Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Superdry

Superdry (LSE: SDRY) is a clothing company. It designs, produces, and sells clothing items and accessories. This is done primarily under the Superdry brand. With the Superdry share price down by 35% this year, a huge director transaction was executed. The purchase of a large sum of shares could boost investor sentiment.

- Name: Julian Dunkerton

- Position of director: Chief Executive Officer

- Nature of transaction: Acquisition of shares

- Date of transaction: 27 May 2022

- Amount purchased: 1,805,172 @ £1.42

- Total value: £1,144,954.58

Foxtons

Second on the list of director dealings is Foxtons (LSE: FOXT). The firm is a British-based estate agency. Foxtons serves as a go-between to buy, sell, and let properties. The Foxtons share price has had a slight hiccup this year, down 5%. A high-ranking director took the opportunity to purchase a substantial amount of shares.

- Name: Nigel Rich

- Position of director: Chairman

- Nature of transaction: Acquisition of shares

- Date of transaction: 30 May 2022

- Amount purchased: 140,000 @ £0.39

- Total value: £54,180

Big Technologies

Last on the list of director dealings is Big Technologies (LSE: BIG). Big Technologies provides products and services to the remote and personal monitoring industry. It does so under the Buddi brand name in the United Kingdom, Australia, the US, and Colombia. Its share price is firmly in the red at -15% this year. However, this didn’t stop a top director from transferring a number of leftover shares to his self-invested personal pension (SIPP) account after buying and selling.

- Name: Daren Morris

- Position of director: Chief Financial Officer

- Nature of transaction: Acquisition of shares

- Date of transaction: 27 May 2022

- Amount purchased: 10,000 @ £2.91

- Total value: £29,100

- Name: Daren Morris

- Position of director: Chief Financial Officer

- Nature of transaction: Disposal of shares

- Date of transaction: 27 May 2022

- Amount sold: 10,000 @ £2.83

- Total value: £28,300

- Name: Daren Morris

- Position of director: Chief Financial Officer

- Nature of transaction: Acquisition of shares

- Date of transaction: 30 May 2022

- Amount purchased: 15,000 @ £2.82

- Total value: £42,300

- Name: Daren Morris

- Position of director: Chief Financial Officer

- Nature of transaction: Disposal of shares

- Date of transaction: 30 May 2022

- Amount sold: 15,000 @ £2.81

- Total value: £42,150

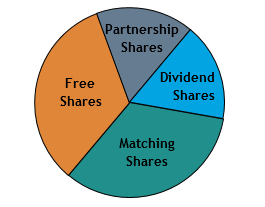

Types of shares in a SIP

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this instance, partnership shares were bought and sold from the deals listed. Employees are usually allowed to buy shares on a monthly basis through a SIP. But they can also buy shares at the end of an ‘accumulation period’. If there is one in effect, employees can buy shares at the market value either at the beginning or end of the period.