Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Marks and Spencer

Marks and Spencer (LSE: MKS) is a major British multinational retailer that sells clothing and beauty, home, and food products. This week, three director dealings were carried out. A large number of shares were received in lieu of a cash dividend, but a portion was sold to cover tax and national insurance obligations.

- Name: Stuart Machin

- Position of director: Chief Executive Officer

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount received: 203,120 @ nil

- Total value: N/A

- Name: Stuart Machin

- Position of director: Chief Executive Officer

- Nature of transaction: Sales of shares to cover tax and national insurance liabilities

- Date of transaction: 22 June 2022

- Amount sold: 99,121 @ £1.37

- Total value: £135,805.68

- Name: Sacha Berendji

- Position of director: Property, Store Development, and IT Director

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount received: 138,115 @ nil

- Total value: N/A

- Name: Sacha Berendji

- Position of director: Property, Store Development, and IT Director

- Nature of transaction: Sales of shares to cover tax and national insurance liabilities

- Date of transaction: 22 June 2022

- Amount sold: 67,399 @ £1.37

- Total value: £92,343.37

- Name: Paul Friston

- Position of director: International Director

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount received: 131,691 @ nil

- Total value: N/A

- Name: Paul Friston

- Position of director: International Director

- Nature of transaction: Sales of shares to cover tax and national insurance liabilities

- Date of transaction: 22 June 2022

- Amount sold: 62,264 @ £1.37

- Total value: £88,048.11

Cranswick

Cranswick (LSE: CWK) is a leading UK food producer and supplier of fresh and premium food products. It’s most famous for its meat products. Four directors opted to exercise their share options this week. However, they then proceeded to sell portions.

- Name: Mark Bottomley

- Position of director: Chief Financial Officer

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 31,800 @ nil

- Total value: N/A

- Name: Mark Bottomley

- Position of director: Chief Financial Officer

- Nature of transaction: Sale of shares

- Date of transaction: 27 June 2022

- Amount sold: 16,379 @ £30.82

- Total value: £504,768.02

- Name: Adam Couch

- Position of director: Chief Executive Officer

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 48,100 @ nil

- Total value: N/A

- Name: Adam Couch

- Position of director: Chief Executive Officer

- Nature of transaction: Sale of shares

- Date of transaction: 27 June 2022

- Amount sold: 24,775 @ £30.82

- Total value: £763,515.95

- Name: Jim Brisby

- Position of director: Chief Commercial Officer

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 31,800 @ nil

- Total value: N/A

- Name: Jim Brisby

- Position of director: Chief Commercial Officer

- Nature of transaction: Sale of shares

- Date of transaction: 27 June 2022

- Amount sold: 16,379 @ £30.82

- Total value: £504,768.02

- Name: Chris Aldersley

- Position of director: Chief Operating Officer

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 26,300 @ nil

- Total value: N/A

- Name: Chris Aldersley

- Position of director: Chief Operating Officer

- Nature of transaction: Sale of shares

- Date of transaction: 27 June 2022

- Amount sold: 13,546 @ £30.82

- Total value: £417,460.628

HomeServe

HomeServe (LSE: HSV) offers low-cost home warranty and home repair options. It markets itself as the solution to expensive and inconvenient emergency home repairs. Three massive director dealings happened earlier in the week, as shares were awarded to these directors based on performance conditions.

- Name: David Bower

- Position of director: Director

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 21,119 @ nil

- Total value: N/A

- Name: David Bower

- Position of director: Director

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 10,190 @ £11.69

- Total value: £119,121.10

- Name: Tom Rusin

- Position of director: Director

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 30,619 @ nil

- Total value: N/A

- Name: Tom Rusin

- Position of director: Director

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 11,815 @ £11.69

- Total value: £138,117.35

- Name: Richard Harpin

- Position of director: Director

- Nature of transaction: Free shares

- Date of transaction: 27 June 2022

- Amount received: 34,911 @ nil

- Total value: N/A

Types of shares in a SIP

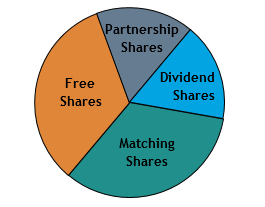

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this instance, all the director dealings above occurred with free shares. These shares were acquired by directors under their companies’ share plans. These were either a restricted share plan (Marks and Spencer), or incentive plans (Cranswick and HomeServe).

Share award schemes give employees actual shares rather than share options. The value of shares given to directors here is treated as employment income. This means that it may be subject to tax and national insurance contributions. That is unless the directors opt for an HMRC-approved share scheme, which has its own rules and requirements. Incentive plans give directors shares when they hit certain performance targets. For HomeServe directors, the awards were subject to the company’s earnings per share.