It’s been a difficult year for Tesco (LSE: TSCO) shareholders. In the last fortnight, Tesco shares briefly dipped to a five-year low below 200p. The FTSE 100 supermarket stock’s consistently remained above this level for over 20 years, except for a couple of rare occasions.

After regaining some ground, the Tesco share price now hovers just above 210p. So, would the company make a good addition to my portfolio today?

Here’s my take.

Why have Tesco shares crashed?

Various factors have contributed to Tesco’s poor performance. I’m going to explore three in particular.

First, there’s the cost-of-living crisis. As consumers feel the pinch, there are indications that spending at the firm’s stores is falling, particularly on clothing and general merchandise. To compound difficulties, food inflation is currently running at 14.5% — the highest level since 1980. In response, Tesco has raised the price of its meal deal package from £3.50 to £3.90 as soaring ingredient costs put pressure on already tight margins.

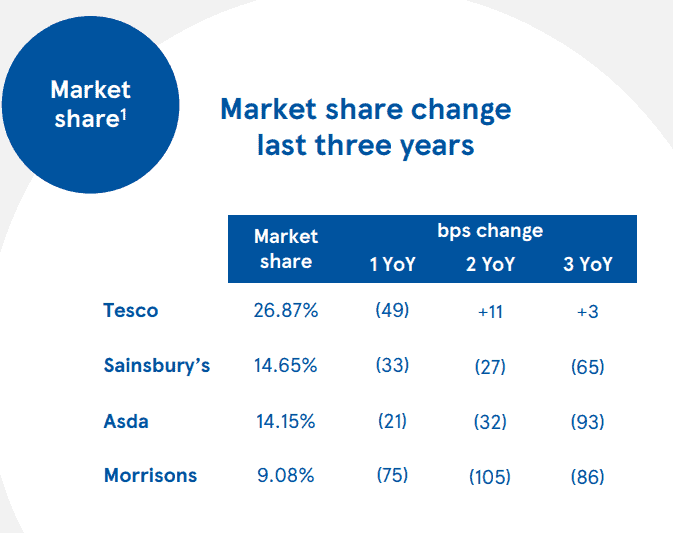

This leads me to another key challenge facing the company — competition. German budget chains Aldi and Lidl have been nipping at the heels of home-grown supermarkets for a while now. As shoppers count the pennies, there are signs competition is intensifying. Recent Kantar research indicates that the duo increased their market share this year following aggressive expansion campaigns over the pandemic.

Finally, Tesco’s vulnerable to currency fluctuations. The business model relies heavily on imports. With the pound trading near generational lows, the company will have to contend with higher supplier costs for the foreseeable future.

Reasons to be cheerful

Despite significant risks, I can find some compelling reasons to invest.

Following recent falls, the stock’s dividend yield has risen to 5.5%, comfortably beating the FTSE 100 index average. Dividend cover looks healthy at 1.9 to 2 times anticipated earnings for the next couple of years. Tesco shares have the potential to be a solid passive income generator for my portfolio in the years ahead, provided the grocery giant can successfully navigate market turbulence in the short-to-medium term.

There are some encouraging signs of financial health. In its interim results, Tesco revealed a £0.5bn net debt reduction. It was also the only one of the UK’s traditional ‘big four’ supermarkets to grow its market share over the past three years.

Admittedly, full-year profit expectations were trimmed to £2.4bn-£2.5bn from the previous forecast of £2.4bn-£2.6bn. However, this could have been worse, and I’m pleased to see updated guidance is still within the previously estimated range, albeit towards the lower end.

Britain’s largest supermarket is also continuing its £750m share buyback programme. It recently appointed HSBC to repurchase shares with a value of up to £100m in the latest tranche. This should act as support for the share price if underlying profits decline.

Would I buy?

I’m tempted by Tesco shares at the current price, but I think there could be further falls ahead, particularly if full-year profits are lower than expected. Ideally, I’d like the stock to revisit its five-year lows below 200p before I start to build a position.

Accordingly, Tesco will take a prominent position on my watchlist, but I won’t be buying at today’s price.