If I’d bought Rolls-Royce (LSE: RR) shares a decade ago, my bank account would be much, much lighter today.

Over the past 10 years, Rolls-Royce’s share price has lost a whopping 74% of its value. If I’d bought £10,000 of the FTSE 100 stock back then my shares would now be worth just £2,600.

That said, could now finally be the time for me to buy Rolls-Royce shares?

Two big reasons to buy Rolls-Royce

Rolls-Royce’s share price fell through the floor during the pandemic. The mass grounding of the world’s commercial aviation sector forced it into record losses and loaded its balance sheet with debt.

However, Rolls-Royce had encountered numerous problems long before the Covid-19 explosion of 2020. Corruption scandals, poor demand for its Trent engines, and extreme currency fluctuations all put profits (and thus the share price) under severe pressure.

However, Rolls-Royce remains a popular FTSE 100 stock with many UK share investors. Two of the reasons why they’re buying the engineer today include:

1. A rebounding commercial aviation sector

Flight activity continues to rebound strongly following the Covid-19 crisis. And so flying hours (and thus servicing activity) for Rolls-Royce continues to improve. The engineer thinks levels will hit 70% of 2019 levels by the turn of the year, up from recent levels of 60%.

Encouragingly, the aviation sector is tipped for healthy long-term growth, too. For example, Boeing predicts that the Middle East alone will need 3,400 more jets over the next 20 years to meet traveller demand. Interest in Rolls-Royce’s engines and aftermarket services could rise strongly in the years ahead.

2. Increasing investment in green technology

The drive towards net zero creates risks for Rolls-Royce. It means the business has to migrate away from technology fuelled by fossil fuels. Developing unfamiliar, next-generation products always brings danger of failure.

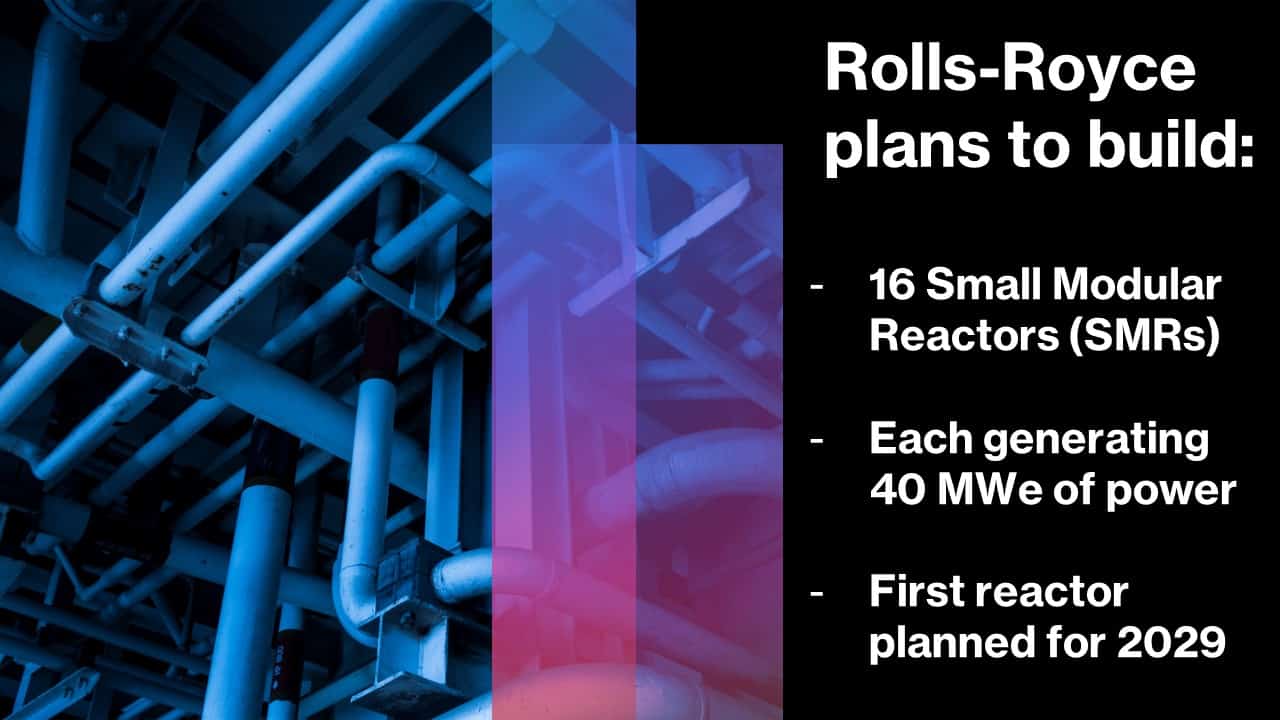

But the steps it is taking to embrace the green economy could well supercharge long-term profits. Its UltraFan jet engine (which is set for testing soon) could be a market leader in low-emissions air travel. Rolls-Royce is also developing engines at its Power Systems division to run on hydrogen, and is designing a fleet of nuclear reactors for the UK.

The verdict

Things could well be looking up for Rolls-Royce and its share price, then. But as a potential investor, I find the business still carries far too much risk for my liking.

First off, a backcloth of soaring inflation threatens the air travel recovery as consumers trim spending. There’s also the problem of surging costs and supply chain problems that caused first-half profits to miss by a distance.

On top of this, Rolls-Royce’s continues to carry massive debts. Net debt sat at £5.1bn as of three months ago. This has the capacity to damage the company’s growth plans and delay the return of Rolls as a dividend-paying stock.

And finally, Rolls-Royce’s shares trade on an enormous forward price-to-earnings (P/E) ratio of 108 times. This is far above the FTSE 100 average of around 14 times and fails to reflect the risks I’ve just mentioned. For all these reasons I’d rather buy other UK shares today.