Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Burberry

Burberry (LSE: BRBY) is a British luxury fashion house. The brand designs and distributes ready-to-wear items. These include leather goods, footwear, and fashion accessories. This week, a director sold thousands of Burberry shares, but they were also awarded from a huge chunk of free shares as part of their compensation.

- Name: Jonathan Akeroyd

- Position of director: Chief Executive Officer

- Nature of transaction: Free shares

- Date of transaction: 15 June 2022

- Amount purchased: 71,106 @ nil

- Total value: £N/A

- Name: Jonathan Akeroyd

- Position of director: Chief Executive Officer

- Nature of transaction: Sale to cover tax liabilities

- Date of transaction: 15 June 2022

- Amount sold: 34,395 @ £16.18

- Total value: £556,399.73

Greggs

Greggs (LSE: GRG) is a British bakery chain. It specialises in savoury products. Among these are bakes, sandwiches, sweet items, and its famous sausage rolls. This week, a non-executive director purchased a thousand Greggs shares.

- Name: Lynne Weedall

- Position of director: Non Executive Director

- Nature of transaction: Purchase of Shares

- Date of transaction: 16 June 2022

- Amount purchased: 1,000 @ £19.01

- Total value: £19,007.20

Deliveroo

Deliveroo (LSE: ROO) is a British online food delivery company. It operates in over 200 locations across the UK and internationally. In the UK, it is the second biggest food delivery platform behind Just Eat. A huge director dealing occurred over at Deliveroo this week. Tens of thousands of Deliveroo shares were traded.

- Name: Adam Miller

- Position of director: Chief Financial Officer

- Nature of transaction: Free shares

- Date of transaction: 15 June 2022

- Amount purchased: 83,200 @ £0.81

- Total value: £67,392.00

- Name: Adam Miller

- Position of director: Chief Financial Officer

- Nature of transaction: Sale to cover tax liabilities

- Date of transaction: 15 June 2022

- Amount sold: 40,314 @ £0.81

- Total value: £32,654.34

Types of shares in a SIP

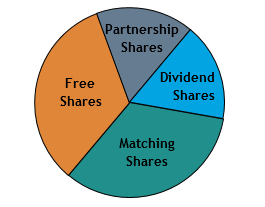

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this instance, the director dealings at Burberry and Deliveroo were free shares. These are a form of restrictive stock units (RSU). RSUs are a form of stock compensation. It is a promise from the company to award a company’s shares in the future.

For Burberry’s CEO, these shares are yet to be cashed in. As such, they hold nil value. But for Deliveroo’s CFO, shares were awarded at the stock’s market price at that time. This means that he decided to cash in his awarded shares.