HSBC Holdings (LSE: HSBA) has had a patchy dividend record in more recent years. However, market-beating dividend yields, and the prospect of explosive payout growth for the next couple of years, now make this a FTSE 100 income stock worth a close look.

HSBC’s share price of around 530p results in a bulky 4.8% yield for 2022, based on current dividend forecasts.

This beats the broader FTSE index average of 3.9% by a decent margin. And things get even better for 2023. The dividend yield then marches to 7.2%.

But do these high dividend yields make HSBC a top income stock to buy? Here, I’ll drill down into its dividend forecast for the next couple of years and explain why I’d buy — or wouldn’t buy — the bank’s shares for my portfolio.

A rocky road

To recap, HSBC froze the annual dividend for several years before the pandemic. Then it cut the payout twice during the coronavirus crisis as earnings toppled.

But the bank’s given its investors lots to celebrate more recently. In 2021, the annual dividend jumped to 25 US cents per share from 15 cents a year earlier. City brokers expect them to continue rebounding too, as profitability keeps improving.

A dividend of 29 cents is expected for this year. And a much better 41-cent reward is estimated for 2023.

Great cover

It’s my opinion that HSBC has a brilliant chance of hitting these forecasts. The first thing to consider is how well predicted dividends are covered by anticipated earnings. And dividend cover here ranges between 2.2 times and 2.6 times for the next two years, above an investor’s desired target of 2 times.

HSBC also has a strong balance sheet to help it make these dividends. The bank had a healthy CET1 capital ratio of 13.6% as of June. Its strong cash position has even allowed it to embark $3bn worth of share buybacks over the past year.

So should I buy HSBC shares?

Buying highly-cyclical shares like HSBC is a risk in the current climate. The rising threat of global recession means that banks face the prospect of sinking revenues and a jump in loan impairments.

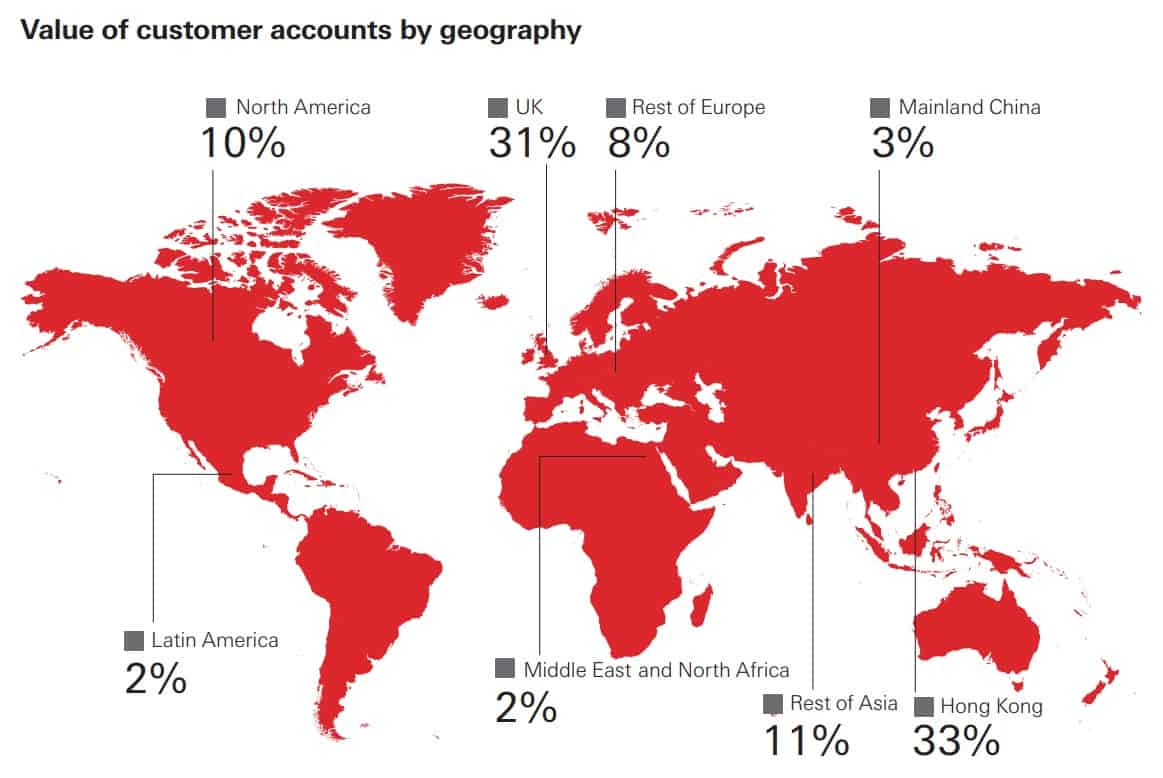

However, as someone who invests for the long term, HSBC is a company that excites me. In particular, I like the company’s huge exposure to Asia, a region where personal wealth levels are booming and, as a consequence, so is demand for financial products.

At the end of 2021, Asia accounted for 44% of the value of all of HSBC’s customer accounts. And the bank is investing a whopping $6bn over the next several years to build its position there in areas such as wealth management.

I’m also impressed by the scale of cost-cutting at HSBC to boost long-term earnings (and, by extension, dividends). The company is on course to hit the higher end of its savings target of $5.5bn this year, and to deliver $1bn of extra savings in 2023.

Today, HSBC’s shares trade on a P/E ratio of just 8 times for 2022. In my opinion, this rock-bottom valuation, combined with those large dividend yields, make the bank a top value stock to buy.