The Rolls-Royce (LSE: RR) share price has taken a huge beating since the pandemic. Its stock has collapsed by over 60% since lockdowns came into place. However, there were many positives to take away from the firm’s Civil Aerospace Investor Day. So, here’s why I think the Rolls-Royce share price could be set for take-off this year.

The engine room

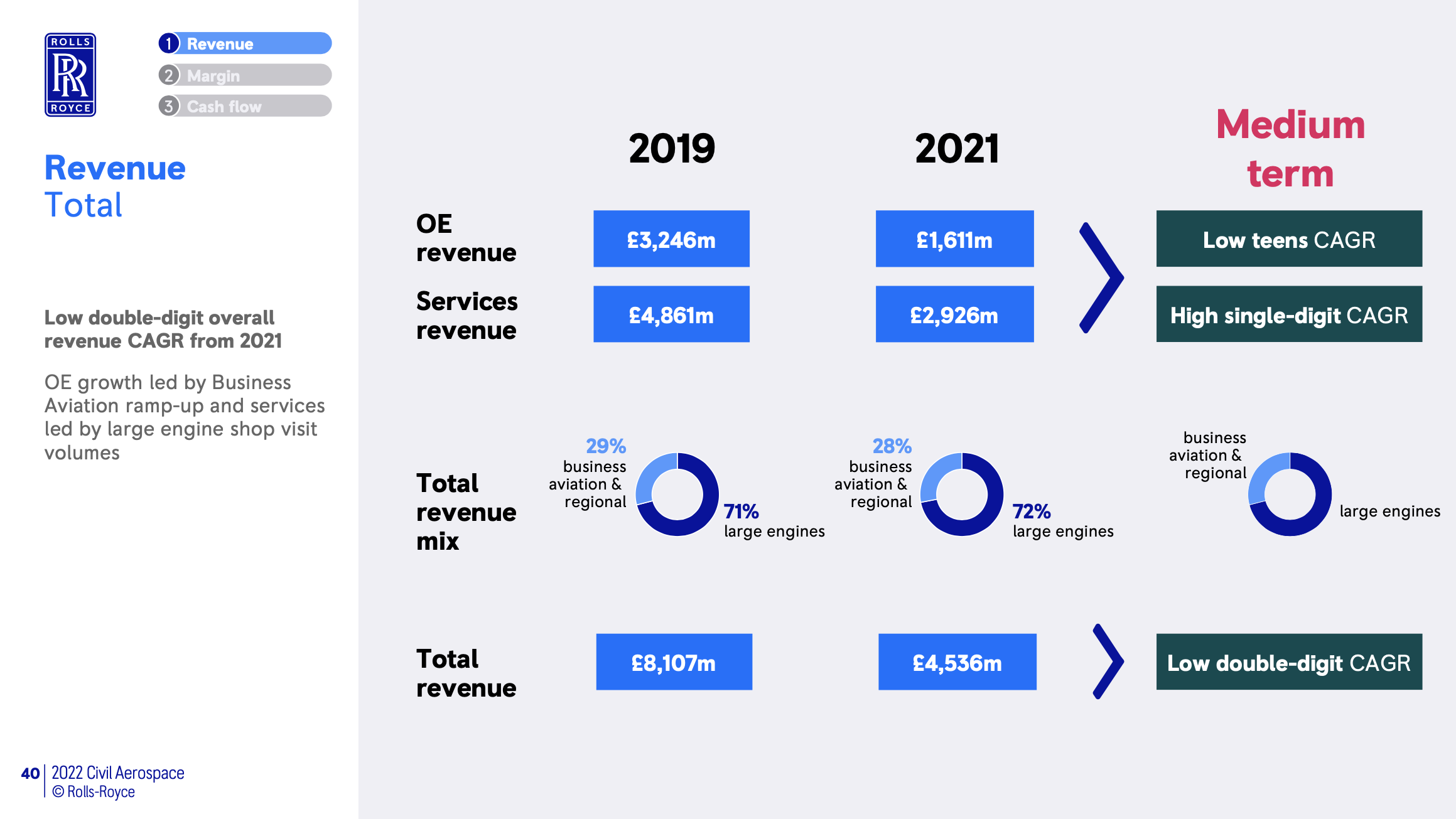

Rolls-Royce’s civil aerospace division is its main revenue driver. The segment generated 41% of revenue in 2021. Of that revenue, 72% is attributed to large engines. It’s also worth noting that while Rolls-Royce generates a huge sum of revenue from engine deliveries, its value proposition comes from the aftermarket. This means it stands to earn more from servicing the engines it delivers. As such, higher flying hours mean more servicing, which results in higher service revenue.

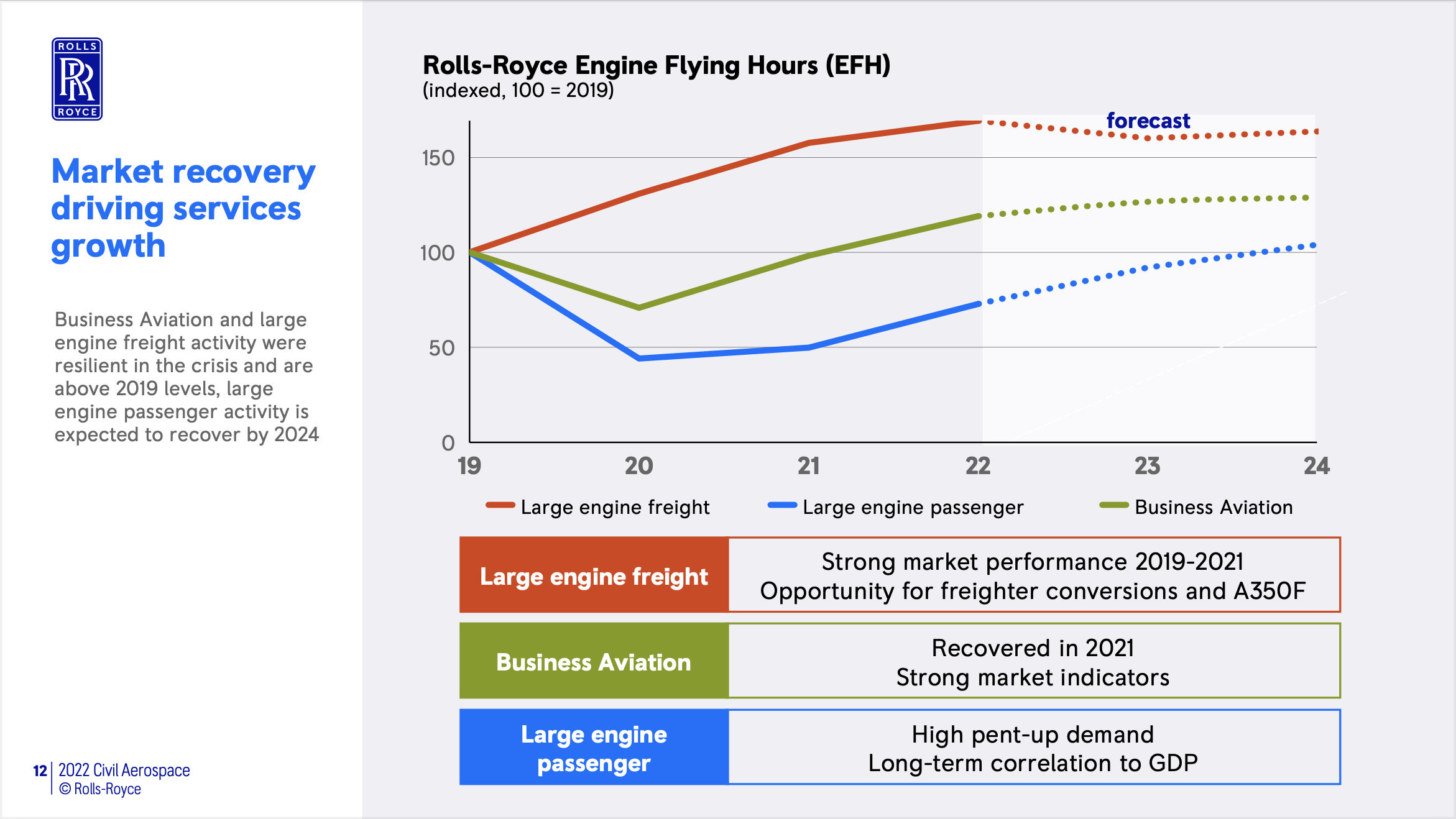

Thankfully for Rolls-Royce, there are plenty of tailwinds as travel demand picks back up. For one, flying hours are forecasted to increase in the medium term. Secondly, freight is anticipated to fly the most hours compared to business aviation and large passenger jets. Therefore, the FTSE 100 firm is expecting more shop visits. Not to forget, the incoming freighter version of the A350, of which Rolls-Royce has a 100% market share, will benefit from this tailwind.

Neo worries

Management didn’t address worries surrounding the cancellation of a chunk of Airbus A330neo orders, but I still remain optimistic. Based on the table below, Rolls-Royce stands to gain a lot more revenue from servicing engines than delivering them.

| Engine Type | Airframe | Market Share | Engines in Service | Engines on Order |

|---|---|---|---|---|

| Trent XWB | Airbus A350 | 100% | 764 | 859 |

| Trent 7000 | Airbus A330neo | 100% | 130 | 550 |

| Trent 1000 | Boeing 787 | 33% | 604 | 122 |

| Trent 900 | Airbus A380 | 48% | 168 | 1 |

| Trent 800 | Boeing 777 | 40% | 176 | 0 |

| Trent 700 | Airbus A330 | 60% | 1,146 | 0 |

| Trent 500 | Airbus A340 | 100% | 92 | 0 |

| Total | 3,080 | 1,532 |

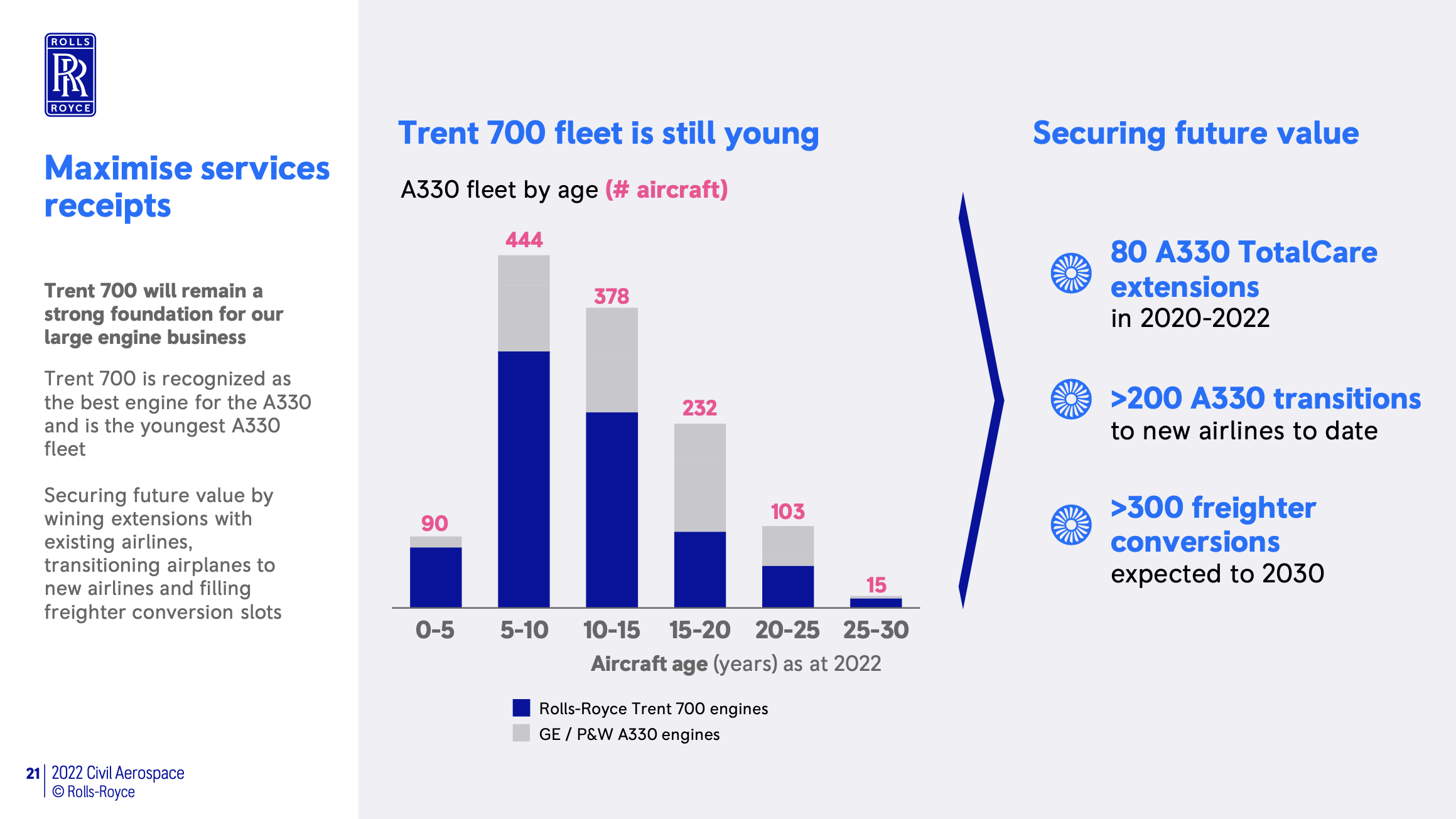

Management mentioned its goal to service over 7,000 engines by 2030, a 30% uptick from the current number. The Airbus A330’s Trent 700 engine is Rolls-Royce’s most profitable engine. On the conference call, the board mentioned that the Trent 700 still has 40% of its flying hours ahead due to its low average age. With more service extensions and engine demand as well, more service revenue is to be expected in the future.

Things are looking up

It’s no secret that Rolls-Royce’s financials are a nightmare. The British firm has negative shareholders’ equity with staggering amounts of debt. Nonetheless, I have reason to believe that things are looking up. At the investor day presentation, CFO Arvind Balan guided the firm’s civil aerospace division to breakeven this year. This is in line with Rolls-Royce’s wider outlook when it released its Q1 trading update.

Additionally, the London-based firm is seeing higher operating margins. This is down to investments in digitalisation and a leaner production system which includes reuse of parts, as well as a reduction in overheads and R&D costs. Consequently, Rolls-Royce expects free cash flow to comfortably exceed operating profit. From this, I expect the company to be able to start paying off its debt in 2024.

Nevertheless, I am wary of the economic headwinds which could hit flying hours, and as a consequence, Rolls-Royce’s top line. That being said, management reiterated that economic headwinds have been accounted for in their projections. That being the case, I am closely watching Rolls-Royce, and may potentially buy shares once it’s able to settle its debt.