The Lloyds share price (LSE: LLOY) hasn’t been that strong for a while. And now it’s down over 15% this year already.

That doesn’t compare favourably to the FTSE 100 fall of just over 2% in the same period.

In fact, while the FTSE 100 has pretty much recovered from it’s pandemic-driven lows, Lloyds shares remain stubbornly below their pre-Covid range of 50p-60p.

And let’s not even get started on looking back to before the financial crash of 2008, when the shares were well above £2.

But does that mean there’s an opportunity for me to pick up Lloyds shares now on the cheap?

As one of most traded shares in the FTSE 100, maybe I should finally be getting in on the act too.

Positive news ahead?

The history of a stock is a useful guide, but the future is what matters. So, when considering which shares to buy for the long term, I look ahead rather than back.

And the future holds some good news from Lloyds’ perspective, with further interest rate rises on the cards from the Bank of England. The next rate decision, due on 4 August, has analysts and markets evenly split between forecasting a 0.25% or 0.5% rise.

Rising rates could continue for a while as the UK and other countries alike try to tame inflation. Higher rates mean higher margins on Lloyds’ main mortgage lending business. That should boost profits and the share price.

But there’s a way to go before we return to the more ‘normal’ 5% interest rate range we saw before the financial crash. So realistically, I think Lloyds shares have far more potential as an income share, rather than a growth share for now.

Can Lloyds be a stable earner?

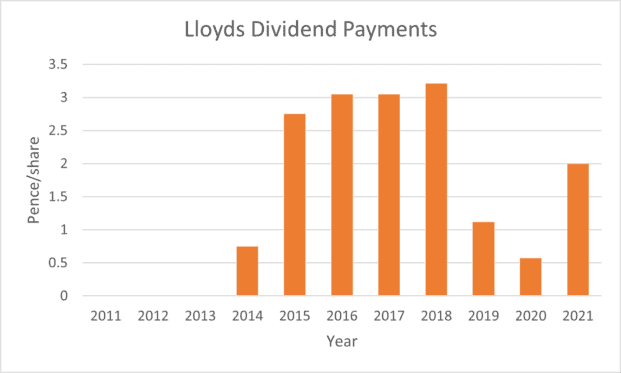

Long-term shareholders have had a tough time of it. After the dividend was halted in 2008, it wasn’t restarted until 2014.

Since then, it’s not exactly been a dividend aristocrat, but it has at least been paying a dividend. And at current prices, the yield is around 4.5%.

That won’t beat inflation, but it’s comfortably above the 3.8% FTSE 100 average.

So, I could buy now while it’s relatively cheap and hold, just for the income. But I do see some major hurdles ahead for Lloyds.

Long-term challenges

There’s no doubt that banking is changing. As more and more people go for the ease and convenience of online banking, Lloyds needs to evolve.

So far, the wider digital transformation in the sector has focused on simpler accounts. But it’s not difficult to see the big online competitors expanding into cross-selling other more complex products, including mortgages.

That’s why I think Lloyds faces a real threat to the competitiveness of its main mortgage business. Especially with rising interest rates making that business more attractive to rivals.

I think it will come down to how well and how fast CEO Charlie Nunn can implement the new group strategy. It’s something to watch out for.

Am I tempted by the low Lloyds share price?

I can see why, when priced in the low-40s, Lloyds shares can look an attractive income prospect. But I’m not yet convinced about its long-term growth prospects.

I’ll hold fire on buying for now and watch that dividend reliability.