The Pinterest (NYSE: PINS) share price is now trading below its initial public offering price. Once an $85 stock, it now exchanges hands at less than $20 per share. So, here’s why I’ve opted to buy its shares despite the monumental drop.

Money doesn’t always talk

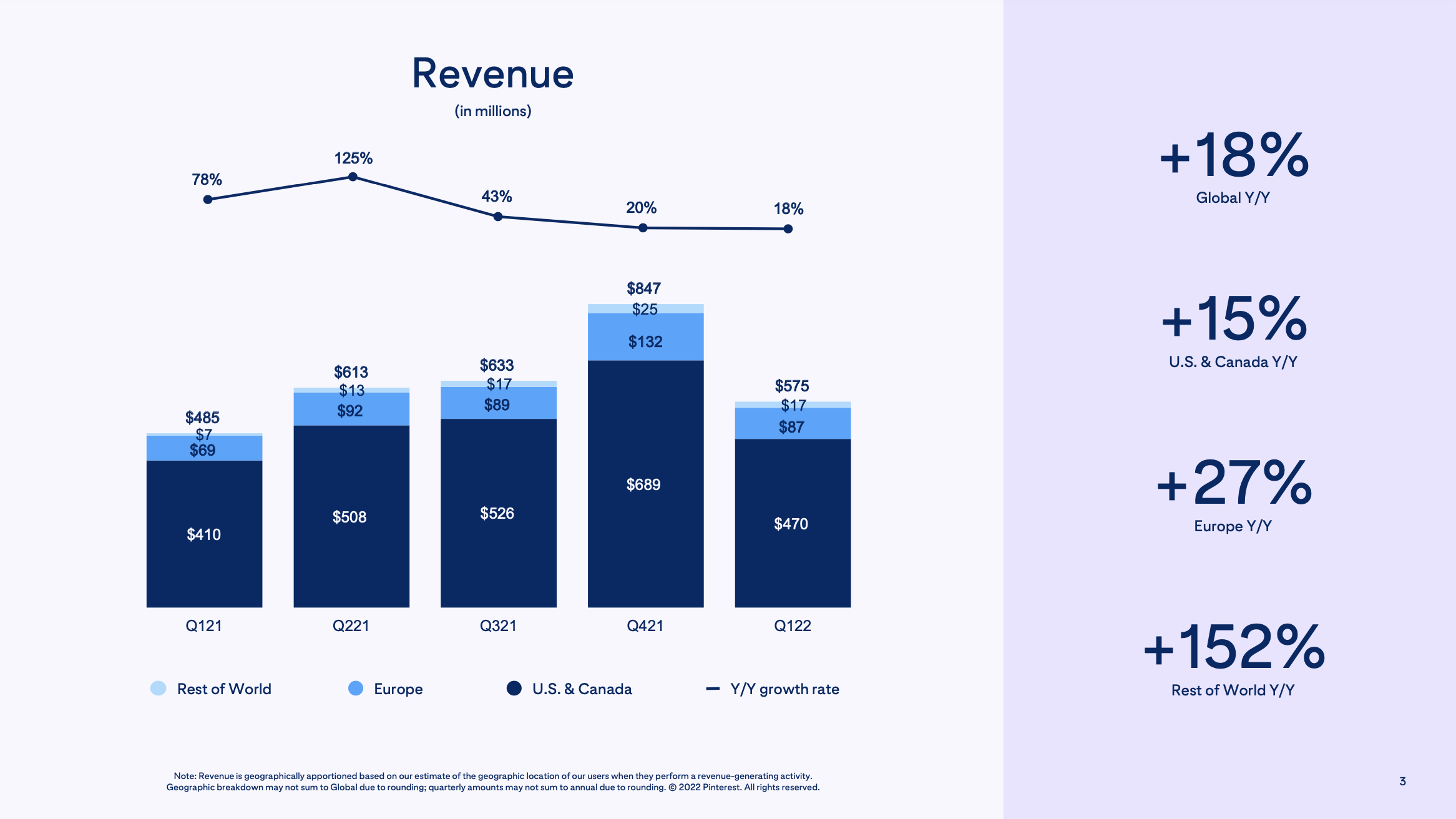

Pinterest stock and its earnings seem to have an inverse correlation. While earnings and average revenue per user (ARPU) continue to grow on a year on year basis, its stock continues to plummet to new one-year-lows.

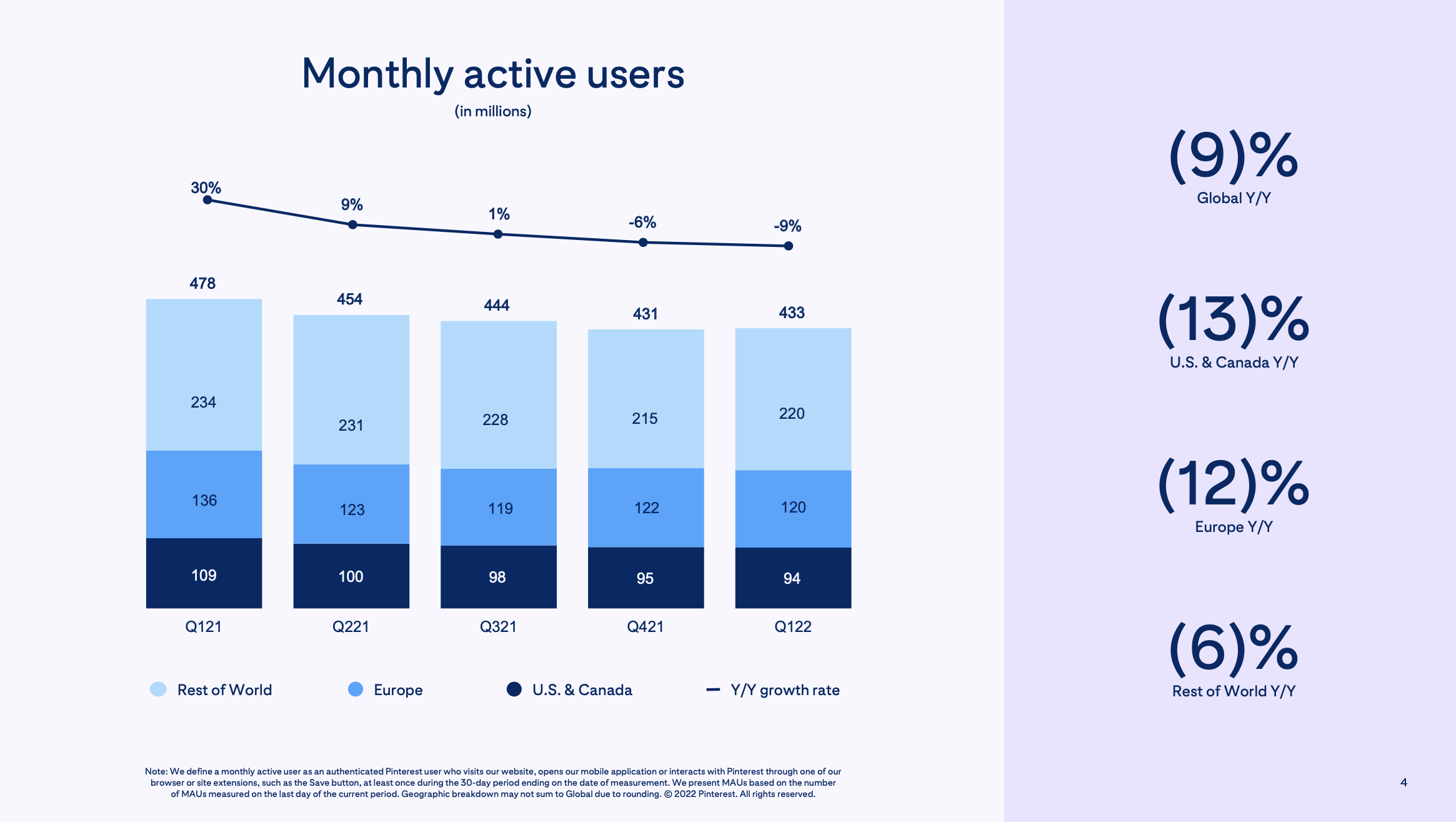

Despite the increase in ad spend, the majority of analysts seem to misunderstand the tech firm’s business model. The focus seems to be pinned on monthly active users because Pinterest is seen as a social media platform. When viewed as such, a declining number of monthly active users (MAU) doesn’t bode well for the stock. Nonetheless, management stated in its Q1 results that this decline seems to be bottoming out, and expects MAUs to grow again later this year.

That being said, Pinterest is more than just a social media company that generates revenue from users scrolling through its platform. It’s an e-commerce platform with a social media front. The business generates revenue from engagement. This means that advertisers only pay when users engage with promoted pins. As most of these have indirect promotions of products in a pin, Pinterest is essentially selling products through a creative manner.

‘Pinning’ users down

Given that the NYSE-listed firm struggles with pinning users down, a number of acquisitions and partnerships have recently been made. This is an effort to bring better proposition to both advertisers and users.

For one, the company recently acquired Vochi, a video creation and editing app. Additionally, it partnered with Tastemade on a multi-million dollar deal. I can see how these developments will allow creators to create better video content and consequently, bring more users and revenue to Pinterest.

The firm also recently acquired The Yes, an AI-powered shopping platform. It uses an algorithm to find the right products that are personalised for a user’s taste and style. This acquisition aligns with much of what Pinterest is trying to achieve in the e-commerce space, given its recent introduction of Your Shop. Its key partnership with Shopify has paid dividends as well. I expect its top line to increase as it continues to roll out seamless checkout to more merchants.

Discount season

Nevertheless, Pinterest faces economic headwinds. A slowdown in the US economy, where it gets the majority of its revenue from, is expected. This could hinder growth in the short to medium-term. However, this isn’t a huge concern for me, as I plan to buy and hold Pinterest stock for the long term.

With a flawless balance sheet, a mountain of cash at $2.7bn, and zero debt, I’m confident that Pinterest can weather a potential economic slowdown. Not to mention its 12.5% profit margin shows that it’s got substantive earnings power. Moreover, its recent acquisitions and partnerships lead me to believe that Pinterest is finally doing a better job of marketing itself to potential users. As such, I see a further drop in its share price as a buying opportunity for me for Pinterest stock.