The Anglo American (LSE: AAL) share price has slumped 7% this year. It’s a descent that — on paper at least — suggests the FTSE 100 miner could be a great value stock to buy.

The iron ore miner’s shares spiked in value in the first quarter as prices of the steelmaking ingredient ballooned. But they’ve fallen heavily from the year’s highs struck in April amid soaring worries over the global economy.

Could this represent a top dip-buying opportunity for me?

An attractive dividend stock

I’ll begin by spelling out why Anglo American’s share price looks cheap based on widely-used metrics.

City analysts think the mining stock’s earnings will slump 22% this year. But at £28 per share Anglo American trades on an attractive forward price-to-earnings (P/E) ratio of just 5.5 times.

This is well below the FTSE 100 average of around 14 times.

As a value investor I’m also drawn to the share’s huge dividend yield. This sits at a healthy 7.7% for 2022, almost double the Footsie average.

In spite of its uncertain near-term outlook Anglo American’s enormous dividend projections don’t look fanciful either. For 2022 the anticipated payout is covered 2.4 times by expected earnings, providing a wide margin of safety.

Near-term dangers

There’s no doubt that the mining sector faces huge challenges as economic conditions worsen. This FTSE 100 stock is being weighed down particularly badly by a slowdown in the steelmaking sector.

Analysts at S&P Global have warned that things could get even more difficult. It said today that “iron ore prices in Asia will continue to grind lower in the fourth quarter as steel production cuts intensify during the winter season.”

Weak activity could persist into 2023 and beyond too. China’s property sector is locked in a slump and central banks remain committed to hiking rates.

This is especially problematic for Anglo American as it generates a third of revenues from the iron ore and metallurgical coal sectors (26% and 7% of group turnover respectively).

A top dip buy

The question is whether Anglo American’s share price fairly reflects the frosty economic environment. As a potential investor, I think a case can be made that it does.

I also believe the mining giant could recover strongly from current levels once the global economy picks up. The long-term demand outlook for iron ore remains pretty bright amid rapid urbanisation in emerging markets and infrastructure updating programmes in the West.

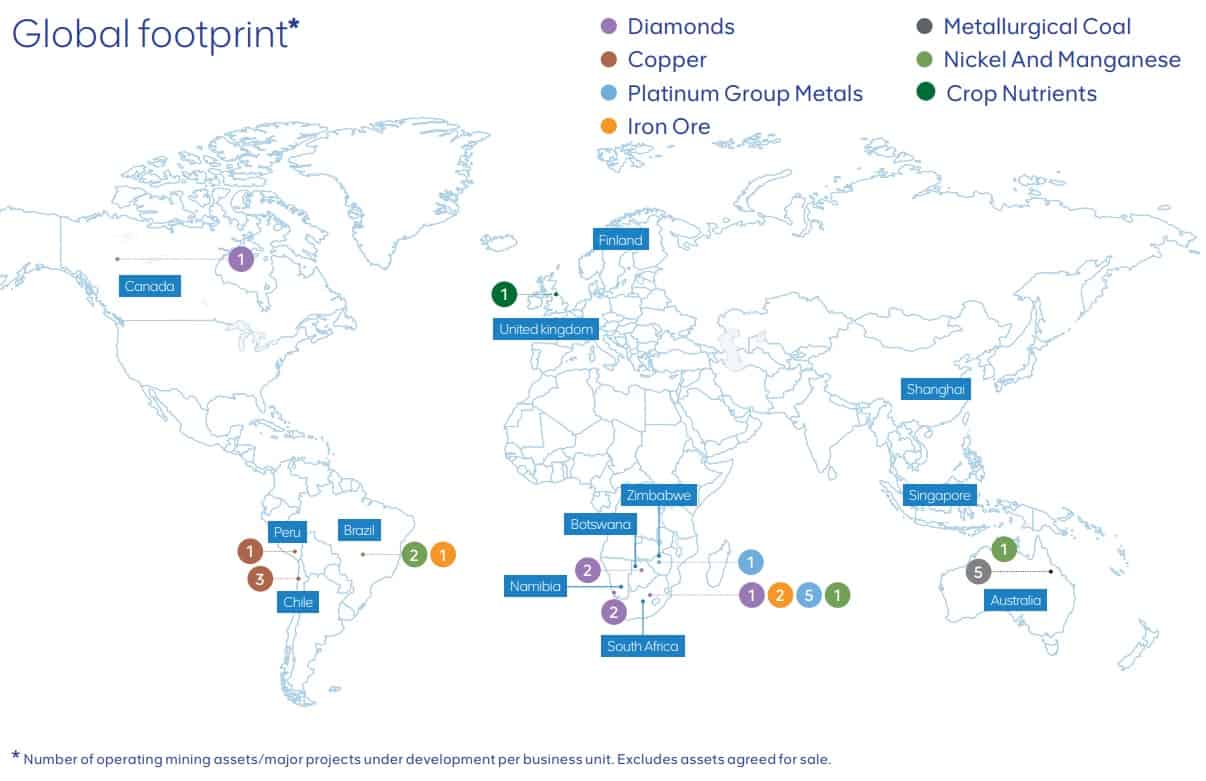

And I like Anglo American too as its diversified asset base protects overall earnings from weakness in one or two markets, as the map above shows. Additionally, its wide portfolio gives it multiple ways to make money from the green economy.

Sales of its copper and nickel are likely to soar as electric vehicles take off. Growing demand for green hydrogen also means demand for its platinum — a catalyst in the gas-making process — might rise strongly.

I expect Anglo American’s share price to rebound from current levels. And given its low P/E ratio and huge dividend yield I think now’s a great time for me to buy.