The Tesla (NASDAQ:TSLA) share price has slumped 44% in 2022. However, a revival in buying interest among some UK share investors has emerged more recently.

According to Hargreaves Lansdown, Tesla shares were the most frequently bought on its platform last week. The electric vehicle (EV) maker accounted for 2.48% of all buy orders made through the investment firm.

Should I also join the stampede?

Great value for money?

Tech stocks like Tesla tend to carry high price-to-earnings (P/E) ratios. Shares in this category tend to have the potential for rapid earnings growth. So investors are prepared to pay a premium for this.

Elon Musk’s revolutionary business is no different in this respect. At $224.64 per share it trades on a forward P/E ratio of 55 times.

But this isn’t the end of the story. Dig a little deeper and Tesla’s share price could actually be considered excellent value. City analysts think earnings will soar 119% year on year in 2022. This creates a price-to-earnings growth (PEG) ratio of 0.5 times (a reading below 1 indicates a stock is undervalued by the market).

3 problems at Tesla

So why might Tesla shares be trading so cheaply today? One reason is supply chain issues that are affecting its ability to meet orders.

The automaker delivered 343,830 units during the third quarter. That was more than 15,000 short of its reported target.

Musk explained that “it is becoming increasingly challenging to secure vehicle transportation capacity and at a reasonable cost.” Chip shortages are another ongoing problem for the firm, one which has prevented it launching any new models in 2022.

Recurrent vehicle recalls are another issue plaguing Tesla. Last month it announced the recall of 1.1m more vehicles due to a window malfunction.

And finally, investors are concerned that demand for its big-ticket items like EVs could sink as the global economy cools.

Why I’m thinking of investing

Tesla clearly faces its share of problems today. However, I still believe the company’s investment case is very attractive. Musk certainly remains bullish over the company’s long-term prospects. In recent weeks he’s predicted that Tesla could “be worth more than Apple and Saudi Aramco combined.”

It’s a pretty outrageous claim. Today, the consumer electronics giant and oil producer have a combined market-cap of $4.5trn. Tesla’s, meanwhile, sits all the way back at around $700bn.

But this doesn’t mean the business doesn’t have colossal investment potential. Even as its third-quarter financials missed forecasts, there were still bright spots to celebrate.

Revenues and earnings are still rising rapidly (up 56% and 55% respectively in Q3). And each of its US, Chinese and German factories delivered record production in the period.

The verdict

Like billionaire investor Warren Buffett, I appreciate companies that offers market-leading products with significant brand power. And Tesla has it in spades, putting it in pole position to exploit the EV boom.

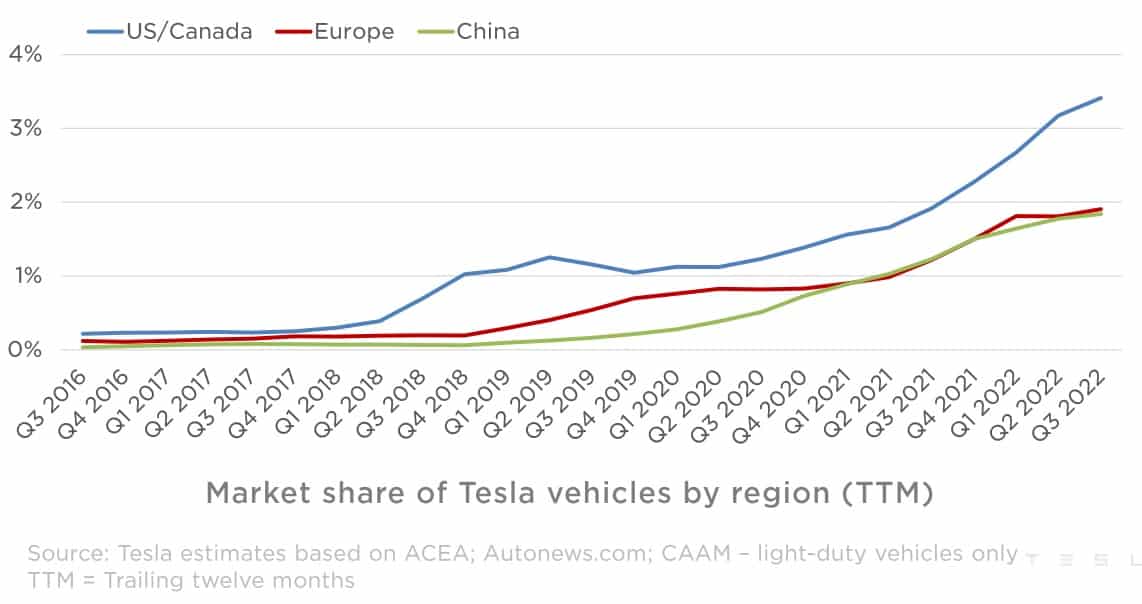

This is why the company continues to steadily build its market share in each of its major regions. Demand is rising strongly, and Tesla is making impressive progress on the production front to meet future orders too.

As a long-term investor, I intend to buy Tesla shares for my own portfolio soon.