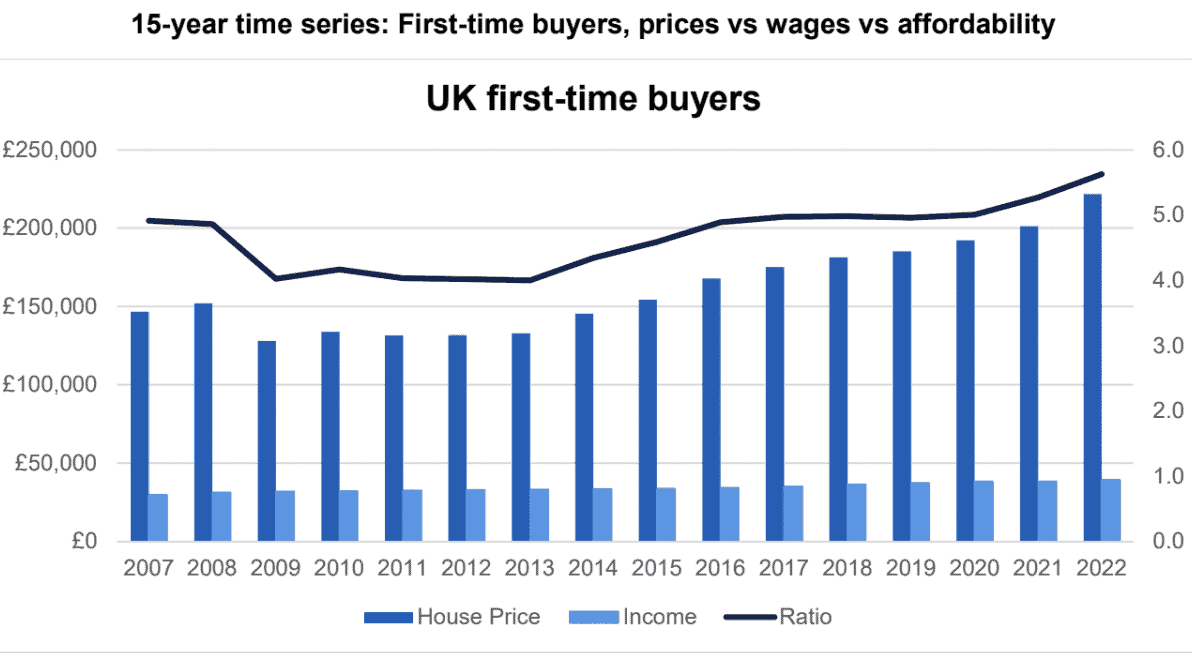

Boris Johnson’s Conservative government announced a new, Help to Build scheme late last week. The new proposal is meant to help Britons get onto the property ladder amid the increase in house prices outstripping wage growth. So, here are three FTSE shares that I think stand to gain from this new programme.

Grafton

Grafton (LSE: GFTU) is a FTSE 250 constituent, and could be a beneficiary from the Help to Build scheme. This is because, unlike Help to Buy, the new initiative won’t directly benefit property developers such as Barratt and Taylor Wimpey. The loan is only available for houses built by self-builders and custom builders. As the scheme is set to last until 2026, the group could end up benefiting from a long-lasting tailwind.

Grafton is a builders merchant that sells all sorts of goods required to build a house. These include building materials, timber, decor, DIY items, and pipes. Its manufacturing segment only accounts for 5% of its revenue, so I expect the business’ distribution segment to fair better from the new builds. Not to mention, its history of producing healthy profit margins makes it an attractive stock for me to purchase. However, it’s worth noting that the current cost-of-living crisis could hamper sales figures.

Breedon

Breedon (LSE: BREE) is the UK’s largest independent construction materials firm. It is listed on the FTSE AIM index. The company produced a combine 31.6m tonnes of cement and aggregates in 2021. But more importantly, the board expects further growth this year.

Constructing a new house typically uses more than a 100 tonnes of cement and aggregates. Therefore, I expect the Help to Build scheme to act as a tailwind for the FTSE firm. That being said, Breedon’s revenue doesn’t just stem from building houses. It paves roads and builds other infrastructure as well. Given how well the S&P Global/CIPS UK Construction Purchasing Managers Index (A measure of how well the construction sector is doing) has been performing, Breedon shares could improve in the long term. Its share price also currently trades at a decent price-to-earnings (P/E ratio) of 13, so I see this as a buying opportunity for me.

Dunelm

Inflation continues to run rampant. Thus, new home owners will be looking for bargains in furniture. Thankfully, FTSE 250 staple Dunelm (LSE: DNLM) provides exactly that. Its everyday necessities have an average price of £6, while its furniture has a low average price of £120.

Management has stated its goal of bringing better value proposition to its customers too. This is evident as Dunelm introduced more entry price products and promotional buys, which should entice more customers and purchases.

The retailer still has to compete with IKEA though, as its competitor offers cheaper products in certain categories. That being said, consumers still seem to prefer shopping at Dunelm. This is due to its excellent customer service, such as cheaper deliveries. On that account, as long as Dunelm can maintain its competitive prices and good customer service, I see it being one of the few FTSE shares riding the tailwinds of the new Help to Build scheme.