UK house prices have been on the rise. In 2021 they grew by more than 10%, according to Halifax, which is the fastest rate of growth in 15 years.

Will this high growth continue into 2022? Unlikely if you read UK Finance’s latest quarterly report into the state of the UK households’ personal finances. They say it is “inevitable” activity will be weaker this year. What are the warning signs for the housing market in 2022?

Consumer spending is increased

People are increasingly getting back to old spending habits, and with inflation rising they are using unsecured debt to fund this spending. There are still significant weaknesses in certain sections of the economy: while some are close to “pre-pandemic levels”, there are others that continue to struggle. This means household incomes remain vulnerable to shocks in the labour market.

Personal loans also on the increase

Although not back to pre-pandemic levels, personal loans have also been on the increase. UK Finance reckon that’s a sign that borrowers aren’t “yet sufficiency confident in the wider economic outlook or their own position to take on additional debt to fund bigger ticket purchases”. In this context, it’s unlikely that house prices will continue to grow at the levels we’ve seen previously since if consumers aren’t confident enough to take a personal loan then it’s unlikely they will be confident enough to commit to a bigger mortgage, which will limit demand and therefore house price growth.

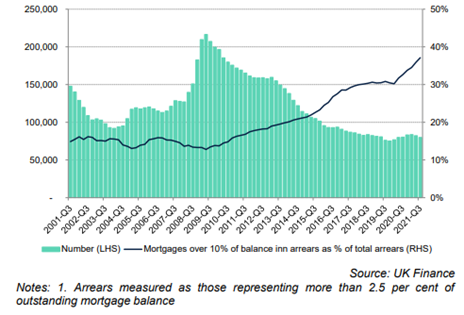

Heavier mortgage arrears increasing and risk of repossessions looms

At the moment most people are coping with their monthly mortgage repayments, but the signs are that those who are struggling are continuing to sink deeper. The furlough scheme has protected people from unemployment but now that has come to the end, the big question mark is what will happen in the labour market in the early part of 2022. If unemployment rises, then it’s inevitable that the big rises in mortgage arrears will become a big rise in repossessions. That will increase the supply of houses available on the market, which will result in downward pressure, as banks look to recoup their losses.

These three factors show that there is a real vulnerability in the UK economy from a household perspective. There is a lack of resiliency to people’s finances, which means that increases in either inflation or interest rates could set off a tailspin.

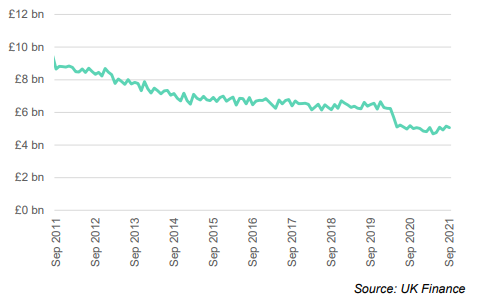

There’s still a lot of money in overdrafts

To underline this reality, take a look at overdraft balances. Although the market has restructured over time, and overdraft balances feel at the start of the first lockdown, lots of people are still entrenched in their overdraft, with well over £4bn being lent to UK consumers via this facility. UK Finance observe that this is likely a sign that there is no “increasing household financial stress”, recognising there is an inbuilt level of vulnerability within household finances.

Inflation will bite in 2022

There are growing concerns that higher inflation will be around for longer and it will eat into income growth. Interest rates were increased in November, and although the official line from the Bank of England was ‘wait and see’, if the inflationary pressures that are expected flow through into prices early next year, we will see more interest rate rises. This means that not only will day-to-day expenditures be more costly for consumers, but mortgages will become more expensive.

The reality is that higher interest rates affect affordability and increase risk to mortgage lenders. Therefore, the amount they’re willing to offer you on a mortgage is reduced. This means there’s less money available in the market for buying houses and therefore demand is reduced, which softens prices.

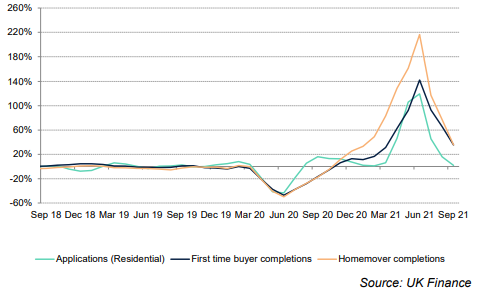

Homeowners have been leveraging equity to fund purchases

The evidence says more and more people have been using the equity built up in their homes to finance the purchase of larger properties. This is likely to have contributed to the boom in 2021, as people took advantage of the Stamp Duty holiday to buy bigger properties than they otherwise would have been able to afford.

House purchases fell sharply after the Stamp Duty holiday

The three-month rolling average of applications and completions collapsed following the end of the Stamp Duty holiday in June. The chances are people brought forward purchases into the first half of 2021 so it’s likely activity will end up being even weaker in 2022, further reducing the upward pressure on house prices.

What does it all mean?

It’s likely that the increases we’ve seen in 2021 were a one-off and will not continue into 2022. We know that inflation will materialise and therefore stretch household incomes that are already vulnerable. The real threat is the labour market, as there are a lot of people out there with high levels of mortgage arrears. All in all, 2022 could be a tough year for the UK housing market.