Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Tesco

Tesco (LSE: TSCO) is the UK’s biggest supermarket. Apart from selling groceries, the retailer also has businesses in fuel, banking services, and mobile phone plans. It also has operations in several European countries.

The grocer posted its half-year earnings earlier this week. Tesco shareholders reacted negatively to the numbers, dropping the stock by 3% as CEO Ken Murphy revised the company’s outlook downwards, albeit slightly. Nevertheless, a large number of director dealings occurred with executives of the FTSE giant opting to purchase a substantial number of shares to shore up investor confidence.

- Name: John Allan

- Position of director: Chairman

- Nature of transaction: Purchase of shares

- Date of transaction: 5 October 2022

- Amount bought: 45,000 @ £2.09

- Total value: £94,050

- Name: Ken Murphy

- Position of director: Group Chief Executive Officer

- Nature of transaction: Purchase of shares

- Date of transaction: 5 October 2022

- Amount bought: 24,352 @ £2.04

- Total value: £49,675.64

- Name: Imran Nawaz

- Position of director: Chief Financial Officer

- Nature of transaction: Purchase of shares

- Date of transaction: 5 October 2022

- Amount bought: 24,352 @ £2.04

- Total value: £49,675.64

Legal & General

Legal & General (LSE: LGEN) is a multinational financial services and asset management company from London. Not only does it offer life insurance, it also offers services such as investment management, lifetime mortgages, pensions, and annuities.

L&G also reported results, although just a brief trading update on its H1 performance. In short, it expects full-year operating profit growth to roughly match its first-half figure of 8%. Additionally, the insurer expects annual capital generation of £1.8bn as interest rate increases should positively impact its bottom line and solvency coverage ratio. Following this positive update, four director dealings were carried out.

- Name: Henrietta Baldock

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 3 October 2022

- Amount bought: 1,096 @ £2.14

- Total value: £2,343.25

- Name: Ric Lewis

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 3 October 2022

- Amount bought: 1,486 @ £2.14

- Total value: £3,177.07

- Name: Nilufer von Bismarck

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 3 October 2022

- Amount bought: 3,061 @ £2.14

- Total value: £6,544.42

- Name: Sir John Kingman

- Position of director: Chairman

- Nature of transaction: Purchase of shares

- Date of transaction: 3 October 2022

- Amount bought: 759 @ £2.16

- Total value: £1,642.48

Next

Next (LSE: NXT) is a multinational clothing company. Aside from clothes, it also sells footwear and home products. It has 500 stores located in the UK, with another 200 across Europe, Asia, and the Middle East.

Next shares have dropped 15% since its half-year report and are now down almost 45% this year. Under those circumstances, it seems Next’s chairman and his partner bought a large number of shares to reassure investors. Having said that, this trade occurred last week and was only reported this week.

- Name: Michael Roney & Sandra Silverio De Roney

- Position of director: Chairman and civil partner

- Nature of transaction: Purchase of shares

- Date of transaction: 30 September 2022

- Amount bought: 7,500 @ £2.16

- Total value: £359,211.59

- Name: Lord Wolfson of Aspley Guise

- Position of director: Chief Executive Officer

- Nature of transaction: Long-term incentive plan (partnership shares)

- Date of transaction: 3 October 2022

- Amount bought: 4,891 @ Nil

- Total value: N/A

- Name: Amanda James

- Position of director: Group Finance Director

- Nature of transaction: Long-term incentive plan (partnership shares)

- Date of transaction: 3 October 2022

- Amount bought: 2,978 @ Nil

- Total value: N/A

- Name: Richard Papp

- Position of director: Group Merchandise and Operations Director

- Nature of transaction: Long-term incentive plan (partnership shares)

- Date of transaction: 3 October 2022

- Amount bought: 2,887 @ Nil

- Total value: N/A

- Name: Jane Shields

- Position of director: Group Sales, Marketing, and HR Director

- Nature of transaction: Long-term incentive plan (partnership shares)

- Date of transaction: 3 October 2022

- Amount bought: 2,887 @ Nil

- Total value: N/A

- Name: Amanda James

- Position of director: Group Finance Director

- Nature of transaction: Sale of shares (gift to spouse)

- Date of transaction: 3 October 2022

- Amount bought: 2,978 @ Nil

- Total value: N/A

Types of shares

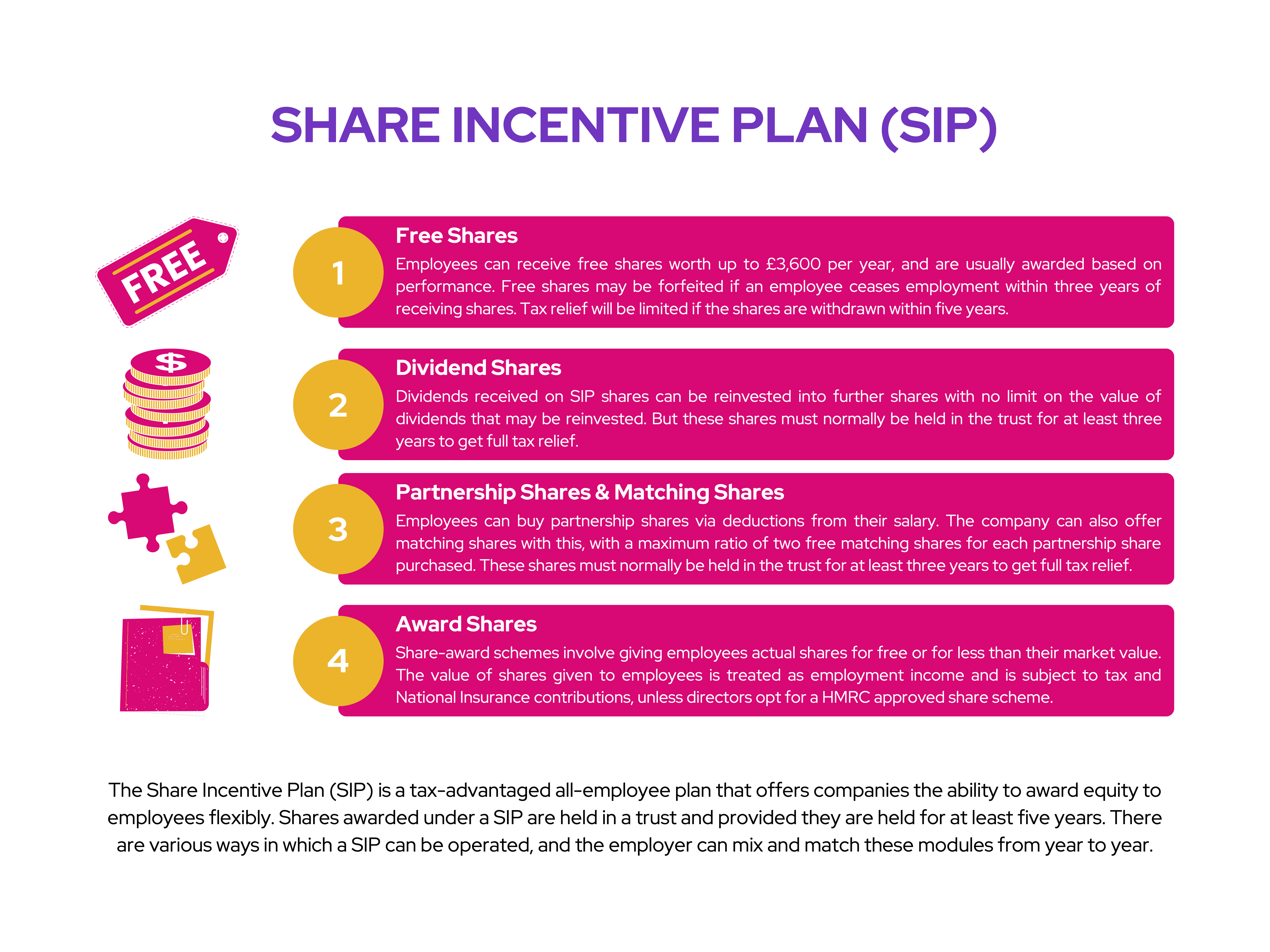

To provide context, there are a few types of shares that can be purchased by directors. Some directors opt to purchase shares via the open market. Having said that, directors also have the option to purchase and receive shares via a share incentive plan (SIP).

A SIP is an employee plan for companies within the UK to flexibly award shares to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

On this occasion of FTSE director dealings, Tesco’s three most influential directors bought shares with their own cash. This was also the case with L&G’s directors, although its non-executive directors bought shares under their terms of appointment.

On the other hand, Next’s chairman and his partner purchased shares at several venues which amounted to £0.3m worth of equity. Meanwhile, the other four directors acquired shares as part of a vesting of share awards under the March 2019-22 plan. These shares need to be held for a minimum period of two years before realising their value.