounding headcount growth, and the vague answers to questions don’t give me as much confidence in the board as I used to have. Even so, I’m still hopeful that Alphabet will be able to deliver excellent return on investment, given its historical return on assets (18.3%) and return on equity (26.4%). Not to forget, the tech giant still has $43.5bn worth of stock buybacks to complete.

Most importantly, Alphabet stock still has the backing of many brokers. The likes of Citigroup, Wells Fargo, and Bank of America opted to reiterate their ‘buy’ ratings for the stock. For that reason, I think the downside risks for Alphabet remains low for the time being. And with a historically low forward price-to-earnings (P/E) ratio of 18 and an average price target of $130.20, I’ll be looking to buy more Alphabet stock for my portfolio.