There’s nothing wrong with building a portfolio centred around dividend stocks on the FTSE 100 and FTSE 250.

After all, investing in large-cap companies has allowed countless UK investors to make their plenty of money down the years.

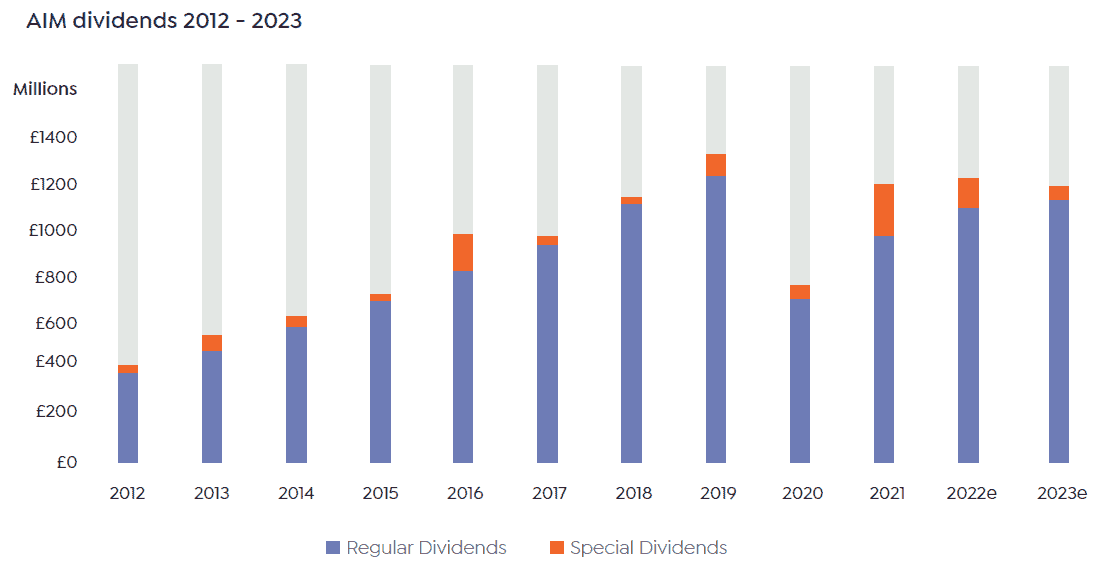

But there’s a treasure trove of top stocks below the major indices that can also help individuals make serious money. And with dividends rising from smaller companies on the Alternative Investment Market (AIM), now could be a good time to go hunting for some lesser-known companies.

AIM dividends keep soaring

According to Link Group, dividends from AIM-listed companies rose 7.4% in the first half of 2022 to £574m. However, the data business says that the level of total payouts was held back by fewer special dividends. Stripping out these one-off rewards, dividends surged 19.8% year on year.

Link Group says that “the strong underlying rate of growth in the first half of 2022 follows a rapid rebound in 2021 from the pandemic”. Last year, dividends jumped 60% from 2020 levels (or 39.9% excluding special dividends).

And for the current year Link expects total dividends from AIM stocks to rise 2.5% year on year to £1.22bn. On an underlying basis it’s predicting growth of 13.3%.

Two dividend stocks to buy

With this in mind here are two AIM stocks I think could deliver healthy dividend income for years to come.

1. Begbies Traynor Group

Insolvency specialist Begbies Traynor’s (LSE: BEG) hunger for accquisitions leaves it at risk of unexpected costs or overpaying to generate growth. But I’m highly encouraged by the firm’s record on this front and think earnings could soar as insolvency cases in the UK rocket.

Begbies Traynor’s grown the annual dividend by around 8% in the past four years. City analysts think another such hike is due this year too, resulting in a 2.6% dividend yield.

City analysts think the company’s earnings will rise 9% in the current financial year. This means the predicted dividend is also covered 2.6 times, well inside the safety benchmark of 2 times and above. There’s a high chance then that Begbies Traynor will make this expected payout.

2. Greencoat Renewables

I think Greencoat Renewables (LSE: GRP) is a perfect income stock to buy for these uncertain times.

Electricity demand remains broadly stable at all points of the economic cycle. Consequently this AIM business — which owns wind and solar power assets in Ireland and Continental Europe — should have the means to pay dividends even if the global economy tanks.

This view is shared by City brokers. And so Greencoat Renewables carries a fatty 5.1% dividend yield for 2022.

My main concern with buying renewable energy stocks like this is the huge cost it takes to set up wind farms and other low-carbon assets. This can take a big bite out of the balance sheet.

But, on balance, I think Greencoat’s will prove a brilliant buy for the long term as demand for clean energy heats up.