Food retail stocks like FTSE business J Sainsbury (LSE: SBRY) are traditionally-popular safe havens when economic conditions worsen. It’s thought that the vast array of essential products they sell give them supreme profits visibility at all points of the economic cycle.

But with the UK facing a catastrophic cost-of-living crisis not even grocery businesses can be considered lifeboats. And particularly those who don’t operate at the value end of the market like Sainsbury’s.

Indeed, the FTSE 100 firm saw like-for-like sales (excluding fuel) drop 4% in the 16 weeks to 25 June.

Share price slips

Sainsbury’s has its merits from an investment perspective. In particular I like the huge investment it’s making in online grocery, an e-commerce sector with plenty of growth potential over the next decade.

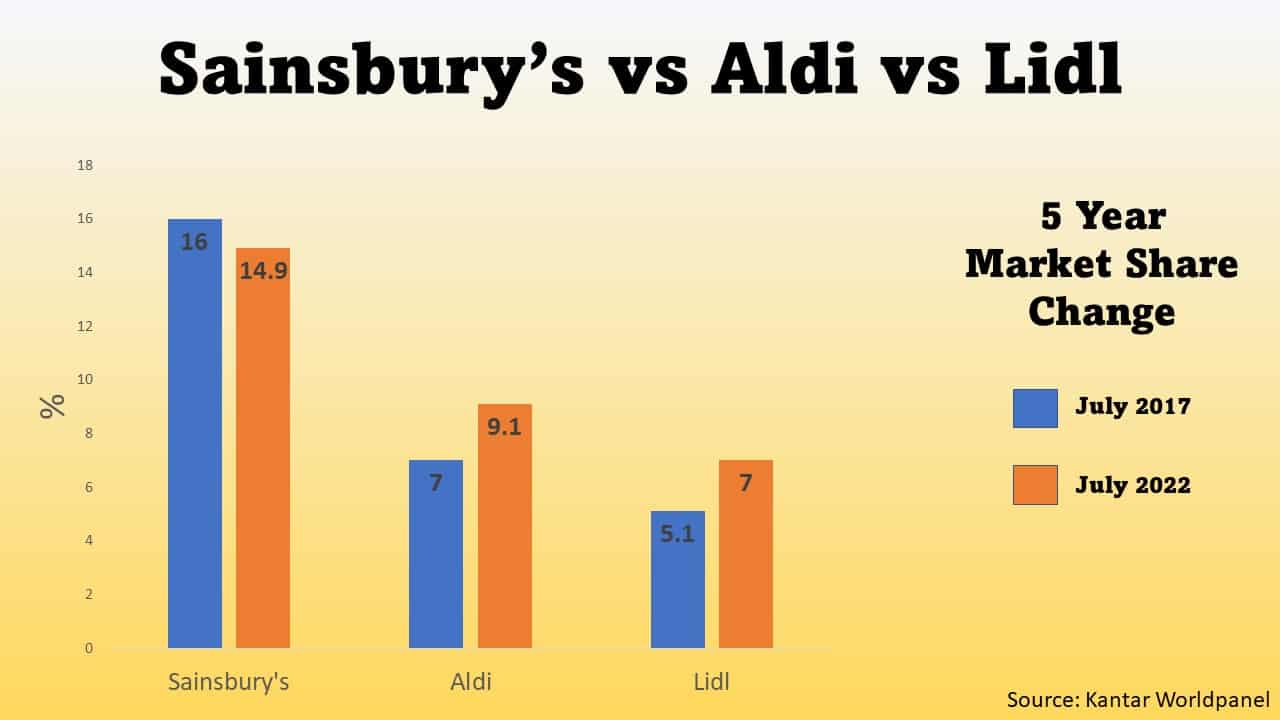

But, in my opinion, the mounting pressures on already-thin margins make Sainsbury’s an unattractive stock to buy. Alongside falling consumer spending power, the retailer also has to bat away the growing threat of competitors Aldi, Lidl and Amazon. This means the business has to keep slashing prices at the expense of profits.

City analysts think Sainsbury’s will pay dividends of 12p per share this year and 13p next year. These forecasts create healthy dividend yields of 5.5% and 6%.

However, anticipated dividends are covered just 1.3 times by expected earnings through this period. This is well below the widely-accepted benchmark of 2 times. With trading conditions rapidly worsening I think there’s a good chance dividend forecasts could miss.

8%+ dividends!

I’d be much happier to buy Aviva (LSE: AV) shares for the long term. But more on this later. First let’s take a look at Aviva’s dividend outlook for the next couple of years.

City analysts think the FTSE 100 firm’s dividends will rise to 32p per share in 2022 and then to 33p next year. This means dividend yields clock in at a mighty 8.1% and 8.4% respectively.

On the downside however, dividend cover is also quite weak at Aviva. This sits at just 1.2 times for 2022. And it edges only fractionally higher, to 1.5 times, for next year.

A better FTSE 100 buy

But despite the threat of disappointing dividends I still believe Aviva’s a top buy.

The business has had one of the strongest brands in the insurance business for centuries. Having a brand that consumers trust is particularly important when it comes to things like money and financial services. It’s why Aviva commands around 25% of the UK’s life insurance market.

Following recent restructuring to improve its focus on core markets, Aviva looks in good shape to deliver strong shareholder returns for the next decade at least. Its decision to divest most of its assets outside the UK, Ireland and Canada has given it a big pot of cash to return to investors too, or to invest for growth.

I also like the FTSE business because of the exceptional progress it’s taking to digitalise its operations. As well as bringing down costs this has the potential to turbocharge revenues by boosting its cross-selling opportunities.

Despite the intense competitive pressures it also faces I’d happily add Aviva to my shares portfolio.